Get a Bad Credit Loan in Vancouver

Live in Vancouver and need a bad credit loan? Worried you won’t qualify? Use Borrowell to get your free credit score and quickly find a loan with confidence, even if you have bad credit. Compare loans that match your credit profile and instantly see your chances of approval.

How to Find Loans in Vancouver with Bad Credit

If you have bad credit, you may have trouble finding a loan that you qualify for. Borrowell can help. When you get your free credit score from Borrowell, you can quickly compare loan options that are available to you. You’ll instantly see your chances of approval for a loan, even before you apply for one! Over 42,000 Vancouver have signed up for Borrowell to check their credit score, find loans, compare rates, and apply for a loan online.

Bad Credit Loans Vancouver

What You Should Know

Most lenders in Vancouver will allow you to submit an online application for a bad credit loan. While some lenders may have additional eligibility requirements, such as proof of income, the process will typically involve submitting an application for loan approval and providing supporting documents (as needed). Lenders will also conduct a credit check to verify your score.

It’s important to know what your credit score is before you start applying for loans. With Borrowell, you can check your credit score for free and see which loans you qualify for, even if you have bad credit.

Borrowell works with over 50+ financial partners in Canada to find loans that match your profile - showing your likelihood of approval in minutes. Find the right lender for you and start your online application by signing up for Borrowell.

Bad credit loans can be either unsecured or secured. Secured loans are guaranteed by collateral that provides insurance on the loan, while unsecured loans do not require collateral.

With a secured loan, you will need to offer collateral to the lender (like a car), which the lender can repossess if you default on your loan payments. Secured loans usually have lower interest rates because you are offering collateral as insurance on the loan.

Unsecured loans, on the other hand, do not require collateral, which means the lender is taking on a greater amount of risk by lending you money. Unsecured loans tend to have higher interest rates because of this.

Co-signers are not required for bad credit loans in Vancouver. While it’s not required, having a co-signer may help potential borrowers who are unable to qualify for a loan obtain one at a lower interest rate.

In these cases, lenders will take the financial information of both the potential borrower and the co-signer into account, including items such as their credit score, income, and debt-to-income (DTI) ratio. Once signed, the guarantor cannot be removed from the loan, and agrees to take over the loan payments if the borrower defaults on the loan.

One of the benefits of bad credit loans is that they can be used for almost anything. These types of loans are good for consolidating debt to make payments more manageable, but there are a wide range of potential uses, including:

Funding a large purchase

Paying outstanding bills

Covering unexpected expenses

Making home or car repairs

Covering life emergencies

Improving a low credit score by making timely and consistent payments

In Vancouver, depending on the specific agreement you’ve made with your lender, there may be limitations to how you can use your bad credit loan. These limitations vary and are based on both the lender and your individual financial profile.

Missed or late payments will have a negative impact on your credit score. According to Borrowell data, Canadians with one missed bill payment have credit scores that are 150 points lower than those who make payments on time.

If you think you will be unable to pay your loan payments in a timely manner, here’s what you need to know about making late payments or skipping payments altogether:

Late Payments: Lenders often have built-in late fees that borrowers must pay if they cannot make their loan payments by the due date. Typically, payments made within 30 days of billing is considered ideal, while payments made between 31 to 59 days may incur late fees. These late fees add up quickly and can negatively impact your credit score.

Skipping Payments: Skipping an entire billing cycle (e.g., 60 days past due date) may result in the lender reporting you to a credit bureau, constantly attempting to reach you, or contacting you through a debt collector to receive outstanding payment. Three or more missed billing cycles will severely impact your credit score and ability to apply for a new loan, in addition to the interest that will accrue on the late fees.

If you miss several consecutive payments and do not communicate with your lender about your circumstances, there is a possibility your debt will be “written off” by the lender as a loss. This will once again severely impact your credit score and limit your ability to receive future loans. Following a write-off, your debt may be sold to a debt collections agency, in which case you will be frequently and persistently contacted to receive the amount owed. Finally, if all else fails, or if the lender is not willing to use a debt collections agency, they may pursue legal action to pay back the original debt (or more) in full.

Each of the scenarios described will negatively impact your credit report score, limiting your ability to obtain loans in the future. To avoid such issues altogether, we recommend prioritizing your bills and debt payments as much as possible, limiting your use of credit products, and most importantly, sticking to a budget.

This may not sound very fun, but your credit score will thank you for it!

Here's How Borrowell Helps You Find Bad Credit Loans

Check your credit score for free

Your credit score is one of the main criteria for qualifying for a loan. With Borrowell, you can check your credit score for free before applying for a loan. This way, you’ll know exactly what score you need to qualify with, and it will help you determine what loans you are likely to qualify for.

Compare loans and see your chances of approval

Quickly see terms, rates, and lenders that you're likely to qualify for based on your credit score. You’ll instantly see your chances of getting approved for each loan option. This will help you save time researching and avoid rejection.

