Here are eight tangible steps you can take to improve your credit score. Your credit score directly impacts your ability to get approved for financing, including credit cards, loans and mortgages.

The Borrowell Team

Nov 28, 2025

Learn More

Borrowell offers weekly credit score updates! Sign up for free to measure, monitor and improve your credit score today!

Welcome to The Ultimate Guide to Canadian Credit Scores, the most comprehensive guide to Canadian credit scores on the web! Credit scores in Canada can be confusing, and it’s sometimes hard to find reliable information to help you understand your credit score. It's our hope that the information in this guide can help make credit scores more accessible and will help you either improve your low credit score or take advantage of your good credit score.

Credit is an invaluable part of your financial status, and having a good score is invaluable when seeking a loan, credit card, mortgage or other financial product. When you use credit but don't focus on the importance of responsible use, there are consequences that could have an effect on your score.

Knowing what a credit score is, the best practices to using credit and how to reach and maintain a good number is important. This guide will help answer all of your questions surrounding financial success and the credit score. Let’s get started!

Sign up for Borrowell to get your free credit score and receive tailored tips to improve your score. Find out instantly what credit cards, loans, and mortgages you can qualify for.

A credit score is a number given to anyone who uses credit, and ranges between 300 and 900 depending at the two credit bureaus in Canada, TransUnion and Equifax. At Borrowell, we use your Equifax credit score, which is calculated by the Equifax Risk Score 2.0 (ERS 2.0). Your credit score is determined based on information in your credit report. Financial institutions will use this number to determine current and future interest rates, among other financial offerings. The number as a whole recaps your willingness to repay loans and other credit products.

The higher your score, the better. But what do these numbers mean? Credit reporting agencies in Canada collect information on consumers like us. They know how often we pay our bills, when we pay our bills and how long it takes us to pay our bills. They’ll share this information with financial institutions and credit providers if you provide them with permission to do so.

Your score is calculated through careful analysis of information in your credit report by the credit bureau, either Equifax or TransUnion. Financial institutions use this information to help make decisions about the services and products they offer you, such as interest rates and insurance premiums.

This information also relates to your debt: how much you have, how long it takes you to pay back, what type you have and how long you’ve had it.

Don’t know your score? You can check your credit score for free with Borrowell! Over three million Canadians have signed up with Borrowell to get their Equifax credit score and credit report for free.

Your credit score is a measure of trust: the higher your score, the more trust lenders and institutions will have in your ability to pay them back. A good credit score can help you improve your financial well-being and make getting a mortgage, buying a car or starting a business a lot easier (and cheaper!). Check out what the current credit score requirements are for a mortgage in Canada.

Your credit score is vital, as it presents your level of risk as a potential customer. Credit scores are mostly used on applications, but can also be used by landlords, insurers and beyond. It is very important that you're aware of what your credit score is to track your financial well-being and also to catch any fraudulent activity.

Most organizations recommend that you review your credit report at least once each year, although checking it more frequently (e.g. monthly or weekly) is even better. Ensuring that you have a good credit score can help you to attain financial goals that you have set, such as: getting a mortgage, buying a new vehicle, or starting a business.

In Canada, we have two credit reporting agencies – Equifax and TransUnion. They are both independent companies who gather credit information from your financial institutions (e.g. your payment history), phone and utility companies. They then create complex models using this information and produce credit scores.

Both of Canada’s credit bureaus, Equifax and TransUnion, will allow you to purchase your credit score and credit report.

Borrowell is a credit education company and was the first company in Canada to provide you with your credit score online for free. It’s safe, secure and only takes 3 minutes. No credit card or SIN is required. Sign up to get your free credit score with Borrowell!

Sign up for Borrowell to get your free credit score. That's right. For free.

