Get an Installment Loan in Edmonton

Looking for installment loans in Edmonton? Use Borrowell to quickly compare loan options, find the best interest rates, and instantly see your likelihood of approval based on your credit score. Sign up to get your free credit score, monitor your score weekly, and receive personalized tips to improve your credit health.

Find the Best Installment Loans in Edmonton

Lenders in Edmonton look at your credit score before approving your loan application, which is why knowing your credit score is a crucial step in the application process. Over 45,000 Edmontonians have signed up for Borrowell to get their free credit score and find the right lenders that match their credit profile. By signing up for Borrowell, you can speed up your loan search and find the best rates available to you.

Installment Loans Edmonton:

What You Should Know

Installment loans in Edmonton deliver a set amount of money to borrowers, known as the principal. This amount is repaid with added interest in predetermined installments until the full amount is paid back.

The total amount that a borrower will pay back at each installment will depend on the principal, the interest rate, the loan term, and whether the installment is weekly, biweekly, monthly, or otherwise.

Installment loans can be as low as $500 and can go up to $35,000. Terms generally range between 6 months and 5 years. Installment loans can be secured or unsecured, and interest rates on these loans can be variable or fixed.

In Edmonton, most installment loans give borrowers between $500 and $10,000. However, depending on the lender, borrower’s needs, and financial profile, loan amounts can go up to $35,000.

Installment loans in Edmonton can be used for:

Car repair

Paying large bills or taxes

Paying uninsured medical bills

Travel

Large purchases or deposits for large purchases

Special events

Getting an installment loan in Edmonton can cover a wide variety of financial needs. With flexible amounts, terms, and repayment schedules, borrowers can suit loans to their specific needs.

Most lenders across Alberta have similar requirements for loan qualification, so when applying in Edmonton, it is a good idea to prepare the following:

Proof of employment and income, for example paycheck stubs, bank statements, or tax slips.

Proof that the borrower is of the age of majority, for example valid government issued IDs such as an Alberta driver’s license or Canadian passport

Proof of citizenship or residency

Proof of Canadian bank account to receive loans and issue repayments

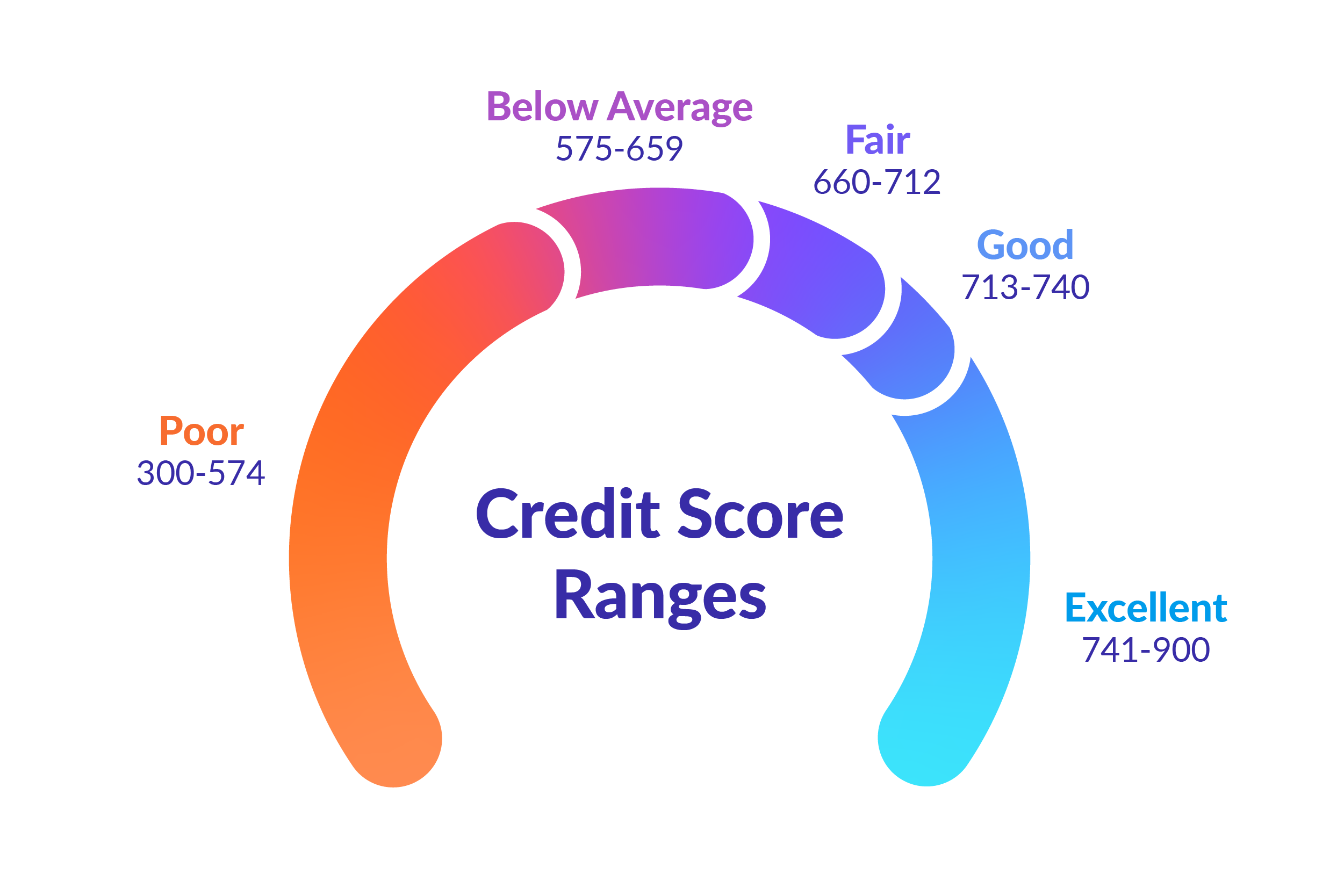

Your credit score also impacts your ability to qualify for a loan. Lenders in Edmonton will be more willing to work with borrowers with a good credit score. If you have a bad credit score, there are still loan options available, but lenders may charge higher interest rates.

