Get a Personal Loan in Alberta

Looking for a personal loan in Alberta? Use Borrowell to quickly compare the best personal loans and see your likelihood of approval in minutes! Plus, access free online tools to track and monitor your credit score and achieve your financial goals.

How to Get a Personal Loan in Alberta

If you’re applying for a personal loan, you should know that lenders in Alberta will qualify you based on your credit score. More than 230,000 Albertans have signed up for Borrowell to get their free credit score, and you can too! After checking your score, you can find a trusted lender that best matches your credit profile. Sign up for Borrowell and quickly find the best loan options for you today.

Personal Loans Alberta: What You Should Know

The process of qualifying and getting approved for a personal loan in Alberta is very straightforward. First, you’ll choose your lender and start the application process. The lender you choose will depend on the following information:

How much you earn

Your debt load and housing expenses

Your credit score

Depending on the lender you choose, you’ll submit your application in person at a branch or online. The loan application will require some essential documentation like your name, address, and information about your financial situation. Once your application is submitted, your lender will let you know if you are approved. Depending on the lender, this could take between a few minutes and several days.

You can use Borrowell to quickly find the right lender for you based on your credit score. You can easily compare different loan options and interest rates that you’re likely to qualify for.

Most personal loans in Alberta fall in the range between $1,000 and $35,000. The size of the personal loan you’ll get approved for depends on a number of factors, your financial stability, financial history, and creditworthiness.

To apply for personal loans in Alberta, you’ll need personal details and documentation about your financial situation, including:

Your name, address, and email address

Your social insurance number

Your employment status, which may include a recent pay stub or a letter from your employer

A void cheque to a bank account that is capable of setting up automatic deposits and withdrawals