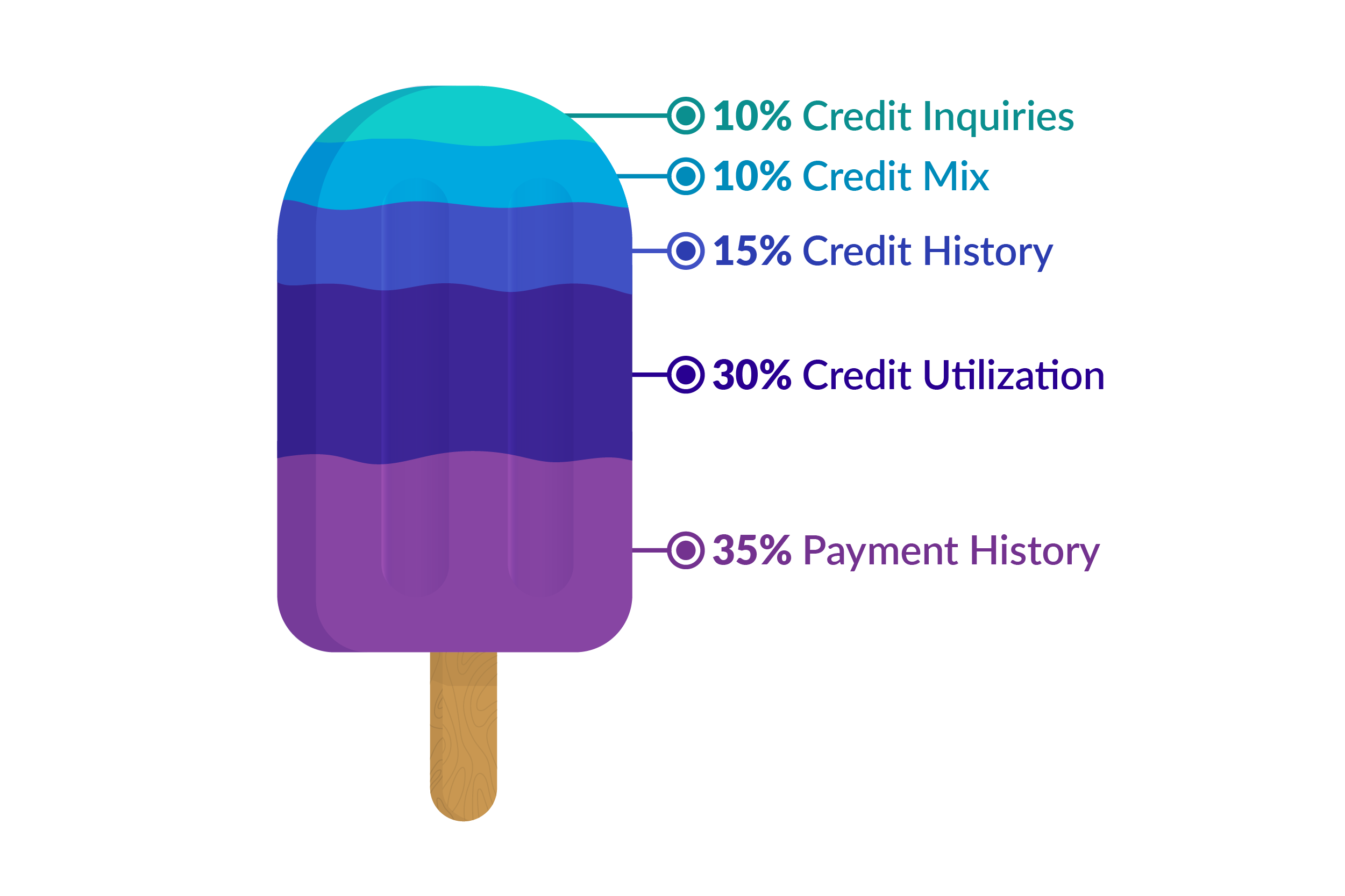

Credit scores are calculated by weighing various factors from your credit report.

As the illustration shows, your credit score is affected by payment history, credit utilization (how much credit you use out of what is available to you), your credit history, credit mix (types of credit), and your number of credit inquiries.

The information is weighted like so:

Your credit score fluctuates, and you can access your updated free credit score and report every single week as a Borrowell member. When you get your credit score from Borrowell, we update it weekly and provide tips for improvement.

When applying for new credit, or anything that may require a credit report to be sent out, your credit score will be calculated alongside the report. This means that your credit score is calculated and recalculated many times. As you clean up your credit history and this information is mapped out within your credit report, your credit score should improve.

