Here are eight tangible steps you can take to improve your credit score. Your credit score directly impacts your ability to get approved for financing, including credit cards, loans and mortgages.

The Borrowell Team

Nov 28, 2025

Learn More

One of the most important factors that can affect your credit score is credit utilization, but many Canadians don’t know what it is!

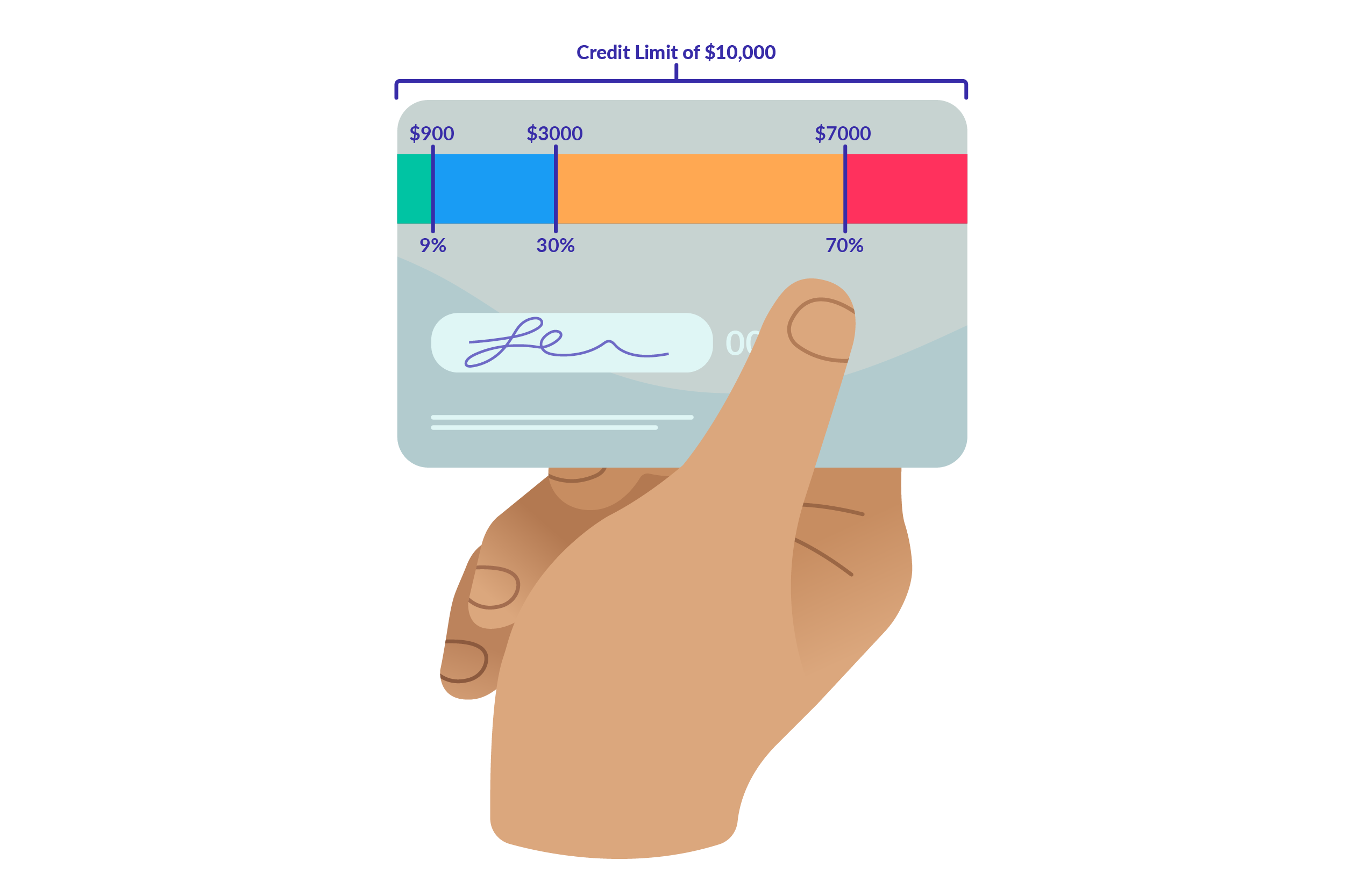

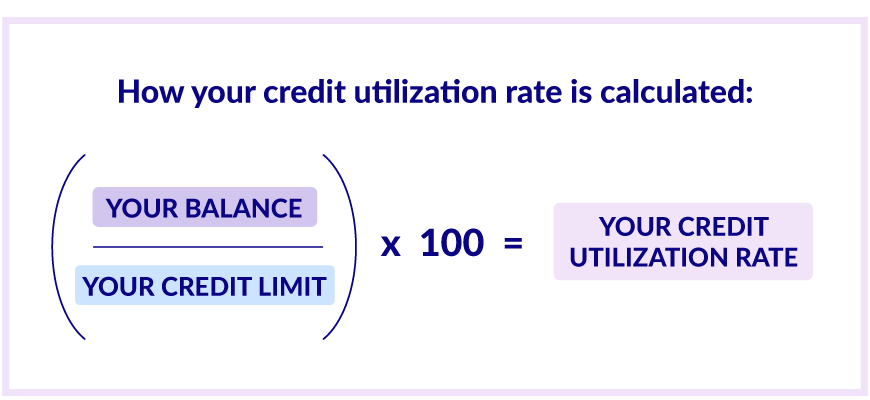

Your credit utilization ratio, also known as your debt-to-credit ratio or credit utilization rate, measures how much of your available credit you're currently using. It's expressed as a percentage and calculated by dividing your outstanding balance (what you owe) by your credit limit. So, for example, if you have a credit limit of $10,000 and a balance of $2,500, your credit utilization ratio would be 25% ($2,500 ÷ $10,000 = 0.25 or 25%).

Your credit utilization ratio is a primary factor that the credit bureaus use to calculate your credit score. In fact, credit utilization accounts for around 30% of your score, so if you’re looking to understand and improve to buy a house or get a loan, you need to pay attention to how much of your available credit you’re using.

A high credit utilization rate can negatively impact your score, as lenders take it to mean that you might be relying too heavily on credit and could potentially be at risk of defaulting on your debts. Generally, it’s recommended that you aim to keep your credit utilization ratio below 30% to maintain a good credit score.

Your credit utilization is the amount of credit you've used out of the total amount available to you. The lower your credit utilization, the more attractive you are to lenders.

You can figure out your credit card utilization in Canada by dividing your total credit card debt by your total limit. For your overall credit utilization, just add up all your cards and lines of credit, including home equity lines of credit, and divide them by your total credit limit.

For example, if the balance on your credit card is $500 and your credit limit is $1,000, then you have a high credit utilization, with a rate of 50%. We recommend keeping your it below 30%.

Step 1: Tally all your balances from all your credit cards

Step 2: Tally the limits you have on all your cards

Step 3: Divide the total balances you have by the total credit limit

Step 4: Multiply by 100 to get your ratio as a percentage

Carrying large balances on your credit cards suggests you’re not able to pay them off in full, credit bureaus see this as an indication that you might have problems paying bills in the future. If for example, you’re relying on your credit to cover your regular expenses, once your credit cards are maxed and the lines of credit are used up, you may not be able to cover loan payments.

We recommend keeping your utilization below 30%. Credit providers and financial institutions will see your low ratio as responsible credit use. So if your credit card limit is $5,000 and your balance is $1,250, your utilization is 25%.

In a 2021 study, Borrowell found that the average credit utilization rate of Canadian consumers was 43.5%.

