Get a Bad Credit Loan in Calgary

Not sure what loans you qualify for? Worried about getting rejected based on your credit score? Use Borrowell to check your Equifax credit score for free and quickly find loans in Calgary that match your credit profile. Sign up today without hurting your credit score, and see your likelihood of approval for loans instantly.

How to Find Loans in Calgary with Bad Credit

Lenders look at your credit score when approving you for a loan. If you have bad credit, banks and traditional lenders might shut you down. But there are other trusted options available to you. With Borrowell, you can quickly find the best Calgary loans available to you based on your credit score. You’ll see your likelihood of approval instantly, so you don’t have to worry about applying for a loan, getting rejected, and harming your credit score. Over 68,000 Calgary residents have signed up for Borrowell to check their credit score, compare loan options, and apply for loans with confidence.

Bad Credit Loans Calgary

What You Should Know

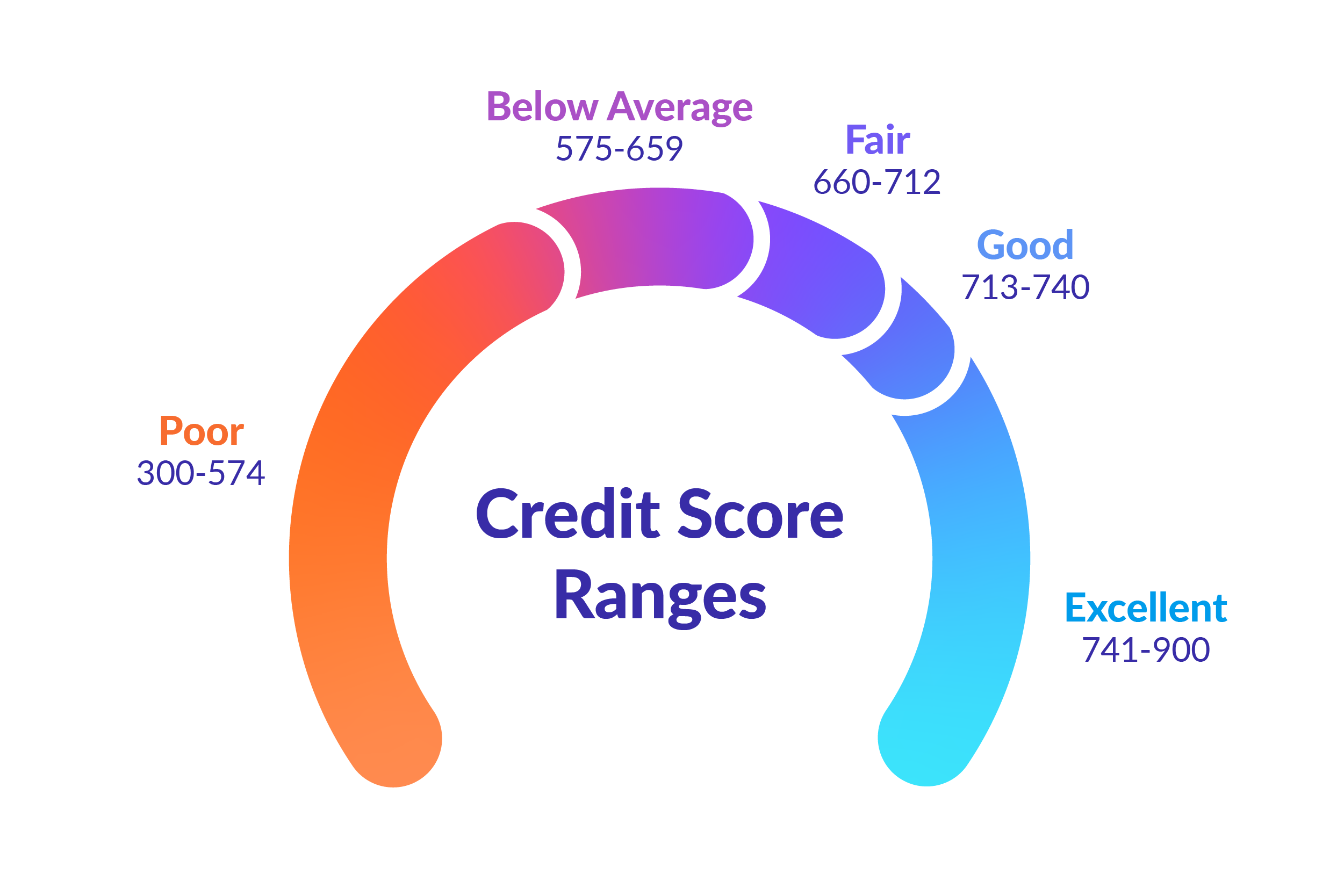

A bad credit score in Calgary is any score between 300 and 575. Not all lenders will stick exactly to these numbers, but this is the general rule of thumb.

Credit scores in Canada range from 300 to 900. Typically, the higher your credit score is, the more likely you are to qualify for an attractive loan.

Paying down a bad credit loan on time and in full contributes to your payment history. Since payment history is a large part of how credit scores are calculated, getting a bad credit loan and making on-time repayments can help you improve your credit score over time.

Another way that bad credit loans can help improve credit scores is by giving borrowers the opportunity to consolidate and pay down other debt that may have higher interest or be more difficult to manage. Using a loan instead of going into credit card debt can also help your credit profile by reducing credit utilization. Keeping utilization below 30% can improve credit scores, so this is yet another way that bad credit loans can help.

With the growth of online and alternative lending, even borrowers with bad credit are likely to find a loan offer. While qualification criteria for bad credit loans in Calgary are flexible, most still have some basic requirements to qualify.