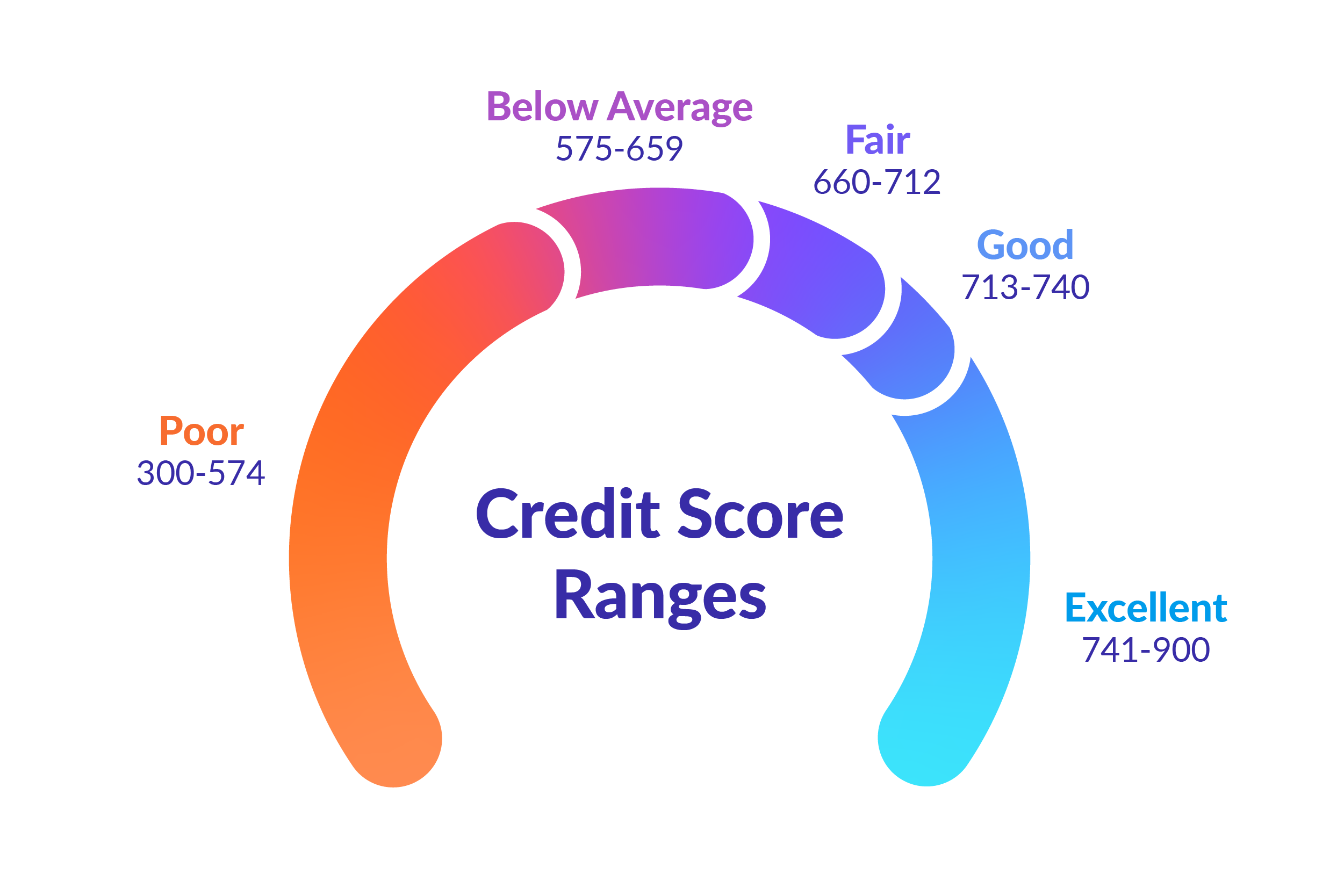

Many traditional lenders, like banks and credit unions, require a credit score of 660 or higher to qualify for a personal loan. Your credit score is a number between 300 and 900 that represents your creditworthiness. This is one of the critical financial details your lender will check when you apply for personal loans in Alberta.

If your credit score is below 660, there are still options available. You may be approved for a loan from traditional lenders, but with a higher interest rate. If not, you may need to seek out a non-traditional lender that specializes in lending to Albertans with a lower credit score.

Not sure what your credit score is? You can use a platform like Borrowell to check your credit score for free, and also learn tips and tricks to improve it. With Borrowell, you can also quickly compare loan products and the interest rates that you’re likely to qualify for, based on your score.

Some non-traditional lenders in Alberta will approve you for a loan without a credit check. Keep in mind, however, that non-traditional lenders will charge much higher interest rates than lenders who qualify you based on your credit score. These lenders typically focus on other aspects of your financial situation, such as your income and debt levels, to ensure you can afford to pay back your loan.

A personal loan with a credit check will have lower interest rates than loans without a check. Borrowell can give you your free credit score and match you with lenders that are likely to approve you after checking your credit score.

Yes, you can still qualify for a personal loan in Alberta with bad credit. These loans are usually available from non-traditional lenders and have a higher interest rate to offset the increased risk to the lender. These loans may require additional security in the form of either collateral, such as a car, or a co-signer, which is an individual such as a family member who will legally agree to pay back the loan in case you default.

Checking your credit score through an online platform like Borrowell is entirely free. It gives you valuable information about what type of lenders you should work with, and what kinds of interest rates you can expect. If your credit score is low, you can improve your chances of qualifying for the best possible interest rates by employing Borrowell’s recommended credit score raising strategies.

Why You Should Check Your Credit Score First

Lenders qualify you based on your credit score

Your credit score is one of the main criteria for qualifying for a personal loan. Because of this, you should find out what your actual credit score is before applying for a loan. With Borrowell, you can check your credit score for free before applying for a loan.

Applying for a new loan affects your credit score

When you apply for a loan and a lender checks your credit score, it is recorded on your credit report as a “hard inquiry.” Hard credit inquiries temporarily lower your credit score, so it’s in your best interest not to apply for multiple financial products in a given time frame.

Borrowell shows you your likelihood of approval for each loan

To minimize impacts to your credit score, you want to make sure you apply for a loan that you're confident you'll get approved for. Borrowell helps protect your credit health by showing you your likelihood of approval for the loan products recommended to you on our platform, based on your credit score.

Borrowell's Quick & Easy Loan Process

Sign Up & Get Your Score For Free

When you sign up to Borrowell, you’ll get your free Equifax credit score free in just three minutes. Checking your score won't impact it, and you can see which loans you will be eligible for.

Check Rates & Choose Your Offer

Borrowell automatically matches your credit profile with the best loan products available based on your credit score. Select your offer and complete the online application.

Get Your Loan

Once your personal loan is approved by a Borrowell loan partner, you can usually access your funds in just a few days.

Is Signing Up for Borrowell Free?

