Get an Installment Loan in British Columbia

Need to get an installment loan in British Columbia? Scroll down to see some of the options available. Want to know if you'll qualify? Sign up for Borrowell, check your credit score for free, and instantly see your approval chances for installment loans based on your score. Use Borrowell to compare installment loan options and apply with confidence!

How to Find the Best Installment Loans in B.C.

Finding the right loan can be time-consuming, whether you’re looking for a car loan, a mortgage, or any other type of installment loan. That’s where Borrowell can help. Over 260,000 B.C. residents have already signed up for Borrowell to check their credit score for free. Sign up and quickly compare loan options available to you based on your credit score.

Installment Loans B.C.

What You Should Know

Getting an installment loan involves borrowing a set amount of money that is paid back in installments, with interest added, over a specified loan term until the full amount is repaid.

Installments can consist of weekly, biweekly, or monthly payments depending on the lender’s terms. Installment loans can be secured or unsecured, and interest rates for installment loans in BC can be fixed or variable. Interest rates range from 3-50%.

For BC residents looking for money quickly to cover unexpected expenses or large purchases, installment loans are a good option. Installment loans in BC are easy to apply for online and many lenders a qualification process in just a few minutes.

If you’re looking for the right lender, you can sign up for Borrowell and quickly compare loans available to you. Find loans that you’re likely to qualify for based on your free credit score. Once you’ve found the right product, you can complete an online loan application through the platform.

Installment loans can be used for many purposes, including:

Emergency home or car repairs

Medical bills for uninsured procedures

Vacations

Large purchases, such as appliances or vehicles

Milestones events

Credit card debt consolidation

Home renovation

Overdue bills or taxes

Investment opportunities

Installment loans are a good option for BC residents seeking to fund short term or long term expenses. The availability of flexible payment plans, terms, and loan amounts means that borrowers will likely find a loan offer that suits any financial need.

Borrowers seeking installment loans should compare the details of any loan offer and ensure that they will be able to pay back the loan according to the contract. You can sign up for Borrowell to quickly compare loan options and see the best rates available to you based on your credit score.

Qualifying for an installment loan generally requires that the applicant has the following:

A Canadian bank account

BC residency

Personal ID attesting that the applicant is at least 18 years of age

Bank statements, employment deposit slips, or other documents demonstrating steady income

