Get a Personal Loan in Prince Edward Island

Live in PEI and need a personal loan? Use Borrowell to quickly compare loans and rates that you qualify for based on your credit profile. Sign up to get your free Equifax credit score, quickly compare personal loan options, and easily apply online for a loan today.

How to Get a Personal Loan in PEI

When you apply for a personal loan in PEI, lenders will look at your credit score to qualify and approve your loan application. That's where Borrowell can lend a hand. Borrowell gives you your credit score for free and shows you your likelihood of approval for loan options from over 50 lenders in Canada. Sign up for Borrowell to check your credit score, compare loan options, apply online for the right loan, and improve your overall financial health.

Personal Loans PEI: What you should know

When applying for a personal loan in PEI, applicants will likely need to supply the following:

Proof of Canadian bank account

Proof of Canadian and PEI residency

Personal ID attesting to the legal age

Credit rating and credit history

Proof of income, for example employment deposit slips

Social Insurance Number

Personal details

Qualifying for a personal loan in Prince Edward Island entails gathering some basic financial and personal details. Lenders in PEI will verify any previous bankruptcies or defaulted debt payments, and verify that borrowers have a steady income by checking bank statements and pay stubs. Most lenders will also check credit scores, making it vital to know this information ahead of time. That’s where Borrowell can help.

By signing up for Borrowell, you can gain immediate access to your Equifax credit score for free. You can compare different loan options available in PEI through the Borrowell platform, and you’ll instantly see your likelihood of approval for each loan before even applying.

It’s easy to apply for a personal loan online in PEI. Borrowers just need to fill in a simple online application, scan required documents, and wait for approval.

When applying for a personal loan online, borrowers can compare various options before committing to ensure they get the best loan for their needs. With over 50 lending partners on the Borrowell platform, you can sign up for free and quickly compare loan options in PEI and across Canada. When you’ve found the best personal loan for you, you can simply apply through the platform to get the money you need, with approval taking just hours and funds transferred within a few business days.

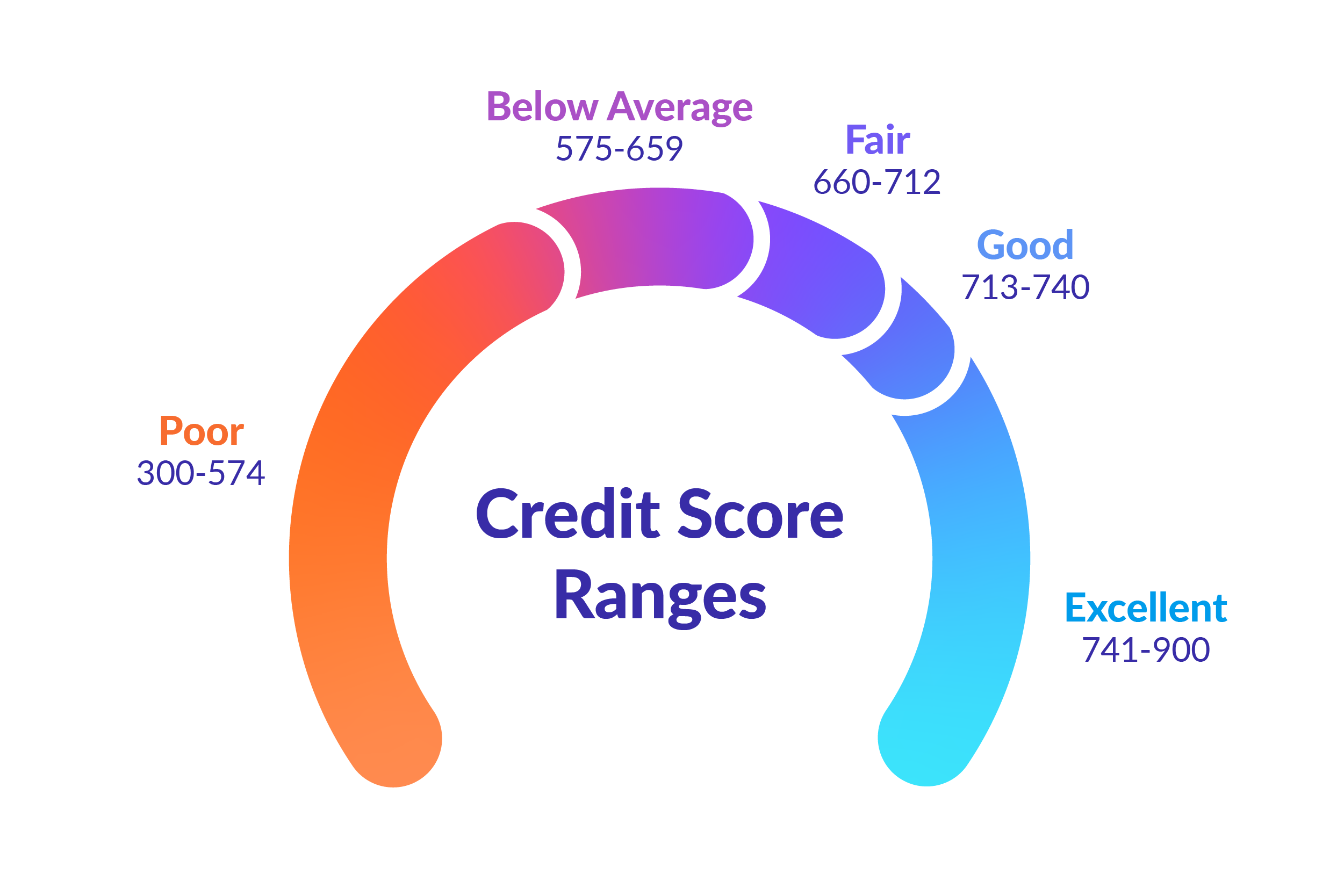

In Prince Edward Island, interest rates typically fall between 5%-20%. Interest rates on PEI personal loans vary depending on the applicant and the lender. Rates depend on loan amounts, borrower’s financial history, and credit score. Applicants with a steady income, history of consistent payments, and meeting basic conditions, will likely secure a better interest rate than applicants with bad credit.