There are a few different ways that you can improve your credit utilization and luckily, they are pretty simple.

The best way to improve your score is by minimizing the balances you owe on your credit card accounts. To do this, you should try and pay off your balance in full each month.

If you’re having trouble meeting your monthly bills (payment history makes up 35% of your score), you may want to consider debt consolidation or a low-interest personal loan. Loans don’t count towards your credit utilization because they’re a form of instalment credit: you’re approved for a set amount, which you pay off through fixed payments over time.

Since credit card interest on missed payments usually exceeds 19.9%, you’ll likely receive a lower interest rate on a personal loan and save money in the long run. You can use our loan calculator to see how much you could save on a monthly basis.

Another way to improve your utilization rate is to ask your credit card company to increase your credit limit, or you can apply for another credit card. This is called a balance transfer. If you can handle credit responsibly without overspending, this is a great option. The goal is to increase the total amount of credit available to you and not to add to any existing debt you may have.

It is important to regularly check your credit card balance throughout the month and pay off the balance if it is likely to give you a credit utilization ratio of more than 30%. Here’s why:

Boost your credit score: The credit scoring models used by Canada’s credit bureaus consider a high credit utilization ratio a sign of financial trouble and so a high ratio will negatively impact your credit score. Keeping your credit utilization ratio below 30% can help give your credit score a boost.

Avoiding interest charges: If you carry a balance on your credit card, your credit card issuer will likely charge interest on the unpaid balance. Interest payments can add up very quickly and result in paying much more than the original purchase price. Paying off your credit card balance in full each month ensures you avoid interest charges and save significant amounts of money.

Avoiding late fees: If you don't pay your credit card balance on time for each billing cycle, you may be charged a late fee. Late fees can be a significant expense over time. Setting up a balance alert to keep track of your billing cycle and credit card balance is easy to do (most banks allow you to set up an alert online) and will ensure you stay on top of your payments and avoid late fees.

Building a good credit history: Consistently paying off your credit card balance on time can help you build a good credit history, which will make it easier for you to get approved for credit in the future.

Setting up a balance alert can help you stay on top of your credit card balance and avoid a high debt to credit ratio. By checking your balance regularly and paying off your balance in full each month, you can maintain a low credit utilization ratio, avoid interest charges and late fees, and build a strong credit report.