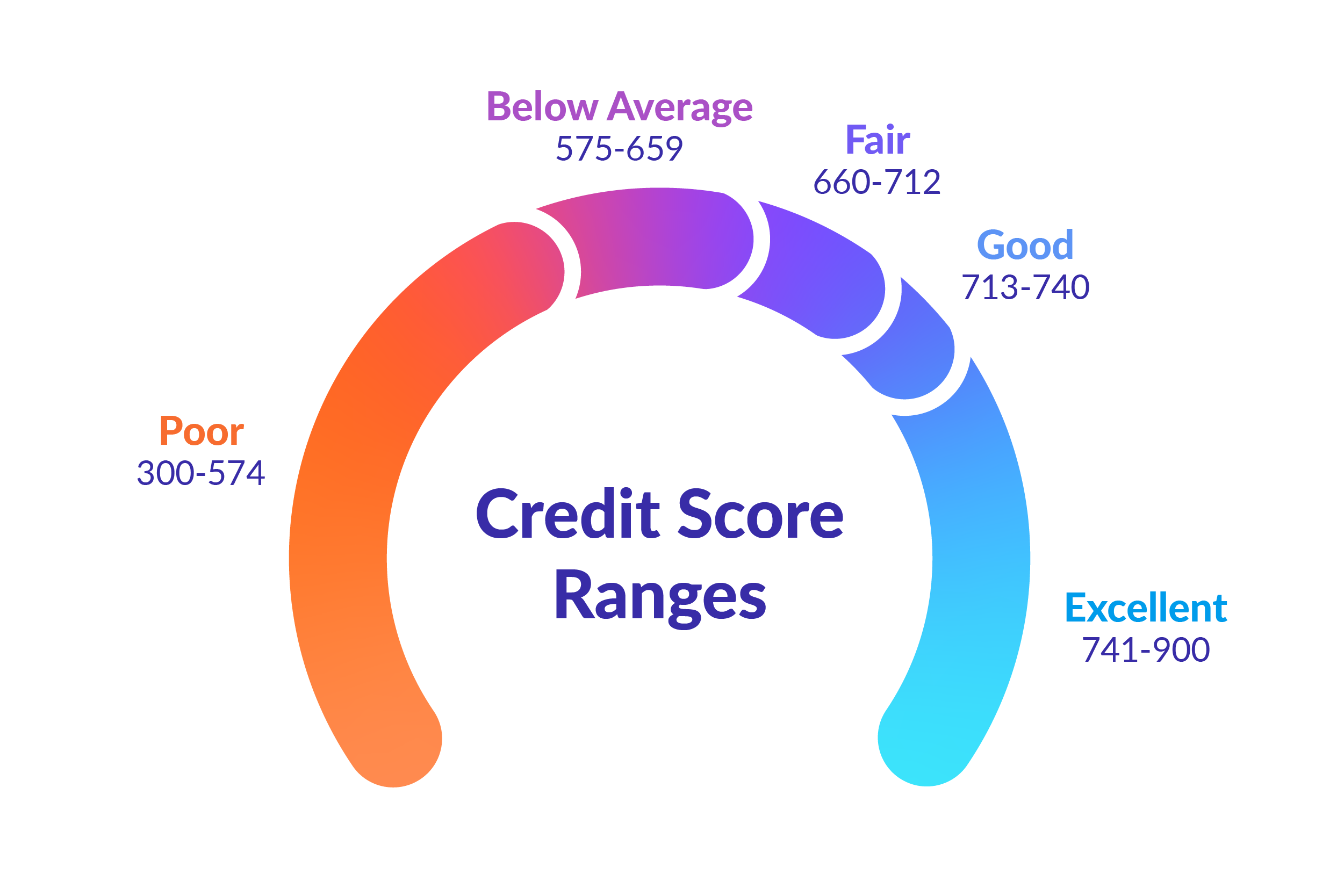

Your credit score also plays a role in determining whether you qualify for an installment loan. Each lender has different minimum credit score requirements for loan approval. The higher your score, the more likely you are to get approved for a loan. A general guideline is that credit scores over 660 have the best chance of getting approved.

If your credit score is below 660, there are still personal loan options available. Sign up for Borrowell to see what loan options are available based on your credit score.

You can apply for an installment loan in BC either in-person or online. Many lenders only require applicants to fill out a simple online form and upload any relevant documents. With certain lenders, applications are processed and approved in just a few hours. Upon approval, funds can be transferred as early as a couple of days.

Traditional loans can be difficult to get approved for if the applicant has bad credit. But getting approved for an installment loan from alternative or online lenders in BC is accessible even to those with weaker financial profiles.

Not sure where to start? Sign up for Borrowell to quickly compare loans that you qualify for based on your credit score. Once you’ve found the right product, you can complete an online loan application through the platform.

When used and managed properly, an installment loan can actually help you improve your credit score. There are a number of ways that installment loans can benefit your credit score. Your credit score is made up of five main factors:

Payment history

Credit history

Credit mix

Credit inquiries

An installment loan can lower your credit utilization and make your credit mix more varied. These can both boost your credit score. Unlike revolving credit card debt, installment loans don’t count towards credit utilization. Consolidating your credit card debt into one installment loan can lower your credit utilization and can help improve your credit health.

If you manage an installment loan responsibly and make on-time payments towards your loan, you can improve your payment history, which will in turn improve your credit score.

While there are numerous benefits to installment loans, making late payments towards your loan can have a negative impact on your credit score. This can make it more difficult to secure funds in the future.

