A personal loan and a personal line of credit are both useful borrowing options, but they work differently.

Jessica Martel

Jan 16, 2023

Read More

Looking to consolidate your debt into one affordable monthly payment? Scroll down to compare some of the best debt consolidation loans in Canada. Want to know whether you'll qualify? Sign up with Borrowell to get your free credit score and instantly see your approval chances. Find the best debt consolidation options available to you.

| Provider | Loan Amount | Interest Rate | Term |

|---|

A debt consolidation loan is a personal loan intended to pay off all of your debts at once. A debt consolidation loan is usually offered by a lender to streamline your debt repayment process. They give you a single debt to pay off, instead of many, and generally with a lower overall interest rate. You’ll use the money issued by your debt consolidation loan to pay off your various debts (including credit cards, personal loans, and other debt) and then make a single monthly payment to your debt consolidation loan lender.

If you have several different types of debt at higher interest rates (for example, multiple credit card balances) and are having trouble staying on track with your debt repayment, a debt consolidation loan can help. A debt consolidation loan will streamline these debts into a single loan with a single payment at a lower interest rate. You’ll save money every month on interest charges, and you can focus on a single debt, instead of choosing how to prioritize your monthly payments and deciding which debts to eliminate first.

“Good” and “bad” kinds of debt are a common way to classify various debts. Good debt, when managed properly, is debt that helps you build equity or improve your professional prospects – like a mortgage or student loans. Bad debt is generally considered any consumer debt, such as credit card debt, car loans, or line of credit debt, that can accumulate quickly if not managed properly. Bad debt is often accumulated by daily overspending, and not in the pursuit of improving your financial situation.

Debt consolidation loans are often used for debt relief to pay off bad debt that has gotten out of hand. For example, if you have accumulated thousands of dollars in credit card debt over the years, a debt consolidation loan can help you consolidate your debts into a single loan with a lower interest rate.

Managing your debt responsibly, including loans and credit cards, can help you maintain a good credit score. On the other hand, unpaid debt can have a significant impact on your credit score, especially if it’s been sent to collections. If you manage your debt poorly and don’t pay it back on time, your credit score will suffer.

There are key factors that make up your credit score, including your payment history and your credit utilization ratio. If you have too many sources of debt that are difficult to manage, you could start missing your bill payments or maxing out your credit cards. When this happens, your credit score will be negatively impacted. A debt consolidation loan could help you organize your various debt into one affordable monthly payment, when managed properly.

You can consolidate a wide variety of debts when you apply for a debt consolidation loan. These types include:

Credit card debt – If you overspend and have a high credit card balance, the high interest rate on your credit card can make it challenging to pay off this debt.

Personal loan debt – If you have taken out multiple personal loans for big purchases, home renovations, emergency expenses, or other items, paying back these loans individually can turn into a logistical nightmare. You can consolidate them into a single loan to simplify the repayment process.

Utility bills – If you miss a utility bill payment, you’ll be penalized with interest charges and impacts to your credit score. You can use a consolidation loan to bring your bills up to date and avoid future penalties.

While debt consolidation can be extremely helpful, not all forms of debt in Canada can be consolidated. Forms of debt you can not consolidate include:

Mortgages

Government student loans

Car loans or RV loans

Back taxes owed to the Canada Revenue Agency

To qualify for a debt consolidation loan, you’ll need to prove to your lender that you are likely to pay it back. Your lender will request the following details to make this determination:

Your income – Prove you have sufficient income to pay back your loan by providing pay stubs or a letter from your employer showing how much you earn.

Amount of debt – Include statements and current balances on the debt you wish to consolidate.

