Get a Personal Loan in New Brunswick

Live in New Brunswick and need a personal loan? Use Borrowell to quickly compare loans and rates that you qualify for based on your credit profile. Sign up to get your free Equifax credit score, quickly compare personal loan options, and easily apply online for a loan today.

How to Get a Personal Loan in New Brunswick

Lenders in New Brunswick qualify loan applications based on credit score. That's where Borrowell can help. Borrowell gives you your credit score for free and shows you lenders that you qualify for based on your credit profile. Quickly compare loans and see your likelihood of approval for each one. Over 50,000 New Brunswick residents have signed up for Borrowell to check their credit score, compare loan options, apply online for the right loan, and improve their credit health.

Personal Loans New Brunswick: What You Should Know

Borrowers in New Brunswick frequently use personal loans to fund the following:

Vacations or travel

Large purchases

Funding an investment

Car purchase or repair

Renovations or home repairs

Vacations or special events

Paying off higher interest debts

Paying off taxes

There are few limits on what borrowers can use personal loans for in New Brunswick. Regardless of the purpose, personal loans are a good way to cover costs without relying on credit card debt. Personal loans can also be used to settle high interest debt and improve credit health.

Most lenders will ask for the following:

Canadian bank account

Proof of New Brunswick residency

Personal ID attesting to legal age (18 years or above)

Credit history and credit score

Proof of steady income and consistent employment

Personal information, including address and phone number

The growth of online loans and alternative lending has made it easier for borrowers in New Brunswick to qualify for a personal loan. While it is fast and easy to apply for a personal loan online, most lenders will require that borrowers meet basic requirements and provide certain documents.

You can sign up for Borrowell to compare loan offers from over 50 partners and see whether you qualify based on your credit score. Even applicants with bad credit will likely find a lender willing to work with them on Borrowell’s marketplace. However, interest rates and other terms may be less favourable than those offered to borrowers with good credit.

Getting a personal loan in New Brunswick is easy with online application and qualification. Applicants can sign up to Borrowell for free and instantly gain access to credit information. This lets borrowers better understand what loans they are likely to qualify for and apply for loans from several vetted lenders.

When applying for a loan in New Brunswick, collecting all necessary personal and financial documents beforehand can help expedite approval. Once documents have been received, lenders typically process applications in just a few hours. If approved, borrowers can expect funds to be transferred within a few business days.

Online personal loan applications are processed quickly, usually within just a few hours of submission. If the loan application is approved, funds will typically be deposited in just a few business days.

Paying back a personal loan in New Brunswick can help improve credit health over time. Payment history is a significant criterion for credit scores, making up 30-35% of a credit score. Making personal loan payments builds positive payment history with credit bureaus, which in turn boosts individual credit rating.

Diversifying the borrower’s loan portfolio is another way that personal loans build credit. Personal loans don’t contribute to higher credit utilization, unlike revolving credit card debt, and contribute to improved credit mix.

Using personal loans to consolidate multiple smaller or higher interest debt is one use of personal loans that can significantly improve your credit score. By combining loans into one larger, lower interest loan, borrowers lower credit utilization and make debt more manageable. Reducing credit utilization rates and making payments in full and on time will improve credit scores over time and improve the chance of getting approved for better loans in the future.