Another way to manage credit utilization is to consolidate your debt from credit cards to a personal loan. By doing so, you’re essentially paying off your credit card balances with the loan. Credit card interest rates are notoriously high so the goal is to get a personal loan with a much lower interest rate. This can help save you money and reduce your credit utilization ratio because you will have more revolving credit available to you.

For example, if you have a total credit card debt of $10,000 with a credit limit of $20,000, your credit utilization ratio is 50% (and remember you want to keep it below 30%). However, if you consolidate your debt with a personal loan of $10,000, your credit utilization ratio will be reduced to 0%, as you will have paid off all your credit card balances and your credit limit will remain unchanged. It’s important to understand that your credit utilization ratio is made up of only revolving credit. Unlike credit cards and lines of credit, which are revolving credit, personal loans are installment accounts and therefore don’t count towards your debt to credit ratio when calculating your score.

Reducing your credit utilization ratio can have a positive impact on your credit report and score because it shows that you know how to use credit responsibly and don’t rely too heavily on credit. In addition, a personal loan typically has a fixed interest rate and a set repayment period, which can make it easier to manage your debt and avoid late payments or missed payments that can hurt your credit score.

Be aware, however, while consolidating debt with a personal loan is a good way to manage credit utilization it’s not the right solution for everyone. You should carefully consider the terms and fees associated with a personal loan and compare them to the interest rates and fees on your credit cards before making a decision. You should also have a plan to pay off the personal loan within the set repayment period to avoid accruing more debt and damaging your credit report and score even more.

Thinking of adding another credit card to your wallet? Your credit utilization ratio can also be improved by opening a new card because getting a new credit card gives you a credit limit increase. This in turn will increase your total available credit, which can lower your credit utilization ratio. For example, if you have a total credit limit of $10,000 with one credit card and you open a new credit card with a $5,000 credit limit, your total available credit will increase to $15,000. If your balance stays the same at $2,000, your credit utilization ratio will decrease from 20% to 13.33%.

However, be aware that applying for a new credit card can also have negative consequences. It can lower the average overall age of your credit card accounts, which can decrease your credit score (not to mention harm your credit report). If you struggle with managing your spending, having another card can also lead to overspending and accruing more debt, which can hurt your financial health over time. Therefore, before opening a new credit card, it is important to consider the potential risks and benefits and make an informed decision based on your individual financial situation.

If you want to improve your credit utilization ratio, it’s wise to keep your old credit cards open, even if you're not using them. By not cancelling your cards and keeping them open, you can increase your overall credit limit, which can help lower your utilization ratio.

Note that when calculating your credit score, both your per-card utilization and overall utilization are taken into account. Per-card utilization looks at the percentage of your credit limit that you are using on each individual credit card. For example, if you have a credit card with a $5,000 limit and a balance of $2,500, your per-card utilization for that card would be 50%.

Your overall utilization, on the other hand, looks at the percentage of your total available credit that you are using across all of your credit accounts. For example, if you have three credit cards with credit limits of $5,000, $10,000, and $15,000 respectively, and you have a total balance of $6,000 across all three cards, your overall utilization would be 20% ($6,000 divided by $30,000).

Credit scoring models look at both of these utilization ratios to determine how much of your available credit you are using.

A transfer balance is when you repay or 'transfer' one credit card debt to another card. There are three reasons you might want to consider this as an option:

You can get a lower interest rate on another card

There is a card with a higher credit limit available that can accommodate your old balance

You receive a favourable introductory offer that provides you with time to pay off your existing debt- just pay attention to the fine print and possible increase in the interest rate

If you’re transferring between existing accounts, it typically doesn't affect your credit score, however, if you open a new card the ‘average age’ of your credit accounts will decrease.

Credit history is a part of your credit score, however, payment history and credit utilization have a bigger impact on the scoring model, meaning a balance transfer may be a good option depending on your situation.

Get matched with the credit cards that fit your profile and see your likelihood of approval when you sign up or log in.

As credit utilization accounts for around 30% of the factors that determine your credit score, making it the second most important factor, lowering your credit utilization can have a big impact on your credit score. A lower credit utilization rate signals to potential lenders that you are using your credit responsibly and have not taken on more debt than you can afford to pay back, meaning you’ll be more likely to get approved for the credit products you apply for, and with lower interest rates.

If you are looking to improve your credit score there are lots of ways you can start building positive financial habits and a more stable financial future. If you aren't already a member, you can get your free credit score and track your progress as well as accessing personalized recommendations and advice.

Trusted by over 3 million Canadians, Borrowell provides free weekly credit scores and report monitoring, personalized financial product recommendations and affordable tools to help you build your credit. Sign up for your free Borrowell account today on borrowell.com, or download the mobile app for Android or iOS.

Here are eight tangible steps you can take to improve your credit score. Your credit score directly impacts your ability to get approved for financing, including credit cards, loans and mortgages.

The Borrowell Team

Nov 28, 2025

Learn More

Thanks to rent reporting services, you can now build your credit score by paying your rent on time every month.

Janine DeVault

Jun 17, 2024

Read More

A credit builder loan is specifically designed to help establish and boost your credit.

Jessica Martel

Aug 28, 2025

Read More