Here are some of the requirements and documents most lenders in Calgary request from bad credit loan applicants:

Proof of income: For example, paycheck stubs, bank statements, or tax slips

Proof of age with a valid government ID: For example, a driver’s license

Proof of Canadian residency: For example, bills or ID

Proof of Canadian bank account to deposit and withdraw funds

You can apply for a bad credit loan in Calgary by signing up for Borrowell. With Borrowell, you can quickly find and compare lenders that match your credit profile. You can see which loans and interest rates you have a high chance of qualifying for with your credit score. Once you’ve found a loan that’s the right fit for you, you can start the online loan application through the Borrowell platform.

Most lenders will require you to fill in a simple online application form and scan any required documents. Once you’ve submitted your online application, you will likely hear from the lender within the same business day. Once your application has been approved, funds are transferred within a day or two.

With online applications, applying for a bad credit loan in Calgary is easy and straightforward. Traditional bank loans can be difficult to qualify for and have longer processes, making online lending platforms a quicker process for borrowers.

Most lenders perform hard inquiries on your credit report when you apply for their loans. Hard inquiries can negatively impact your score in the short term. Because of this, you should know what your credit score is before you start applying for loans. You should also avoid applying for loans without knowing your chances of being approved.

With Borrowell, you can check your credit score for free without hurting it. Checking your credit score with Borrowell is a soft credit inquiry, which doesn’t impact your score. You can also use the Borrowell platform to compare loans before even applying for one. You can see terms, interest rates, and your chances of being approved based on your credit score.

Using Borrowell to find bad credit loans can help you avoid hard inquiries from lenders and reduce impacts to your credit score. Sign up today to find the best bad credit loans available to you.

Borrowell can help you quickly access your credit score and compare bad credit loan offers available in Calgary and the rest of Canada. With Borrowell, you’ll have seamless access to loan offers from trusted Canadian lenders, with loan amounts up to $35,000 and a variety of term lengths available.

As soon as you sign up, you can view your free credit score. This can help you determine which loans you are likely to qualify for. It will also help you save time researching and protect your credit score from unnecessary hard inquiries. Borrowell is transparent about interest rates and fees so you always know what you’re getting and what you will need to pay.

Here's How Borrowell Helps You Find Bad Credit Loans

Check your credit score for free

Your credit score is one of the main criteria for qualifying for a loan. With Borrowell, you can check your credit score for free before applying for a loan. This way, you’ll know exactly what score you need to qualify with, and it will help you determine what loans you are likely to qualify for.

Compare loans and see your chances of approval

Quickly see terms, rates, and lenders that you're likely to qualify for based on your credit score. You’ll instantly see your chances of getting approved for each loan option. This will help you save time researching and avoid rejection.

Protect your credit score before applying

Lenders perform hard inquiries on your credit report when you apply for their loans. Hard inquiries can negatively impact your score. Borrowell lets you compare loan offers and see your likelihood of approval before even applying for a loan. This will help you avoid rejection and any unnecessary hard credit pulls.

Borrowell's Quick & Easy Loan Process

Sign Up & Get Your Score For Free

When you sign up to Borrowell, you’ll get your free Equifax credit score free in just three minutes. Checking your score won't impact it, and you can see which loans you will be eligible for.

Check Rates & Choose Your Offer

Borrowell automatically matches your credit profile with the best loan products available based on your credit score. Select your offer and complete the online application.

Get Your Loan

Once your personal loan is approved by a Borrowell loan partner, you can usually access your funds in just a few days.

Is Signing Up for Borrowell Free?

Yes, it's really free. Borrowell provides you with your Equifax credit score, free of charge. Based on your credit score, we provide you recommendations on the best loans, credit cards, and financial products that you are likely to qualify for. Knowing your credit score speeds up the loan application process and helps you get your money as quickly as possible.

Still Have Questions?

Get More Answers

Bad credit loans in Calgary range from $500 to $35,000 and typically carry loan terms between 6 months and 5 years. The total cost of the bad credit loan will depend on the original principal amount borrowed and the interest rate or fees on the loan.

One of the benefits of bad credit loans in Calgary is that they can be used for almost anything. These types of loans are good for consolidating debt to make payments more manageable, but there are a wide range of potential uses.

Bad credit loans in Calgary can be used for the following purposes:

Paying off bills

Paying tax liability

Consolidating other debts

Car purchase

Covering unexpected expenses

Other large purchases

Home or car repair

Bad credit loan terms in Calgary are flexible, with terms ranging from 6 months to 5 years. Typically, shorter term loans mean higher installment payments but lower interest rates. On the other hand, getting a long term bad credit loan will mean lower payments but higher interest.

Most lenders in Calgary let borrowers choose from a variety of repayment schedules, for example weekly, biweekly, or monthly.

Depending on the lenders, bad credit loans in Calgary may come with additional fees. When comparing lenders, some fees you’ll encounter may include:

Application and processing fees

Origination fees

Late payment fees

Insufficient funds fees

You may also find bad credit loan lenders in Calgary that do not charge additional fees.

How Borrowell Can Help You Improve Your Credit Score

Monitor & Track

Sign up and get your free Equifax credit score in just 3 minutes. Checking your score won't hurt it!

Understand & Improve

Receive weekly updates on how your credit score has changed. Get personalized tips on how you can improve your credit health.

Find the Right Product

Get matched automatically with the right loan products and trusted lenders that match your credit profile. Select your offer and complete the online application through the platform.

Find Bad Credit Loans in Calgary with Borrowell

Ready to find loans in Calgary that you qualify for? Sign up for Borrowell to get your free credit score, receive personalized loan recommendations based on your score, and quickly apply for a loan today!