Yes, it's really free. Borrowell provides you with your Equifax credit score, free of charge. Based on your credit score, we provide you recommendations on the best loans, credit cards, and financial products that you are likely to qualify for. Knowing your credit score speeds up the loan application process and helps you get your money as quickly as possible.

Still Have Questions?

Get More Answers

You can use personal loans in Alberta for just about any purpose, but here are the common uses:

Emergencies like car repairs

Post-secondary education

Vacations

The interest rate you’ll qualify for on your personal loan is highly dependent on your financial situation, but most personal loan interest rates range from 5.99% - 29.19%. Some short term payday loans have interest rates as high as 600%, and those should be avoided at all costs. If you have a good credit score, stable employment, and a low level of debt compared to your income, you’re more likely to qualify for loans with interest rates between 5% and 10%.

When you qualify for a personal loan in Canada, your lender will arrange to have your loan amount deposited into your bank account via direct deposit. This process can take from 24 hours to a few days after loan approval.

If you’re applying for a personal loan in Alberta, you’ll want to present a healthy financial picture to your lender. Lenders look for the following criteria during the application process to determine whether or not to approve you for a personal loan:

A healthy credit score, preferably above 660

A credit report with a significant history and varied types of credit

A steady income

No recent requests for personal loans or debt that you may not be able to afford

Assets that could help you secure your loan if needed, such as a car or a home

Bank statements going back several months

If your financial situation doesn’t meet the criteria above, you have two options. First, you can wait until your finances are healthier before applying. You could use an alternative lender who will still approve you, but may perhaps charge a higher interest rate.

If you’re not sure whether you qualify for a loan, you can use Borrowell to check your credit score, compare loan offers from trusted lenders, and find the right one for you based on your financial situation.

There are two types of personal loans in Alberta: secured and unsecured. Secured loans use an asset to “back” the loan. This asset is known as collateral and is usually your car or home equity. If you default on your loan, your lender can seize the asset for payment.

Unsecured loans do not use collateral to secure the loan. Instead, the lender looks at your financial profile to determine whether you can pay back the loan. For unsecured loans, criteria like your income and credit score are essential. Once your lender determines that you are a good candidate for a loan, they’ll require you to sign loan paperwork promising to pay back your loan on a predetermined schedule.

If you can’t pay back the unsecured loan for any reason, your lender can’t take your car or home, but they can send your loan to a collections agency, who will attempt to collect the loan. Your credit score will also be severely damaged, which may prevent you from applying for loans in the future.

Depending on the lender, you may encounter the following fees when applying for a personal loan in Alberta:

The interest rate: This is a percentage of your loan amount that the lender charges to profit from lending you money.

A loan origination fee: This may be a flat fee or a percentage of your loan. The fee may be paid upfront or added to your loan balance.

A missed payment penalty: If you miss a payment, your lender could charge you either a flat rate fee or an interest rate penalty. Missing payments will also negatively affect your credit score.

Most personal loans are installment loans, which means they are paid back on a set schedule. You can choose from a monthly, biweekly, or weekly schedule, and pay your loan back over time. Your lender will automatically withdraw your payment from your bank account. In some cases, you may need to make payments manually.

Most lenders allow you to make extra payments on your loan to pay it off faster, but some lenders may also charge penalties for paying off your loan early, so it’s essential to read the fine print of your loan documentation to avoid surprise fees.

The length of time that it takes to pay off your loan in Alberta (also known as the term of the loan) can vary widely, depending on the loan. Some loans have extremely short terms, such as payday loans, which have terms as short as a week or two. Most personal loans have terms up to 5 years in length with the option to choose between two, three, or five year terms.

The length of the term of your loan will affect your monthly payment, but it’s important to balance the pros of a lower monthly payment with the cons of paying off the debt for a longer period of time and subsequently paying more interest.

How Borrowell Can Help with Your Financial Goals

Monitor & Track

Sign up and get your free Equifax credit score in just 3 minutes. Checking your score won't hurt it!

Understand & Improve

Receive weekly updates on how your credit score has changed. Get personalized tips on how you can improve your credit health.

Find the Right Product

Get matched automatically with the right loan products and trusted lenders that match your credit profile. Select your offer and complete the online application through the platform.

Find a Personal Loan in Alberta with Borrowell

Ready to find the best personal loan in Alberta? Sign up for Borrowell to get your free credit score, receive personalized loan recommendations based on your score, and quickly apply for a loan today!