There are a number of ways that paying off a personal loan can improve a borrower’s credit score. Payment history makes up around a third of an individual’s credit score, so making on-time payments towards a personal loan can help you improve your credit score over time.

Diversifying the borrower’s loan portfolio is another way that personal loans in PEI can improve credit rating. Since personal loans aren’t revolving debt, these don’t contribute to credit utilization. Blending personal loans and revolving credit debt contributes to a broader credit mix, and this can help improve your credit score.

Many borrowers in PEI use personal loans to consolidate debt. Combining multiple smaller, higher interest loans into one larger, lower interest loan makes debt payments more manageable, reducing the risk of missed payments that are reported to credit bureaus. Making debt more manageable can help borrowers achieve financial goals and improve credit health significantly.

Borrowell gives Canadians instant access to their Equifax credit score — for free. An important step before applying for a loan is finding out what loans you are likely to qualify for. Borrowell delivers this information, enabling users to find the best funding solutions for their needs.

Borrowell’s free credit monitoring service also helps borrowers improve their credit health and access better financing options in the future. Sign up today to get your free credit score and stay updated with weekly credit monitoring.

Why You Should Check Your Credit Score First

Lenders qualify you based on your credit score

Your credit score is one of the main criteria for qualifying for a personal loan. Because of this, you should find out what your actual credit score is before applying for a loan. With Borrowell, you can check your credit score for free before applying for a loan.

Applying for a new loan affects your credit score

When you apply for a loan and a lender checks your credit score, it is recorded on your credit report as a “hard inquiry.” Hard credit inquiries temporarily lower your credit score, so it’s in your best interest not to apply for multiple financial products in a given time frame.

Borrowell shows you your likelihood of approval for each loan

To minimize impacts to your credit score, you want to make sure you apply for a loan that you're confident you'll get approved for. Borrowell helps protect your credit health by showing you your likelihood of approval for the loan products recommended to you on our platform, based on your credit score.

Borrowell's Quick & Easy Loan Process

Sign Up & Get Your Score For Free

When you sign up to Borrowell, you’ll get your free Equifax credit score free in just three minutes. Checking your score won't impact it, and you can see which loans you will be eligible for.

Check Rates & Choose Your Offer

Borrowell automatically matches your credit profile with the best loan products available based on your credit score. Select your offer and complete the online application.

Get Your Loan

Once your personal loan is approved by a Borrowell loan partner, you can usually access your funds in just a few days.

Is Signing Up for Borrowell Free?

Yes, it's really free. Borrowell provides you with your Equifax credit score, free of charge. Based on your credit score, we provide you recommendations on the best loans, credit cards, and financial products that you are likely to qualify for. Knowing your credit score speeds up the loan application process and helps you get your money as quickly as possible.

Still Have Questions?

Get More Answers

Interest rates on personal loans in Prince Edward Island are in the same range as the rest of Canada. Interest rates on personal loans across Canada vary depending on many factors, including the borrower’s financial history and credit score. All lenders in the country, regardless of the province, are prevented from charging over 60% interest by Canadian law.

The total cost of a personal loan and how quickly it is paid off depends on the loan contract. Borrowers can choose from a variety of repayment terms, including issuing loan payments weekly, biweekly, or monthly. Most personal loans in Prince Edward Island are paid out monthly and include a portion of the principal and interest.

Borrowers can set up payments to be automatically drawn from their bank account, or can pay manually at every payment cycle.

While some lenders in PEI may forgive a missed personal loan payment, lenders do have the right to pursue legal action against borrowers who default. This information is sent to credit bureaus and can negatively impact your credit score. Having a history of late payments won’t look great on your credit report and will raise red flags to creditors, making it more difficult to secure an attractive loan in the future.

Personal loans usually range from $500 to $35,000.The loan amount that a lender will offer typically depends on the borrower’s credit history, employment status, payment history, and loan term. Higher loan amounts may be harder to qualify for and carry higher interest rates, making it vital for applicants to know their credit rating before applying for a loan.

Some popular uses for personal loans in Prince Edward Island are:

Car repair or purchase

Home renovation

Paying overdue bills

Settling tax obligations

Emergency expenses

Medical bills

Travel or vacation

Large purchases, for example appliances or equipment

Milestones events

Investment opportunities

Personal loans offer a flexible funding solution for borrowers with a variety of needs. With flexible loan amounts, interest rates, and term lengths available, most borrowers will find a loan online in Prince Edward Island. There are few limits on what personal loans can be used for in PEI.

How Borrowell Can Help with Your Financial Goals

Monitor & Track

Sign up and get your free Equifax credit score in just 3 minutes. Checking your score won't hurt it!

Understand & Improve

Receive weekly updates on how your credit score has changed. Get personalized tips on how you can improve your credit health.

Find the Right Product

Get matched automatically with the right loan products and trusted lenders that match your credit profile. Select your offer and complete the online application through the platform.

Find a Personal Loan in PEI with Borrowell

Ready to find the best PEI personal loan? Sign up for Borrowell to get your free credit score, compare loan options from trusted lenders, and quickly apply for a loan today!