Protect your credit score before applying

Lenders perform hard inquiries on your credit report when you apply for their loans. Hard inquiries can negatively impact your score. Borrowell lets you compare loan offers and see your likelihood of approval before even applying for a loan. This will help you avoid rejection and any unnecessary hard credit pulls.

Borrowell's Quick & Easy Loan Process

Sign Up & Get Your Score For Free

When you sign up to Borrowell, you’ll get your free Equifax credit score free in just three minutes. Checking your score won't impact it, and you can see which loans you will be eligible for.

Check Rates & Choose Your Offer

Borrowell automatically matches your credit profile with the best loan products available based on your credit score. Select your offer and complete the online application.

Get Your Loan

Once your personal loan is approved by a Borrowell loan partner, you can usually access your funds in just a few days.

Is Signing Up for Borrowell Free?

Yes, it's really free. Borrowell provides you with your Equifax credit score, free of charge. Based on your credit score, we provide you recommendations on the best loans, credit cards, and financial products that you are likely to qualify for. Knowing your credit score speeds up the loan application process and helps you get your money as quickly as possible.

Still Have Questions?

Get More Answers

When you apply for a loan, the lender will likely perform a hard credit check on your credit report. This can lower your credit score temporarily. You should also avoid applying for loans without knowing your chances of being approved. Comparing options before applying can help you avoid hard inquiries from lenders and reduce impacts to your credit score.

With Borrowell, you can check your credit score for free without hurting it. You can also compare loan options and see your likelihood of being approved based on your credit score.

Using Borrowell to find bad credit loans can help you avoid hard inquiries from lenders and reduce impacts to your credit score. Sign up today to find the best bad credit loans available to you.

Paying back your bad credit loan on time will actually help to improve your credit. On the other hand, late payments can have a long term negative impact on your credit score.

It is very much possible to repair your poor credit score with some patience and diligence, especially if your score is below 575.

Some of the best ways to work towards repairing your bad credit score include:

Paying your bills and debts on time – Make sure to keep up with all of your bills, including loan payments, credit card bills, and utilities. There are free bill tracking solutions that can help you stay on top of your bills. Working to take care of larger debts such as mortgages, car loans, and other assets, is important as well.

Limiting your credit products - While building a credit history is important, it is a good idea to limit applications for new credit products when trying to repair your credit score. Remember – every time your credit report is pulled for a “hard” inquiry (car loans, mortgage, etc.), your credit score will be negatively impacted.

Applying for a secured credit card – Sometimes, individuals with bad credit scores cannot qualify for regular unsecured credit cards. Secured credit cards, which are recommended for those with bad credit scores, require a security deposit for assurance. As a borrower, the longer you can go without missing a payment on secured credit such as this, the more your credit score will improve.

Sticking to a budget – Perhaps the most important factor when working towards repairing a bad credit score is learning how to make and follow a budget plan. This includes cutting down expenses where possible and emphasizing debt payments while saving for the future. This may not sound very fun, but your credit score will thank you for it!

You can take the first step to becoming debt free by signing up for Borrowell to see what loan options are available based on your credit score. Once you’ve found the right loan, you can begin the online application process through the Borrowell platform.

Installment loans are safer than payday loans for several reasons, including interest rate and term length variations. For example, the interest rates on payday loans are very expensive, with an annual percentage rate (APR) equivalent to an interest rate of 400-600%, compared to within 30% for installment loans. In Vancouver, a payday loan must typically be paid within 62 days, whereas installments loans allow for longer repayment periods, making payments more manageable and affordable for borrowers.

Payday loans are typically short-term loans for smaller amounts intended to be paid back in full within 30 days, including interest and other associated fees. Installment loans, on the other hand, will allow you to obtain higher loan amounts with longer payback periods (e.g., 12 months or longer).

Installment loans are also larger and can be used for bigger expenses such as debt consolidation and unexpected life events.

Bad credit scores are affected by several factors, including payment history, debt amount, credit history, credit diversity, and credit inquiries. Here’s an in-depth breakdown of how each of these factors impacts your credit score.

Payment history - missed or late credit card or loan payments will negatively affect your credit score.

Debt amount – carrying large amounts of monthly debt will negatively impact your credit score. For example, using up more than 30% of your available credit limit on a credit card will, over time, affect your score.

Credit history – individuals with a longer history of responsible payments on their credit account will have higher credit scores, than those with short credit histories, especially with late or missed payments. Responsible use of credit over time is a key factor in calculating your credit.

Credit diversity – having several different types of credit accounts (mortgage, car loan, credit card, etc.) actually helps credit scores. Individuals with limited types of credit (e.g., only a credit card) may find it negatively impacts their score.

Credit inquiries – credit scores can be negatively impacted every time a credit card company or lender examines your credit to verify your creditworthiness (typically, for a loan or new line of credit). Multiple credit checks, especially in a short period of time, will affect your credit score.