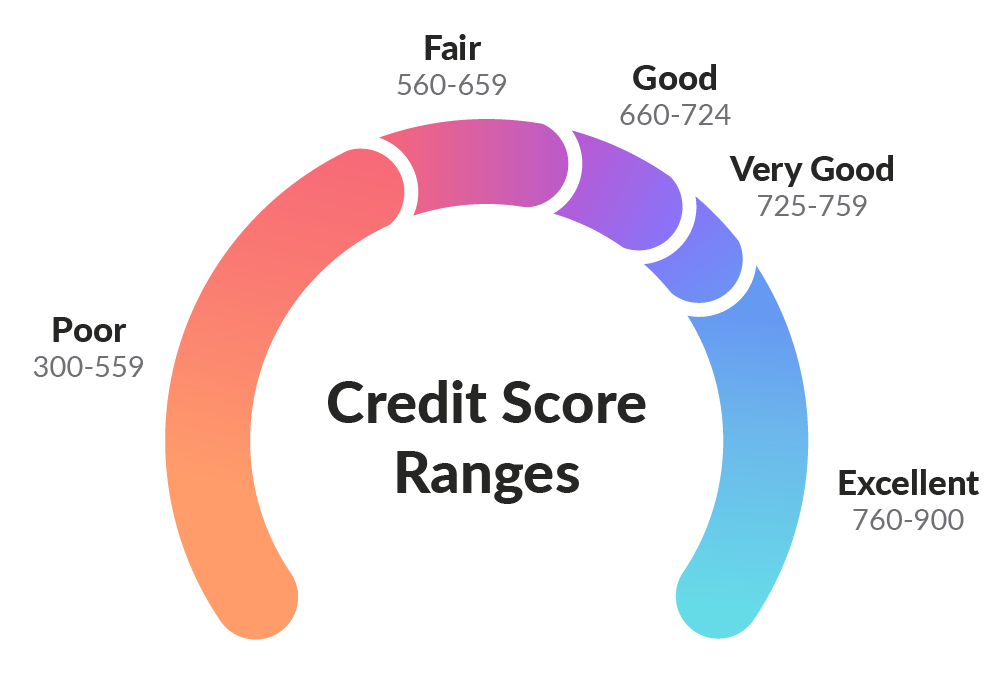

Credit scores in Canada can fall anywhere between 300 and 900 when using the ERS 2.0 scoring model. A very good to excellent credit score in Canada is between 725 and 900. According to 2026 data from Borrowell, the average credit score in Canada is 679.

The higher your score is, the less lenders see you as a risk. However, each financial institution has its own rankings for high- and low-risk borrowers.

Below is an interpretation from Equifax on its Equifax Risk Score 2.0 credit score. remember, there are different credit bureaus and different scores. Every lender will also have its own criteria, and all lenders will look at the information in addition to the credit score to make a decision.

760 - 900: You have an excellent credit score!

725 - 759: You have a very good credit score. You should expect to receive very good interest rate offerings and a variety of credit products.

660 - 724: This is considered good to lenders. But once you get to 659, you’re entering into average credit score territory.

560 - 659: This is a fair credit score.

300 to 559: Your credit score is poor and needs improvement. You’re considered to be a high-risk borrower and even if you’re approved, you could end up paying a lot in interest.

31% of Canadians are unsure of how to achieve a good credit score, but it’s not as overwhelming as one may think. If you have a zero credit score or no credit at all, check these recommendation of how to build your credit score in Canada.

If you are looking to improve your credit score, there are many steps you can take to do so. Below are some of the key steps you can take to improve your credit score. With patience and strong financial habits, you can increase your credit score and reach your future goals.

Paying your bills on time is extremely important. As we mentioned in “how your credit score is calculated” above, making payments on time, or your payment history accounts for 35% of your credit score.

Late payments are generally based on the following three measures: how recent they are, how severe they are, and how frequently you are late.

The typical timeline goes as follows: 30 days, 60 days, 90 days, 120 days, 150 days and then it would typically be written off as a loss. Even one late payment could affect your credit score. Not only could it affect your credit score, but it could also affect your future interest rates and late fees.

Making payments on-time, or reducing the number of payments you miss, can help you improve your credit score over time. Check out how missed payment trends affected credit scores in Canada during the COVID-19 pandemic.

Looking for ways to avoid missed payments? Here are some simple steps you can take:

Control on-time payments by setting up automatic payments or reminders.

Make a budget that includes all bills owing and their due dates.

Don’t forget about phone and utility bills, because those impact your credit score when you miss payments as well! Unpaid utility bills can negatively impact your credit score if your utility company sends your unpaid bills to a collection agency.