Check Your Credit Score Before Applying

Lenders look at your credit score

Your credit score is one of the main criteria for qualifying for installment loans, whether you’re applying for a car loan, a mortgage, or other types of installment loans. To make the application process easier, you should know what your actual credit score is before applying for a loan. With Borrowell, you can quickly check your credit score for free to speed up the process.

Applying for loans impacts your credit score

When lenders check your credit score, it is recorded on your credit report as a “hard inquiry.” Hard credit inquiries temporarily lower your credit score, and applying for many loans at once results in multiple hits to your credit score. To protect your credit score, you should only apply for loans that you’re confident you’ll qualify for.

Borrowell shows you loans you qualify for

To minimize impacts to your credit score, you want to make sure you apply for a loan that you'll likely get approved for. Borrowell helps protect your credit score by showing you your likelihood of approval for recommended loan offers, based on your credit score.

Borrowell's Quick & Easy Loan Process

Sign Up & Get Your Score For Free

When you sign up to Borrowell, you’ll get your free Equifax credit score free in just three minutes. Checking your score won't impact it, and you can see which loans you will be eligible for.

Check Rates & Choose Your Offer

Borrowell automatically matches your credit profile with the best loan products available based on your credit score. Select your offer and complete the online application.

Get Your Loan

Once your personal loan is approved by a Borrowell loan partner, you can usually access your funds in just a few days.

Is Signing Up for Borrowell Free?

Yes, it's really free. Borrowell provides you with your Equifax credit score, free of charge. Based on your credit score, we provide you recommendations on the best loans, credit cards, and financial products that you are likely to qualify for. Knowing your credit score speeds up the loan application process and helps you get your money as quickly as possible.

Still Have Questions?

Get More Answers

Installment loan terms come in a variety of durations, with most lasting between 6 months to 5 years. Regardless of whether the borrower is seeking a long or short term loan, they will likely find a lender with the right term length for their needs.

Paying down an installment loan faster generally means lower interest rates and higher payments, while long term installment loans carry higher interest rates and lower payments.

Lenders in Canada are not permitted to collect more than 60% interest, with most interest rates on installment loans ranging from 3-50%. Interest rates are determined by many factors, including the lender’s qualification criteria, the applicant’s credit score and financial profile, the loan amount, and the loan term.

There are differences between secured and unsecured loans that you should be aware of. Secured loans require that the borrower put up an item of value as collateral. If the loan is not repaid, the collateral is seized by the lender. Since collateral provides insurance against failure to repay the loan, interest rates and fees are often lower than on unsecured loans.

Unsecured loans do not require collateral. Because of this, lenders cover their risk by charging higher interest rates.

Installment loans are calculated based on a number of factors, including:

Interest rate

Amount of principal

Loan term

Fees

A formula integrating these factors calculates what the installment payment amounts will be and what the total cost of the loan is. This formula may be unique to each lender that you work with.

With the growth of online and alternative lending, it has become easier for borrowers with varied financial profiles to access installment loans swiftly and without hassle. Qualifying for an installment loan in BC is fairly straightforward, so borrowers should take the time to compare different offers from multiple lenders before committing. Sign up for Borrowell to easily compare different offers that you qualify for based on your credit score.

Depending on the payment terms determined by the loan contract, borrowers will make weekly, biweekly, or monthly payments consisting of both a part of the principal and interest on the principal until the loan is paid off in full.

Payments can be paid automatically from a bank account, or paid at each payment cycle. For borrowers with the resources to pay off an installment loan early, most lenders will not charge a penalty.

How Borrowell Can Help with Your Financial Goals

Monitor & Track

Sign up and get your free Equifax credit score in just 3 minutes. Checking your score won't hurt it!

Understand & Improve

Receive weekly updates on how your credit score has changed. Get personalized tips on how you can improve your credit health.

Find the Right Product

Get matched automatically with the right loan products and trusted lenders that match your credit profile. Select your offer and complete the online application through the platform.

Find an Installment Loan in B.C. with Borrowell

Ready to find the best installment loans in British Columbia? Sign up for Borrowell to get your free credit score, quickly compare loans, and apply online today!