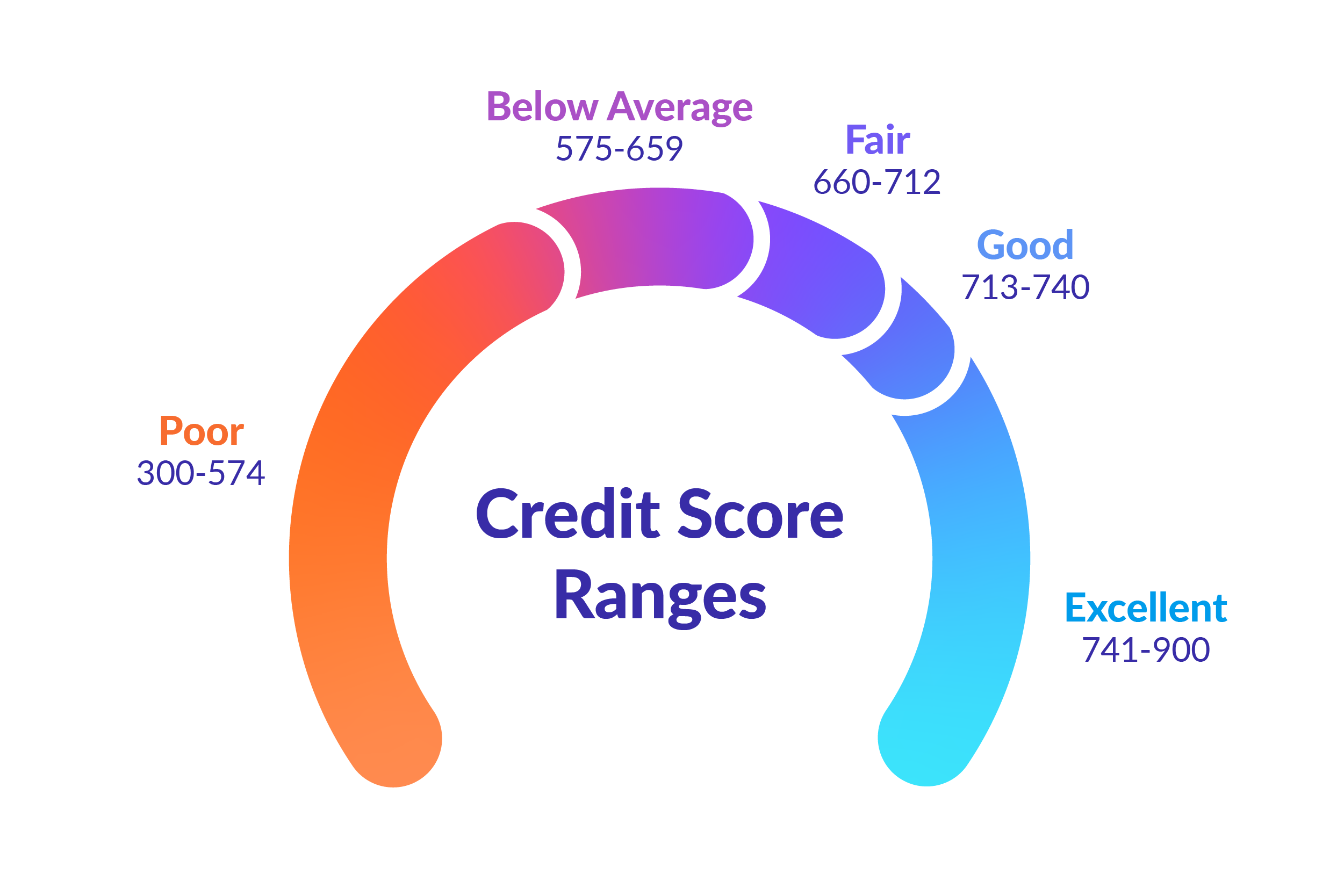

A bad credit score in Vancouver is any score below 575. In comparison, a good credit score is considered to be 660 and above. According to Borrowell data, the average credit score of British Columbia residents is 660. Individuals in larger cities, like Vancouver, tend to have higher credit scores on average. A bad credit score limits your ability to qualify for credit cards, loans, mortgages, and other financial products at low interest rates.

This will depend on your individual situation, as well as the conditions set by each lender. Typically, banks and credit unions across Vancouver will only lend people around 10% of their net worth (your assets minus your debts) on an unsecured basis. Many lenders have debt consolidation loan calculators that you can access online for quotes.

How Borrowell Can Help You Improve Your Credit Score

Monitor & Track

Sign up and get your free Equifax credit score in just 3 minutes. Checking your score won't hurt it!

Understand & Improve

Receive weekly updates on how your credit score has changed. Get personalized tips on how you can improve your credit health.

Find the Right Product

Get matched automatically with the right loan products and trusted lenders that match your credit profile. Select your offer and complete the online application through the platform.

Find Bad Credit Loans in Vancouver with Borrowell

Ready to find a loan and improve your credit score? Sign up for Borrowell to get your free credit score, receive personalized loan recommendations based on your score, and quickly apply for a loan today!