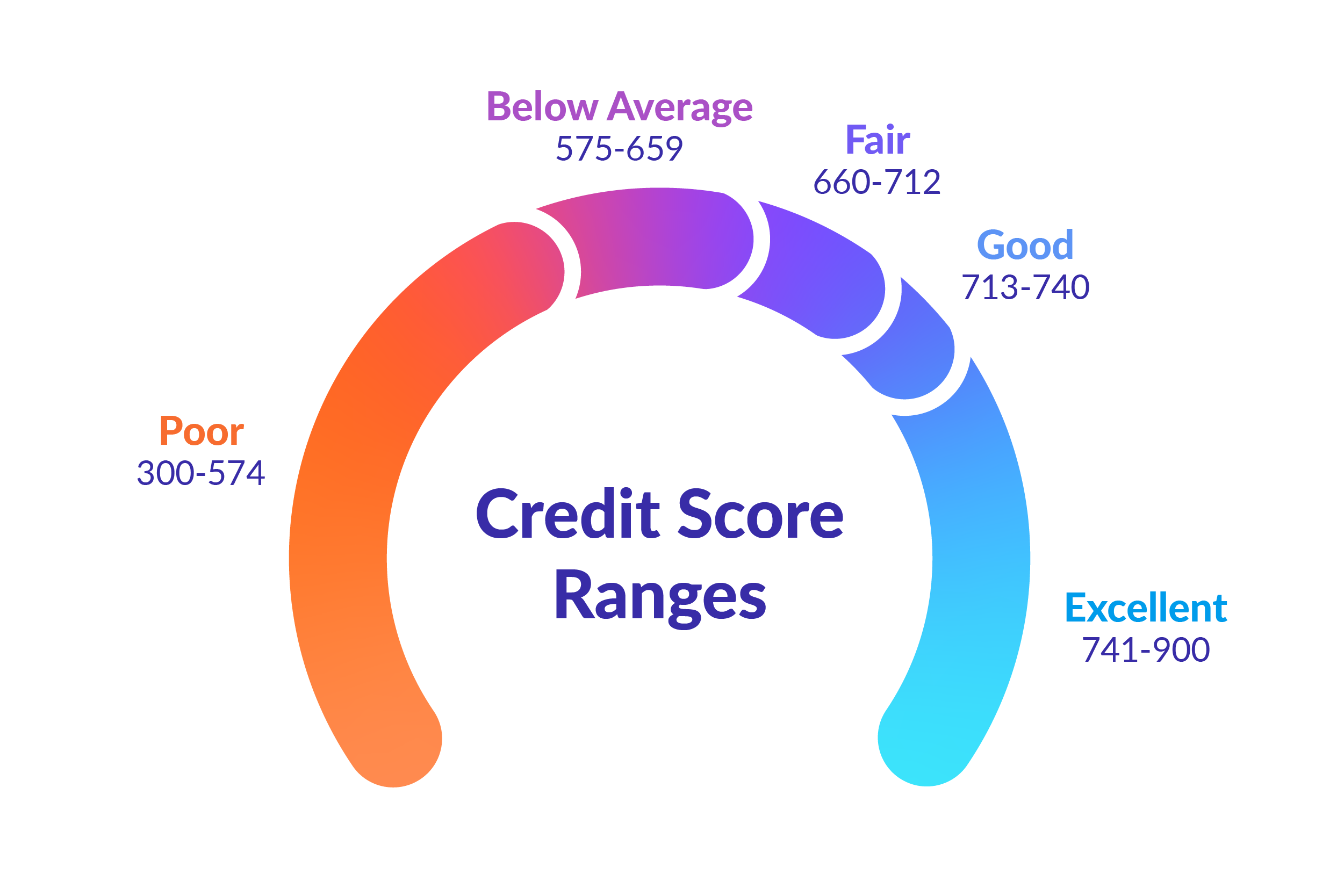

Credit score – Your credit score is a number between 300 and 900 that represents your creditworthiness to lenders. A higher credit score makes it easier for you to qualify for loans, credit cards, and other financial products. When applying for a loan, lenders will look at your credit score before qualifying you.

Yes, there are ways to get a debt consolidation loan with bad credit. A general guideline is that credit scores over 660 have the best chance of getting approved for a debt consolidation loan.

If your credit score is below 660, there may still be debt consolidation loan options available. Certain lenders specialize in helping Canadians with lower credit scores consolidate their debts and improve their credit health over time. Sign up for Borrowell to see what loan options are available based on your credit score.

You can apply for a debt consolidation loan through most credit unions, banks, and online lenders. When applying online, the process is usually straightforward and can be as fast as 15 minutes. Your loan approval can happen as quickly as 24 hours, and you could have money in your account in as little as a few days after that.

If you’re not sure where to apply, you can easily compare lenders online. Sign up to Borrowell for free and easily compare debt consolidation loan options from trusted Canadian lenders. You can compare interest rates and see your likelihood of approval based on your credit score. This will help you find the best lender and debt consolidation loan option that matches your credit profile.

Your credit score is one of the main criteria for qualifying for debt consolidation loans. To make the application process easier, you should know what your actual credit score is before applying for a loan. With Borrowell, you can quickly check your credit score for free to speed up the process.

When lenders check your credit score, it is recorded on your credit report as a “hard inquiry.” Hard credit inquiries temporarily lower your credit score, and applying for many loans at once results in multiple hits to your credit score. To protect your credit score, you should only apply for loans that you’re confident you’ll qualify for.

To minimize impacts to your credit score, you want to make sure you apply for a loan that you'll likely get approved for. Borrowell helps protect your credit score by showing you your likelihood of approval for recommended loan offers, based on your credit score.

Sign up and get your free Equifax credit score in just 3 minutes. Your credit score is updated on a weekly basis, and checking your score won't hurt it!

Your credit profile is automatically matched with the best loan products for you. Select your offer and complete the online application through the platform.

Once you are approved through loan partners, you can usually get access to funds in a matter of days.

Harneet S

@theharneetsingh

Awesome! I've been using @Borrowell for quite some time. Amazing concept.

Rebecca L

@_rbcalee

Just checked my credit score w/ @Borrowell and the best part was that they used emojis! Such fun! So exciting!

Sam V.

Just checked my credit score using Borrowell for FREE and without affecting my score! Gotta love Canadian startups.