Not sure whether you have good or bad credit? Sign up for Borrowell to get your credit score for free and quickly compare installment loans available to you based on your credit score.

For borrowers with poor credit history, it can be difficult to secure a traditional loan. Your credit score is one of the main criteria that lenders look at when qualifying you for a loan. Most lenders require good or great credit before extending a loan. There are, however, lenders that specialize in working with borrowers with bad credit.

There are also lenders in Edmonton that extend installment loans with no credit check. The terms and interest rates on no credit installment loans may be less favorable, Borrowers with bad credit should compare lenders before accepting a loan offer to make sure they’re getting the best terms available.

With Borrowell, you can quickly check your credit score, compare available loan options, and see which ones you qualify for. You can also get personalized tips on how to improve your credit score so you can qualify for better rates in the future.

Installment loans are suitable for borrowers in Edmonton even with low or bad credit scores. When on-time repayments are made towards your installment loan, your credit score will improve over time. However, this only occurs when you make your payments on time. Late payments can lower your credit score, making it vital to manage your debt and payments responsibly.

Taking out an installment loan can also improve credit health by diversifying the blend of loans a borrower carries. Consolidating credit card debt into an installment will reduce your credit utilization and contribute to a better credit mix. This is one way for Edmontonians to improve their credit score.

Check Your Credit Score Before Applying

Lenders look at your credit score

Your credit score is one of the main criteria for qualifying for installment loans, whether you’re applying for a car loan, a mortgage, or other types of installment loans. To make the application process easier, you should know what your actual credit score is before applying for a loan. With Borrowell, you can quickly check your credit score for free to speed up the process.

Applying for loans impacts your credit score

When lenders check your credit score, it is recorded on your credit report as a “hard inquiry.” Hard credit inquiries temporarily lower your credit score, and applying for many loans at once results in multiple hits to your credit score. To protect your credit score, you should only apply for loans that you’re confident you’ll qualify for.

Borrowell shows you loans you qualify for

To minimize impacts to your credit score, you want to make sure you apply for a loan that you'll likely get approved for. Borrowell helps protect your credit score by showing you your likelihood of approval for recommended loan offers, based on your credit score.

Borrowell's Quick & Easy Loan Process

Sign Up & Get Your Score For Free

When you sign up to Borrowell, you’ll get your free Equifax credit score free in just three minutes. Checking your score won't impact it, and you can see which loans you will be eligible for.

Check Rates & Choose Your Offer

Borrowell automatically matches your credit profile with the best loan products available based on your credit score. Select your offer and complete the online application.

Get Your Loan

Once your personal loan is approved by a Borrowell loan partner, you can usually access your funds in just a few days.

Is Signing Up for Borrowell Free?

Yes, it's really free. Borrowell provides you with your Equifax credit score, free of charge. Based on your credit score, we provide you recommendations on the best loans, credit cards, and financial products that you are likely to qualify for. Knowing your credit score speeds up the loan application process and helps you get your money as quickly as possible.

Still Have Questions?

Get More Answers

Most installment loan terms range from 6 months to 5 years. Borrowers in Edmonton will find a wide variety of repayment terms for installment loans. While short term and medium term loans carry higher installment amounts, interest rates are often lower. On the other hand, long term loans carry higher interest rates but lower installment amounts.

Interest rates for installment loans are similar across the province of Alberta and can range anywhere from 3% to 50%. The interest rate depends on the loan amount, loan terms, borrower’s credit health, and lender requirements. Borrowers with a good credit score are more likely to qualify for lower interest rates, while borrowers with a bad credit score may have to pay higher interest rates to get approved for an installment loan.

According to Canadian law, no lender can collect interest above 60%, so borrowers can rest assured that any installment loans in Edmonton have lower interest rates than this.

Depending on the borrower’s repayment history, some lenders in Edmonton will consider issuing a second or even a third installment loan. Other lenders do not permit multiple installment loans, however may let the borrower carry different types of loans from other lenders - for example paycheck loans.

Paying back multiple loans simultaneously can be financially risky, so interest rates and loan terms may be less favorable.

Lenders in Edmonton (and all over Alberta) offer a range of options for structuring loans. Paying off loans happens in regular installments determined by the loan contract and the amount of each payment depends on the loan amount, interest rate, and loan term. Most installment loans in Edmonton have fixed interest rates, so the amounts remain the same at every installment. However, with variable interest rates, this amount can fluctuate.

Short term installment loans can be as short as 6 months, but longer terms are available up to 5 years. Installment loans can be paid back weekly, biweekly, or monthly. If you have bad credit, your repayment options with lenders may be limited.

Payments can be set up to be paid automatically from the borrower’s bank account, or can be paid manually at each payment cycle. Many lenders permit payments that are greater than the required amount without penalty, enabling borrowers to pay down installment loans quicker.

How Borrowell Can Help with Your Financial Goals

Monitor & Track

Sign up and get your free Equifax credit score in just 3 minutes. Checking your score won't hurt it!

Understand & Improve

Receive weekly updates on how your credit score has changed. Get personalized tips on how you can improve your credit health.

Find the Right Product

Get matched automatically with the right loan products and trusted lenders that match your credit profile. Select your offer and complete the online application through the platform.

Find an Installment Loan in Edmonton with Borrowell

Ready to find the right installment loan for you? Sign up for Borrowell to get your free credit score, receive personalized loan recommendations based on your score, and quickly apply for a loan today!