Build credit from $5 biweekly

Build the payment history and credit mix of your credit report with Borrowell Credit Builder. Credit Builder members can see an average credit score increase of 41 points within 5 months¹.

Build your credit affordably

Build credit starting at just $5 biweekly:

- Achieve your financial goals

- No hard credit check when you apply

- You can cancel anytime without financial penalty

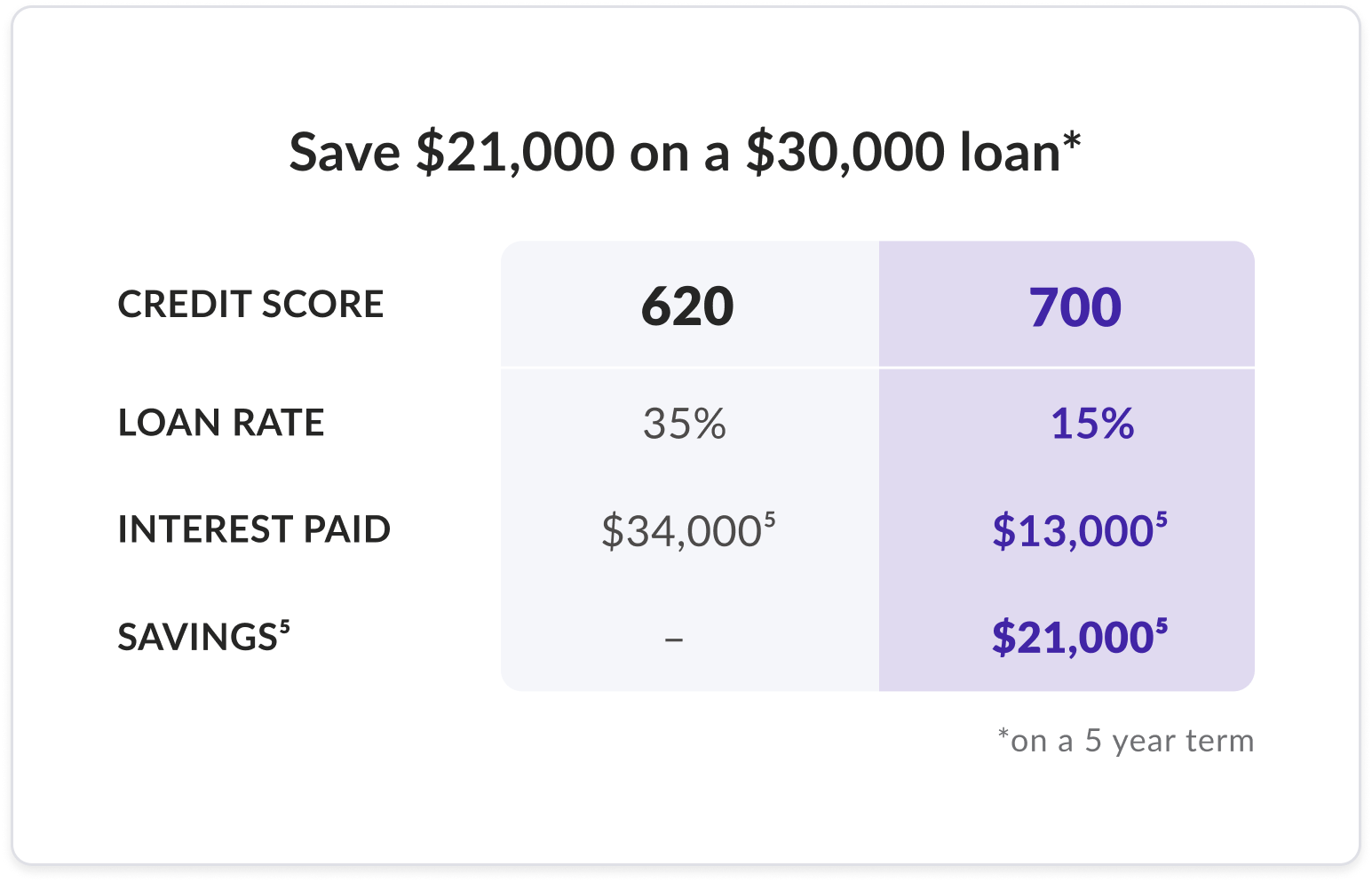

Save money with a better credit score

With an improved credit score, you'll enjoy:

- Lower interest rates

- Better credit card offers

- Increased loan approval rates

- More financial product options

Who benefits from Credit Builder?

- Canadians who want to build their credit history and diversify their credit mix

- Canadians who want to build their credit to qualify for more credit products like loans, credit cards and mortgages, and to access lower interest rates

¹ Based on a May 2022 study of Credit Builder members with an average loan size of $240 and an Equifax Canada ERS 2.0 credit score under 600 who made on-time payments on their Credit Builder and had a credit score increase. Individual results may vary. Other factors, including late payments, activity with your other accounts and credit utilization may impact results.

² To qualify for Credit Builder, you must be a Canadian citizen or permanent resident and you must be the age of majority in your province or territory of residence. Credit Builder is not available in Saskatchewan. Credit Builder is not a traditional loan where you get cash upfront. You are paying for access to cash back rewards and exclusive financial education all while building your credit history. You can cancel at any time without a cancellation fee or financial penalty.

⁴ The Credit Builder program reports all your biweekly payments to Equifax Canada. On-time payments can help build credit history and improve your credit score, while missed payments can negatively impact your score.

This program will report to Equifax Canada as a Borrowell installment loan with a 48-month term at a 0% APR. Please note that this is not a cash loan.