Yes, it's really free. Borrowell provides you with your Equifax credit score, free of charge. Based on your credit score, we provide you recommendations on the best loans, credit cards, and financial products that you are likely to qualify for. Knowing your credit score speeds up the loan application process and helps you get your money as quickly as possible.

Borrowell works with over 50 trusted lenders to help you find loans that will fit your unique financial profile. Borrowell connects you to lenders offering a wide variety of loans, including debt consolidation loans. You can also use Borrowell to track your credit score and receive personalized recommendations on building your score and qualifying for the best possible loan interest rates in the future.

A debt consolidation loan can actually help you improve your credit score. Making consistent, on-time payments towards your consolidation loan every month will build up your repayment history, which is a main factor of your credit score.

However, if you don’t manage your loan properly, you could negatively impact your credit score. Late payments can have a big impact on your credit score — even up to a 150 point decrease.

Also, if you apply for multiple debt consolidation loans at once, your credit score may be impacted in the short term. When you apply for loans and lenders check your credit score, it’s recorded on your credit report as a “hard inquiry.” Hard credit inquiries temporarily lower your credit score, so applying for many loans at the same time results in multiple temporary hits to your credit score.

Secured or unsecured debt refers to whether you have an asset backing your loan or not. A secured debt is backed by an asset you own, such as your car or home. Secured debts are less risky to lenders and so tend to have lower interest rates. Unsecured debts are not backed by an asset, and instead, the lender is relying on their judgment to determine whether you will pay your debt.

Debt consolidation loans are available as both secured and unsecured debts, depending on the lender you choose. If you have an asset that you can use as security, your loan will have a lower interest rate. Keep in mind, however, that if you default on your loan, your lender can seize your asset as payment.

Debt consolidation loans have several advantages over paying off multiple debts in sequence, including:

Lower overall interest rates – If you have high interest debts like credit card balances, a debt consolidation loan will have a lower interest rate. A lower interest rate means more of your monthly payment goes towards paying off the debt and less towards interest charges.

One single payment – Juggling multiple debts can be demoralizing and lead to a failure to follow through with a debt freedom plan. Consolidating your debts into a single monthly payment lets you rest easy, knowing you’ll be debt-free by the end of your loan term.

Protect your credit score – With multiple debts, it can be easy to miss a payment, which will incur penalties and result in a lowered credit score. Debt consolidation loans are auto-debited from your account, so you can’t miss a payment, and your credit score is protected.

There is one significant disadvantage when it comes to applying for a debt consolidation loan, and that’s not changing your habits. Before you take out a debt consolidation loan, carefully consider why you need one in the first place. For example, if you have experienced various emergencies and you've racked up debt, then a debt consolidation loan is a good option because the debt is due to a specific event.

However, if your debt is due to regular overspending, it’s essential to realize that your debt is a symptom of a more significant problem. Unless you address that problem, you’ll most likely end up in the same position in a few years and require more stringent forms of debt relief.

While most debt consolidation loans are personal installment loans, there are other options for consolidating your debt.

Home equity loan - The most popular alternative is to use the equity in your home to pay off your debt. This home equity loan will be secured by your home and be subject to a very low interest rate.

Balance transfer credit card – If you have a small amount of debt that you want to pay off quickly, a balance transfer credit card might be a good option. Balance transfer credit cards allow you to transfer your credit card balance to a credit card that will charge around 0% interest for a set period, usually around six months. Balance transfer credit cards give you a break from interest payments and help you experience debt relief sooner.

Qualifying for a debt consolidation loan is more difficult if you have a low income, but it can be done with specific lenders. If you don’t qualify for a regular debt consolidation loan, you could consider a balance transfer credit card, as we mentioned above. Alternatively, a low interest credit card could be a good option if your debts are primarily high interest credit cards or payday loans.

If you can’t take on new debt to pay off your existing debt, then strict budgeting and earning extra money can help you get out of debt on a low income. If this doesn’t work, consider credit counselling or debt relief programs.

Get out of debt sooner with a debt consolidation loan. Sign up to get your free credit score and we'll use your credit profile to show your best loan options.

A personal loan and a personal line of credit are both useful borrowing options, but they work differently.

Jessica Martel

Jan 16, 2023

Read More

A personal loan can help you improve your credit score if you manage your payments properly.

Kate Smalley

Dec 07, 2021

Learn More

Refinancing a car loan can help secure a lower interest rate and reduce your monthly payments, but how does refinancing affect your credit score?

Karen Stevens

Dec 19, 2022

Read More

Advertiser Disclosure

Some of the products that appear on our website are from partners who pay us a referral fee. This compensation allows Borrowell to provide services such as free access to your credit report and score.

While Borrowell receives compensation from partners for some products, unless the article or review is clearly marked “Sponsored”, products mentioned in articles and reviews are based on the author’s subjective assessment of the products’ value to readers, not compensation.

Our goal at Borrowell is to present readers with product choices that will help them achieve their financial goals but our offers do not represent all financial products. The content provided on our site is for information only and is not financial investment advice or professional advice.