Get a Personal Loan in Brampton

If you’re looking for a personal loan in Brampton, Borrowell can help. Borrowell gives you your Equifax credit score for free and provides you with loan options from trusted lenders based on your credit score. Sign up for free today and compare the best loan options available to you.

How to Get a Personal Loan in Brampton

When you apply for loans, lenders approve your application based on your credit score. Borrowell has helped over 59,000 Brampton residents check their credit score for free, find the best loan products based on their score, and improve their overall financial health. After using the Borrowell app, Brampton residents have seen their average credit score improve by 12 points, which helps them qualify for even better financial products in the future. Sign up for Borrowell today to find the right personal loan for you.

Personal Loans Brampton: What You Should Know

The types of loans in Brampton include, but are not limited to, emergency loans (which can cover any type of unexpected expenses including medical costs), farming loans, car loans, business loans, wedding loans, and home improvement loans. Wedding loans are typically smaller, and home improvement loans are meant for more strenuous renovations and upgrades to your home.

Some requirements may differ depending on the lender, but for a lender to consider if you’re qualified for loans in Brampton you must at least fulfill these basic requirements:

Have a Canadian bank account

Be a Canadian resident

Be 18 years old or older

Have at least one-year credit history

Meet minimum income requirements with consistent employment history

Have no history of bankruptcy

Have a low debt-to-income ratio

Here are some of the essential documents you’ll need to apply for a personal loan in Brampton:

Valid form of ID: For example, an Ontario driver’s license

Proof of residency: For example, utility bills

Proof of employment and income: For example, pay stubs or bank deposit slips

Social Insurance Number

Once you’ve ensured you meet the requirements and have access to all supporting documents, you can apply for a personal loan in Brampton either in person or online. If you’re not sure where to start, sign up for Borrowell to compare loan products and lenders based on your credit score. Once you’ve found the right loan product, you can complete an online application through the platform.

