About Borrowell

Our Mission: Borrowell's mission is to help Canadians feel confident about money. We provide insights and tools to help you make smart money decisions.

How Borrowell Helps

We Give Choice

We help you find the best financial products by comparing options from over 75 partners, giving you the freedom to make informed decisions.

We Offer Insights

We provide personalized tips based on your credit score and report to help you build and maintain your credit. We'll help you know whether you'll be approved, and ensure you're getting the best offers out there.

We Make It Easy

We help you apply and get approved in a few clicks so that you can get the products you want. Get the right tools at the right time to make managing your money easy.

Our Impact

Trusted by over 3 million Canadians to monitor their credit score and reports.

Credit Builder members who make on-time payments and saw a credit score increase had an average credit score increase of 41 points within 5 months.1

Rent Advantage members who made on-time payments on all their accounts saw an average credit score increase of 32 points within 7 months.2

Our Story

2014: Borrowell was founded by Andrew Graham and Eva Wong.

2015: First went live as a lending platform offering unsecured consumer loans in the prime lending space.

2016: Launched free credit scores and introduced a marketplace for financial products.

2018: Launched free credit score monitoring.

2022: Launched Credit Builder and Rent Advantage.

2023: Reached 3 million members!

2024: Launched past rent payments reporting.

Sign Up in 3 Minutes

With Borrowell, you can get your credit score in Canada for free! No credit check required. Once you've signed up for Borrowell, you can download your Equifax credit report for free AND check your credit score at any time without hurting it.

Tools to Help You Build Credit

Credit Builder

Through monthly payments that we report to Equifax Canada, you can build your payment history and credit mix.

Rent Advantage

Build credit history and payment history by reporting your monthly rent and/or up to 24 months of past your past rent.

Financial Marketplace

Based on your credit profile, you can compare financial products from over 75 partners and get personalized recommendations like credit cards and auto loans.

Our Leadership Team

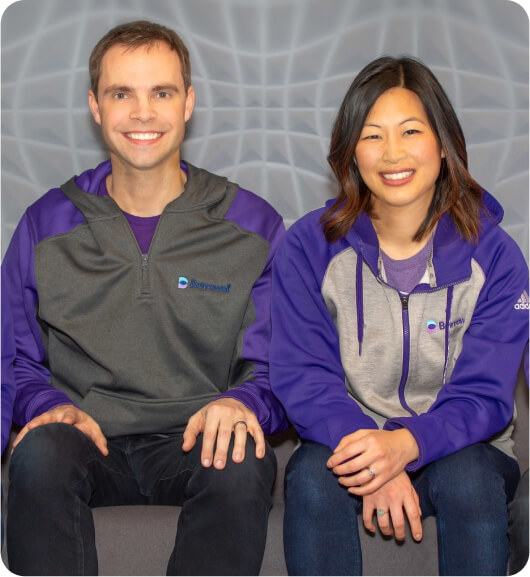

Andrew Graham

Co-Founder & Chief Executive Officer

Eva Wong

Co-Founder & Chief Product Officer

Jeff Yim

Chief Financial Officer

Simon Wyse

Chief Revenue Officer

Jeff LeJeune

Chief Technology Officer

Davinder Singh

Chief Marketing Officer

Samantha Tom

VP, Legal, General Counsel

Our Marketplace Partners

Join Our Team

As one of Canada's largest fintech companies, we know the value of our people. We're always on the lookout for top talent, a fresh perspective, and bright new ideas.

In the Press

Borrowell Introduces First-of-its-Kind Service for Renters

Today, Borrowell, Canada's leading company helping over three million Canadians build and better understand credit, launches the first program in the country allowing renters to report up to 24 months of past rent payments to Equifax Canada with no landlord involvement required.

“My take on debt has changed over time”: Eva Wong on saving and investing

Borrowell’s co-founder and COO on the best and worst financial advice, and the biggest money lesson she’s learned from her customers. Ten years ago, this felt really backwards to Eva Wong—so she co-founded Borrowell, the first company to offer free access to credit scores and credit reports in Canada (in partnership with credit bureau Equifax).

How mortgage shoppers can weave their way through the credit-score maze

“Between financial stress brought on by high interest rates and growing numbers of new Canadians, we’re seeing record numbers of Canadians interested in their credit scores,” says Andrew Graham, co-founder & CEO of free credit score provider Borrowell.

¹ Based on a study of Borrowell members with an Equifax Canada ERS 2.0 credit score between 300-600 when they signed up for Credit Builder after May 2022, made on-time payments on their Credit Builder and had a credit score increase. Individual results may vary. Other credit score factors, including late payments, activity with your other tradelines and credit utilization may impact results.

² Based on Rent Advantage members with an Equifax Canada ERS 2.0 credit score between 300-600 with no missed payments on any of their accounts. If members who made on-time payments on their Rent Advantage account but who may have missed payments on other accounts are included, the average credit score increase was 20 points by month 8. Individual results may vary. Other credit score factors, including late payments and activity with your other accounts can impact your credit score.