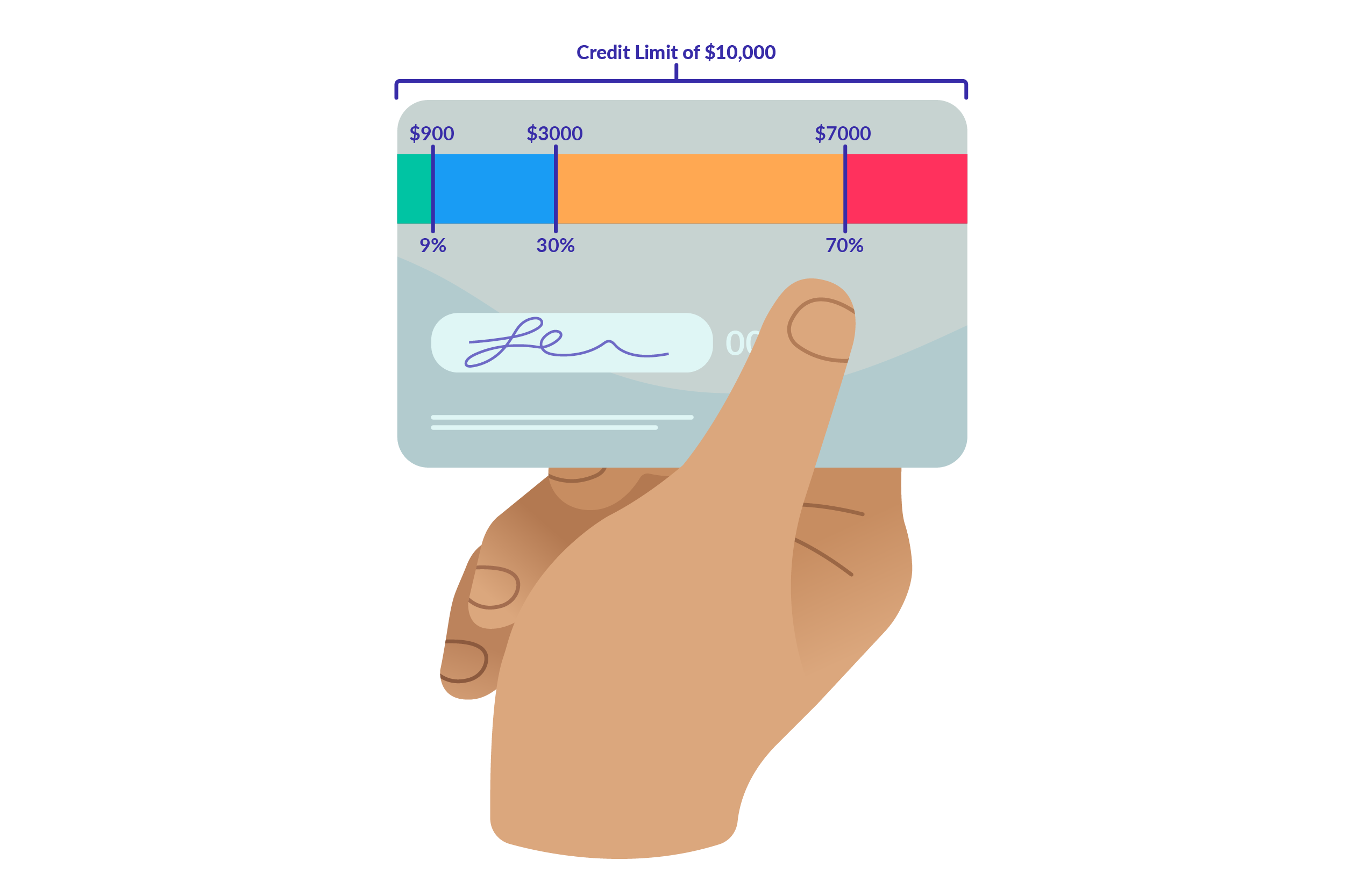

Credit utilization makes up 30% of your credit score, so it’s almost as important as your payment history. The lower your credit utilization, the better (as long as you're still using credit!)

You can figure out your credit utilization by adding up the balances on your credit cards and lines of credit and then dividing by your total credit limit. If the balances you owe total $4,000 and the total of all the credit you have available to you is $10,000, then your credit utilization is 40%.

Equifax recommends that you keep your credit utilization below 75%. Some studies have shown a strong relationship between low credit utilization and high credit scores, with the highest credit scores having 20-30% utilization. At Borrowell, we recommend keeping your utilization percentage under 30%. One way to control your credit utilization is by carrying small balances that you are able to pay off every month. This will demonstrate your financial responsibility, and in turn, boost or maintain your credit score.

Credit history makes up 15% of your credit score. The 15% is based on how long your accounts have been open, and whether they are active. To create a solid history, credit bureaus would prefer a minimum of six months of credit history, and some lenders would require 12 months or more.

Therefore, before you close a credit account, research whether or not this will affect your credit history. If you’ve had one card for 10 years, and another for 5, your best option would be to close the 5-year old account as it holds less credit history. Creating that credit history takes time.

