Get a Personal Loan in Mississauga

Live in Mississauga and need a loan? Use Borrowell’s online platform to find the best personal loan that you qualify for. Get your free credit score, compare loan offers from trusted lenders, and quickly see if you qualify based on your credit profile.

How to Get a Personal Loan in Mississauga

If you’re applying for a personal loan, lenders in Mississauga will pull your credit history. This can impact your score, so you should only apply for loans you are likely to qualify. To protect your credit score, Borrowell gives you your credit score for free and only shows you loan offers that you are most likely to qualify for. Over 50,000 Mississauga residents have signed up for Borrowell to check their credit score, compare loan products, and improve their financial health.

Personal Loans Mississauga: What You Should Know

Personal loans in Mississauga can be put towards a range of expenses or to settle higher interest debt. These expenses could include:

Emergency medical expenses

Weddings or other events

Home repairs or renovations

Vacations or unexpected travel

Car purchase or repair

Debt consolidation

No matter what you need money for, a personal loan is a great option to cover costs and expenses.

In Canada, all banks require similar documentation attesting to your identity, citizenship, and established finances. Whether you apply in person or online, you’ll need to provide:

Proof of a Canadian bank account

Proof of Canadian residency

Personal identification showing that you are 18 years old or older

Banking and credit history

Pay stubs or deposit slips showing that you have steady income

Any other relevant financial documents

The first step to qualifying for a personal loan in Mississauga is to check your credit score for eligibility and then collect all the documents you need for the application process. Applying for a loan through Borrowell means that you’ll already know whether you are likely to be approved. When working with your lender, it’s still necessary to submit documents showing that you are employed, a resident of Canada, and have a good credit profile.

To qualify, lenders will also look for any history of bankruptcy or defaulted debt repayments, so staying on top of your bills can help you qualify for a loan.

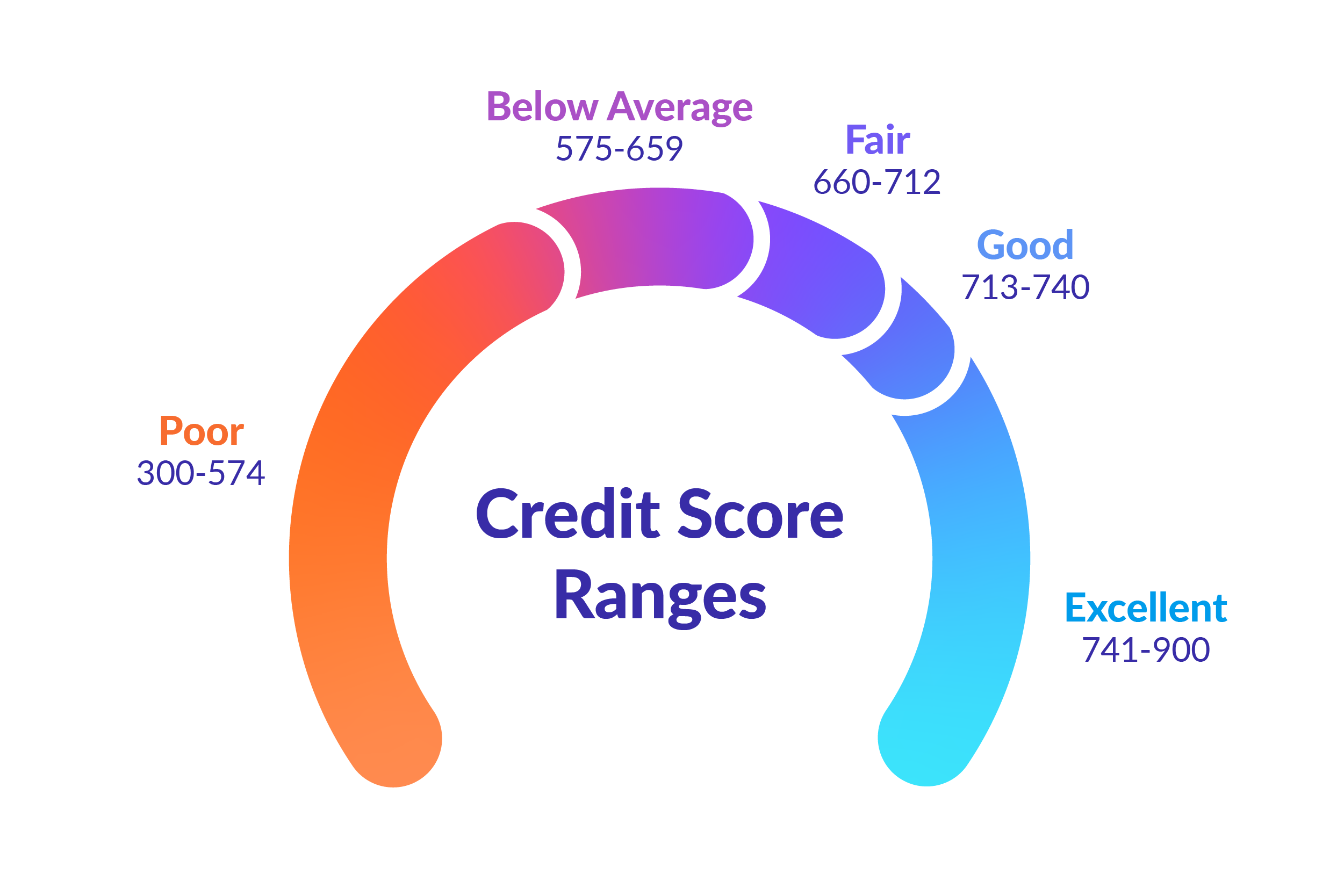

Lenders vary in their requirements for borrowers, including minimum credit scores. If you have good credit or better, for example a score over 660, you are likely to find attractive loans that you qualify for.