Why You Should Check Your Credit Score First

Lenders qualify you based on your credit score

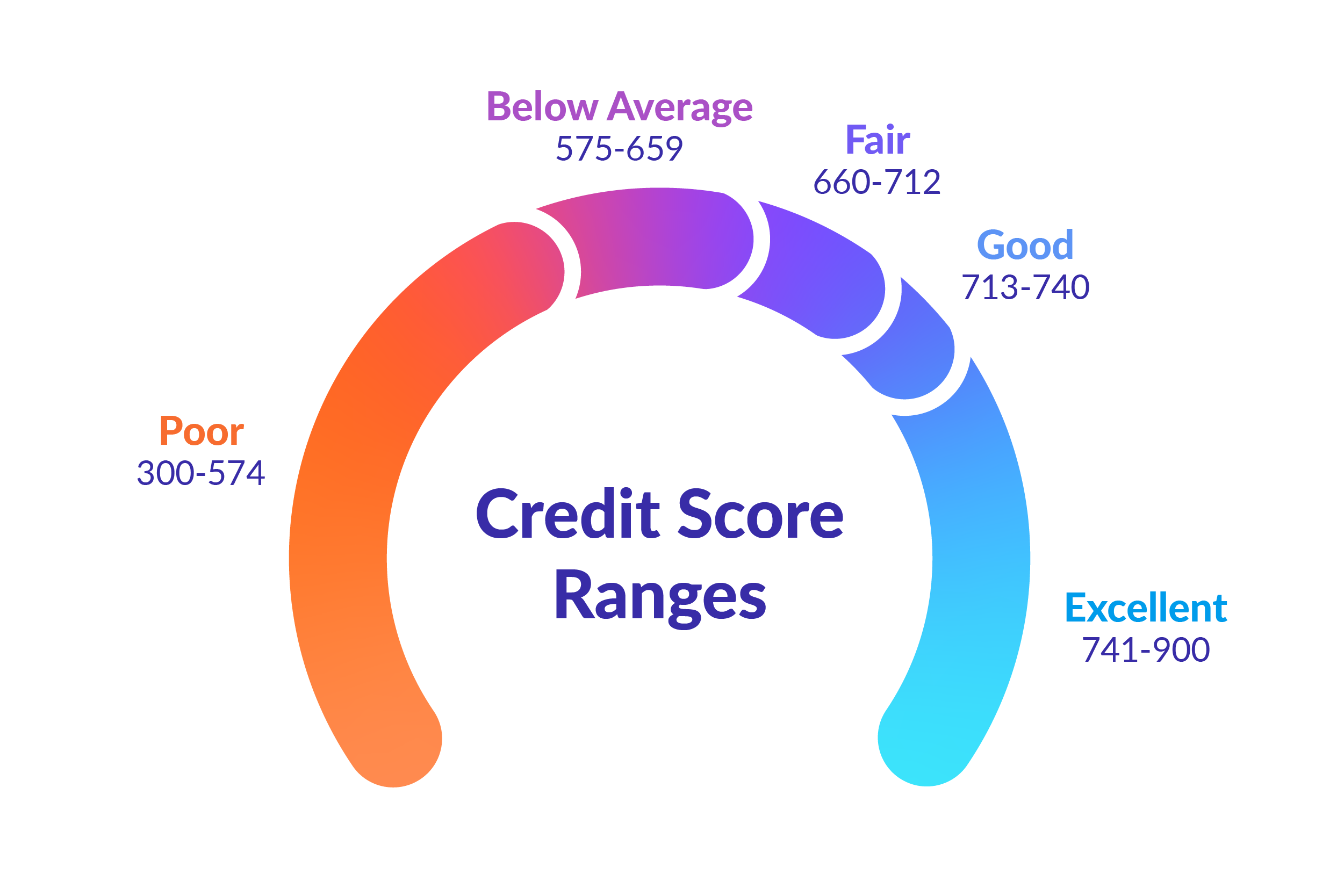

Your credit score is one of the main criteria for qualifying for a personal loan. Because of this, you should find out what your actual credit score is before applying for a loan. With Borrowell, you can check your credit score for free before applying for a loan.

Applying for a new loan affects your credit score

When you apply for a loan and a lender checks your credit score, it is recorded on your credit report as a “hard inquiry.” Hard credit inquiries temporarily lower your credit score, so it’s in your best interest not to apply for multiple financial products in a given time frame.

Borrowell shows you your likelihood of approval for each loan

To minimize impacts to your credit score, you want to make sure you apply for a loan that you're confident you'll get approved for. Borrowell helps protect your credit health by showing you your likelihood of approval for the loan products recommended to you on our platform, based on your credit score.

Borrowell's Quick & Easy Loan Process

Sign Up & Get Your Score For Free

When you sign up to Borrowell, you’ll get your free Equifax credit score free in just three minutes. Checking your score won't impact it, and you can see which loans you will be eligible for.

Check Rates & Choose Your Offer

Borrowell automatically matches your credit profile with the best loan products available based on your credit score. Select your offer and complete the online application.

Get Your Loan

Once your personal loan is approved by a Borrowell loan partner, you can usually access your funds in just a few days.

Is Signing Up for Borrowell Free?

Yes, it's really free. Borrowell provides you with your Equifax credit score, free of charge. Based on your credit score, we provide you recommendations on the best loans, credit cards, and financial products that you are likely to qualify for. Knowing your credit score speeds up the loan application process and helps you get your money as quickly as possible.

Still Have Questions?

Get More Answers

Personal loan terms can be short term or long term, depending on the borrower’s needs. Most loans last between 6 months and 5 years. Long term loans are often used for larger loan amounts, while short term personal loans are typically for smaller loan amounts. Short term loans typically carry lower interest rates than long term loans.

Interest rates in New Brunswick vary depending on the applicant’s financial profile, loan amount, loan term, and lender specifications. Borrowers with a steady income, history of consistent debt repayments, and other requirements, will likely secure a better interest rate.

Most personal loan offers have interest rates ranging between 5%-20%. Canadian law prohibits lenders from charging over 60% interest on personal loans.

Debt consolidation involves grouping multiple small loans or external debts into one single larger loan. There are a number of benefits associated with consolidating loans. Managing one payment is simpler than juggling numerous separate payments, and personal loans offer lower interest rates than credit card debt or other types of loans. This can help borrowers maintain on-time payments, thereby improving credit rating and access to better loans in the future.

While there are many lenders that will work with borrowers with bad credit, there are some basic requirements that need to be met in order to qualify for a personal loan in New Brunswick. Common reasons why loan applications are rejected include:

Bad credit score, if the lender has a credit score requirement

Limited, bad, or no credit history

Insufficient income according to lender requirements

Mistakes or omissions in the loan application

Unstable employment history

Borrower already has active loans

Borrower doesn’t meet basic requirements, such as legal age or residency

Borrowell delivers quick and easy access to personal loans and credit monitoring. With funding solutions for borrowers across Canada, Borrowell gives users access to their credit score instantly to better assess which loans to apply for. Credit score monitoring also helps put borrowers on the path to improved financial responsibility and health.

Borrowell lets users compare loan offers from over 50 partners and transparently displays interest rates and any associated fees so borrowers know exactly what they are getting. Plus with many lenders to choose from, even borrowers with bad credit will likely find an offer to suit their unique needs. Sign up for Borrowell to check your credit score for free and find the best personal loans in New Brunswick that you qualify for.

How Borrowell Can Help with Your Financial Goals

Monitor & Track

Sign up and get your free Equifax credit score in just 3 minutes. Checking your score won't hurt it!

Understand & Improve

Receive weekly updates on how your credit score has changed. Get personalized tips on how you can improve your credit health.

Find the Right Product

Get matched automatically with the right loan products and trusted lenders that match your credit profile. Select your offer and complete the online application through the platform.

Find a Personal Loan in New Brunswick with Borrowell

Ready to find the best personal loan in New Brunswick? Sign up for Borrowell to get your free credit score, receive personalized loan recommendations from trusted lenders, and quickly apply for a loan today!