Credit inquiries account for 10% of your overall score. Credit agencies will review all of your requests within the past six to 12 months. These requests can be seen as soft or hard inquiries. A soft inquiry, such as when you check your score yourself, or sometimes when you get a quote online, will not affect your credit score.

A hard inquiry, like applying for a credit card or a mortgage, will have some effect. Typically, a couple of hard inquiries will not raise any flags. It’s only if you’ve been applying for a lot of credit in a short period of time that lenders may be concerned. If you’re rate shopping for a mortgage or car loan, don’t worry – credit bureaus will combine multiple inquiries on car loans and mortgages in a set period of time because they know you’re not likely to get five mortgages at once!

Different types of credit (credit mix) carry weight in different ways. For example, paying a mortgage means that your amount owed decreases monthly, whereas paying a credit card is seen as a higher-risk loan by credit bureaus because the number can increase or decrease daily.

Having diversity within your credit rating is 10% of your overall score. In comparison to other factors, it’s not as high – but every percentage counts.

Different types of credit include student loans, car loans, mortgages, home equity lines of credit, unsecured lines of credit, credit cards and utility bills.

It’s not recommended you open new accounts to create diversity unless you are planning to use them. Generally, if you stay responsible with your money, your credit score will be good.

Borrowell offers free Equifax credit reports. You can sign up or log in to check your free credit score in under 3 minutes and it won't impact your score. Learn more about how to read your credit report.

Depending on where in Canada you live, this information can stay on your profile for six to seven years. Some examples:

Bankruptcy can stay on your profile for a maximum of 7 years

Negative credit transactions can remain for up to 6 years from the date of your final payment

Negative information from bank accounts can stay on your profile for up to 6 years

Secured loans, such as mortgages and car loans, remain for up to 6 years

Debt collection stays on your profile for up to 6 years from the time the debt is assigned to collections

Legal judgements stay on your profile for up to 6 years

If there are errors on your credit report, you should contact the appropriate credit bureau as soon as possible. You can read more about how to report an error or dispute something on your report here.

Any details provided to the credit agency will be reviewed and compared to their documentation. If the problem is not resolved, the agency will contact the consumer to settle any concerns.

By reviewing your credit score regularly, you can protect yourself from any potential fraudulent activity. Take advantage of Borrowell’s free credit score offer and stay on top of your financial security.

There are two credit bureaus in Canada (Equifax and TransUnion), and each one could collect different information from credit providers and financial institutions. They each also have their own way of calculating the scores they use. Therefore, each of these agencies could have a different credit score for you based on the information that they have and the calculations they use.

What’s more, each credit bureau produces different scores for different purposes. For example, a lender who is looking to approve a mortgage may want slightly different information from a lender looking to approve a smaller, shorter-term loan. So Equifax has a few different scores they produce, as does TransUnion.

Credit scores are based on your credit history and your payment history, not how much money you make or how much you have in your bank account. Credit bureaus actually don’t have access to this information and it does not have an impact on your credit score.

Creditors and lenders want to see that you manage your credit well. This means that usage is a factor in determining whether you are high or low risk. It is smart to have at least one credit card as part of your financial strategy, so long as it is being used responsibly.

As we mentioned above, credit utilization is worth 30% of your credit score, therefore it is very important to maintain and monitor.

Having a good credit score on your own is very important. Much like a driving record is individually based, so is a credit score.

Monitoring your credit score can protect you from any fraudulent activity that could potentially damage your report. If you do not monitor your report you are at risk for these possibilities.

There are lots of different factors that impact your credit score. Being aware of why it matters and building good financial habits is a great first step! Don't forget to track your progress - you can sign up or log in to check your free credit score in under 3 minutes and it won't impact your score. You can also find which financial products match your profile and your likelihood of approval.

Trusted by over 3 million Canadians, Borrowell provides free weekly credit scores and report monitoring, personalized financial product recommendations and affordable tools to help you build your credit. Sign up for your free Borrowell account today on borrowell.com, or download the mobile app for Android or iOS.

Here are eight tangible steps you can take to improve your credit score. Your credit score directly impacts your ability to get approved for financing, including credit cards, loans and mortgages.

The Borrowell Team

Nov 28, 2025

Learn More

Thanks to rent reporting services, you can now build your credit score by paying your rent on time every month.

Janine DeVault

Jun 17, 2024

Read More

A credit builder loan is specifically designed to help establish and boost your credit.

Jessica Martel

Aug 28, 2025

Read More