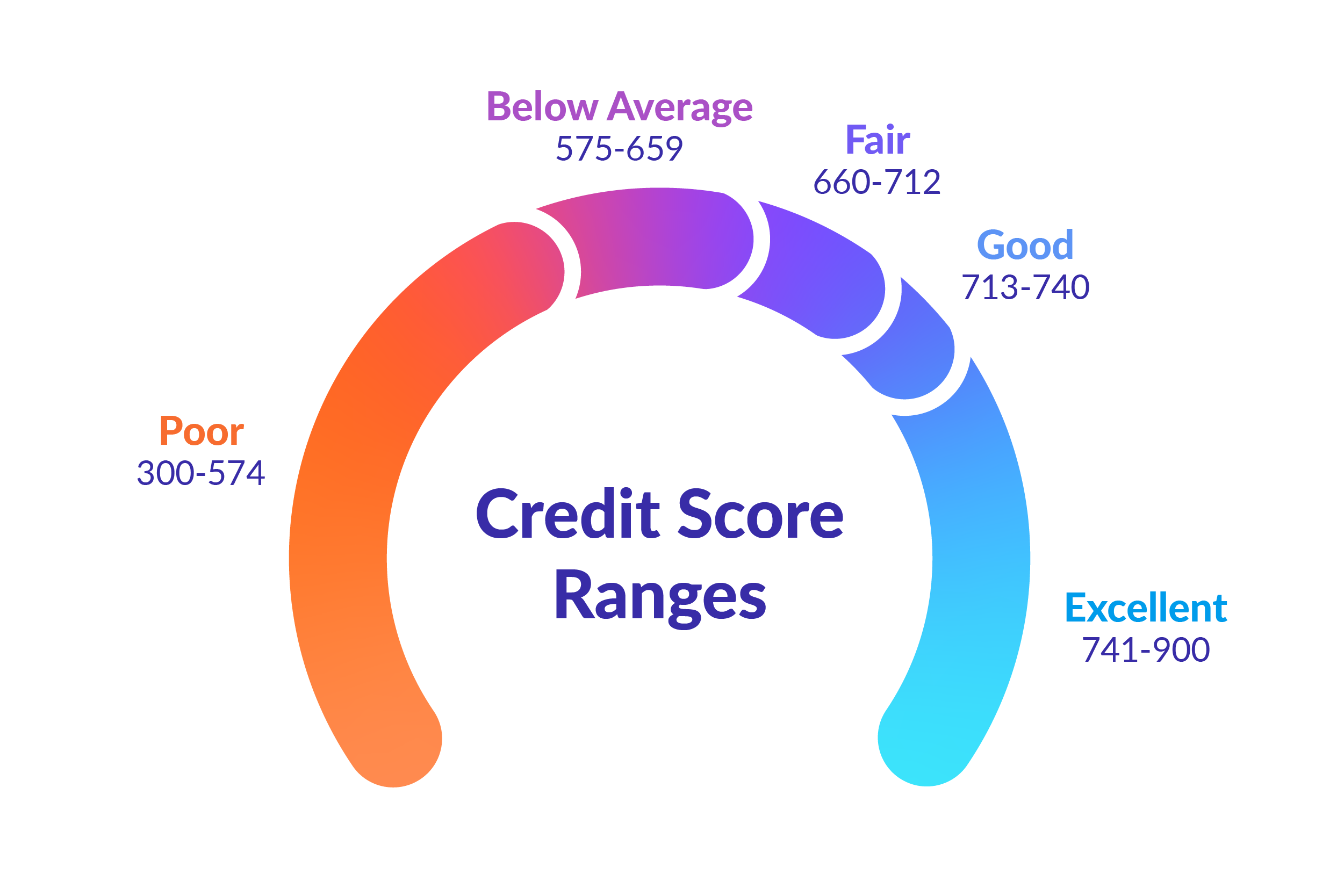

The credit score required to get a personal loan varies depending on the lender’s specific requirements. For many lenders, the minimum requirement is typically a credit score of around 660. This score is in the fair-good range.

If your credit score is below 660, there are still personal loan options available. Sign up for Borrowell to see what loan options are available based on your credit score and financial background.

It is possible to improve your credit score using a personal loan! Many borrowers use loans for debt consolidation and repayment. If used properly, personal loans can help improve your credit score by resolving high-interest debts or outstanding balances to reduce your credit utilization.

Because personal loans are considered an installment loan, regular payments to pay off your loan can help you establish credit history and boost your credit score. Of course, you need to make on-time payments in order to experience these benefits.

Why You Should Check Your Credit Score First

Lenders qualify you based on your credit score

Your credit score is one of the main criteria for qualifying for a personal loan. Because of this, you should find out what your actual credit score is before applying for a loan. With Borrowell, you can check your credit score for free before applying for a loan.

Applying for a new loan affects your credit score

When you apply for a loan and a lender checks your credit score, it is recorded on your credit report as a “hard inquiry.” Hard credit inquiries temporarily lower your credit score, so it’s in your best interest not to apply for multiple financial products in a given time frame.

Borrowell shows you your likelihood of approval for each loan

To minimize impacts to your credit score, you want to make sure you apply for a loan that you're confident you'll get approved for. Borrowell helps protect your credit health by showing you your likelihood of approval for the loan products recommended to you on our platform, based on your credit score.

Borrowell's Quick & Easy Loan Process

Sign Up & Get Your Score For Free

When you sign up to Borrowell, you’ll get your free Equifax credit score free in just three minutes. Checking your score won't impact it, and you can see which loans you will be eligible for.

Check Rates & Choose Your Offer

Borrowell automatically matches your credit profile with the best loan products available based on your credit score. Select your offer and complete the online application.

Get Your Loan

Once your personal loan is approved by a Borrowell loan partner, you can usually access your funds in just a few days.

Is Signing Up for Borrowell Free?

Yes, it's really free. Borrowell provides you with your Equifax credit score, free of charge. Based on your credit score, we provide you recommendations on the best loans, credit cards, and financial products that you are likely to qualify for. Knowing your credit score speeds up the loan application process and helps you get your money as quickly as possible.

Still Have Questions?

Get More Answers

In Brampton, you can use personal loans for things like:

Purchasing a vehicle

Consolidating debt

Booking a trip

Making vehicle repairs

Purchasing furniture or appliances

Paying emergency expenses or medical bills

Covering unexpected costs

In order to be approved for a loan, you may need to inform your lender of why you need the money so they can determine what is best for you financially.

Personal loans in Brampton range from $500-$35,000. The amount of money you can borrow will vary depending on the lender you take your personal loan from, as well as your credit score and financial background. Lenders will want to know that you can pay back the loan, so lower-risk borrowers will be able to secure larger loans.

Interest rates for personal loans in Brampton can range from 12.99% to 46%. The interest rates on personal loans vary from lender to lender, and the interest rate you'll qualify for depends on your financial situation. If your credit score is 660 or above, you’ll be more likely to qualify for loans with lower interest rates.

There are many ways to calculate interest rates. In your loan agreement, the lender will tell you if interest will be calculated on a daily, monthly or annual basis. For personal loans, interest is typically displayed on the loan agreement as an annual percentage rate. This is the amount of interest you’ll pay on your loan during the course of one year.

If a personal loan isn’t right for you, or you do not qualify for the loan options you’re looking for, there are other financial services available. Some of the following financial services and products could support your needs and help you meet your financial goals:

Line of credit

Credit cards

Peer-to-peer loans

Salary advance

How Borrowell Can Help with Your Financial Goals

Monitor & Track

Sign up and get your free Equifax credit score in just 3 minutes. Checking your score won't hurt it!

Understand & Improve

Receive weekly updates on how your credit score has changed. Get personalized tips on how you can improve your credit health.

Find the Right Product

Get matched automatically with the right loan products and trusted lenders that match your credit profile. Select your offer and complete the online application through the platform.

Find a Personal Loan in Brampton with Borrowell

Ready to get the funds you need? Sign up for Borrowell today to get your free credit score, find the best personal loan options in Brampton, and take the next steps towards improving your credit and financial health.