If you have a lower credit score, this doesn't mean you won’t be eligible for any unsecured personal loans in Mississauga. Borrowell partners may have a loan for you even if you don’t have excellent credit.

You may think that taking a personal loan is just another way of taking on debt, but unlike credit card debt, personal loans can help improve your credit score.

Using a personal loan to pay off other debt is a good idea. It is a lower interest option than credit cards, so you save money. This makes it easier to repay your balance every month. Steady repayments will help you improve your credit score. Since personal loans are considered installment loans and not credit, they also contribute to a better credit mix and lower your credit utilization.

The only way to ensure that you gain these benefits of a personal loan is to make on-time payments on your loan.

Why You Should Check Your Credit Score First

Lenders qualify you based on your credit score

Your credit score is one of the main criteria for qualifying for a personal loan. Because of this, you should find out what your actual credit score is before applying for a loan. With Borrowell, you can check your credit score for free before applying for a loan.

Applying for a new loan affects your credit score

When you apply for a loan and a lender checks your credit score, it is recorded on your credit report as a “hard inquiry.” Hard credit inquiries temporarily lower your credit score, so it’s in your best interest not to apply for multiple financial products in a given time frame.

Borrowell shows you your likelihood of approval for each loan

To minimize impacts to your credit score, you want to make sure you apply for a loan that you're confident you'll get approved for. Borrowell helps protect your credit health by showing you your likelihood of approval for the loan products recommended to you on our platform, based on your credit score.

Borrowell's Quick & Easy Loan Process

Sign Up & Get Your Score For Free

When you sign up to Borrowell, you’ll get your free Equifax credit score free in just three minutes. Checking your score won't impact it, and you can see which loans you will be eligible for.

Check Rates & Choose Your Offer

Borrowell automatically matches your credit profile with the best loan products available based on your credit score. Select your offer and complete the online application.

Get Your Loan

Once your personal loan is approved by a Borrowell loan partner, you can usually access your funds in just a few days.

Is Signing Up for Borrowell Free?

Yes, it's really free. Borrowell provides you with your Equifax credit score, free of charge. Based on your credit score, we provide you recommendations on the best loans, credit cards, and financial products that you are likely to qualify for. Knowing your credit score speeds up the loan application process and helps you get your money as quickly as possible.

Still Have Questions?

Get More Answers

There are a few ways that Mississauga lenders will decide if you qualify for loans or other financial services. The first and most obvious criteria is your credit score. You can anticipate this requirement by signing up for Borrowell and getting your Equifax credit score for free.

35% of your total credit score is based on your debt repayment history. When lenders look at this, it gives them confidence that you will be able to repay the loan. Lenders will also make sure that you have steady employment and income by looking at your bank statements and credit report.

Figuring out what it costs to take out a loan can be complicated, but Borrowell keeps you on track with transparent, straightforward loan offers with vetted partners.

A rule of thumb is that the longer repayment term you take, the more cumulative interest you will pay. This makes long term loans proportionately more expensive than shorter term loans. The amount you pay will also depend on your financial history, the loan amount, and the lender’s regulations.

Most Mississauga personal loans are unsecured, variable-rate small loans with an average annual interest between 12–30%. Aside from annual interest, lenders also charge fees for processing and administration ranging from 1-3% of the loan amount.

There are two main types of personal loans in Mississauga: secured and unsecured loans.

Secured loans are backed by something of value, known as collateral. The collateral is a lender’s insurance against defaults and is often required for very large loan amounts.

Unsecured personal loans are not protected by collateral. Because there’s greater risk being taken on by the lender, unsecured loans generally have higher interest rates and stricter eligibility requirements.

Most Mississauga personal loans are unsecured with either fixed or variable interest rates. With so many choices available, Borrowell users have the advantage of only viewing loan offers that they are likely to qualify for based on their credit score. This accelerates the loan search process and helps you get your money quickly. Sign up today to speed up your search for a personal loan.

Interest rates on personal loans depend on several factors that evaluate whether you will be able to repay the loan and how quickly. Separate lenders have internal methods for deciding exactly what you are going to pay. In general, interest on most loans across Canada are calculated in the same way and capped at 60% according to federal law.

Some factors in calculating interest rates are:

Loan size

Borrower’s credit profile

Repayment terms

Individual lender policies

How Borrowell Can Help with Your Financial Goals

Monitor & Track

Sign up and get your free Equifax credit score in just 3 minutes. Checking your score won't hurt it!

Understand & Improve

Receive weekly updates on how your credit score has changed. Get personalized tips on how you can improve your credit health.

Find the Right Product

Get matched automatically with the right loan products and trusted lenders that match your credit profile. Select your offer and complete the online application through the platform.

Find a Personal Loan in Mississauga with Borrowell

If you are ready to find a personal loan in Mississauga then sign up for Borrowell today! Get your free Equifax credit score and choose from a variety of personalized loan recommendations from vetted lending partners. Plus, get individualized tips to help you improve your credit score and achieve your financial goals.