Here are eight tangible steps you can take to improve your credit score. Your credit score directly impacts your ability to get approved for financing, including credit cards, loans and mortgages.

The Borrowell Team

Nov 28, 2025

Learn More

Mar 28, 2023 • 8 min read

Borrowing against credit is helpful – it lets us make big purchases and cover unexpected expenses while paying for it with future income. Misusing credit, however, can negatively impact your credit score and your future ability to borrow money when you need it.

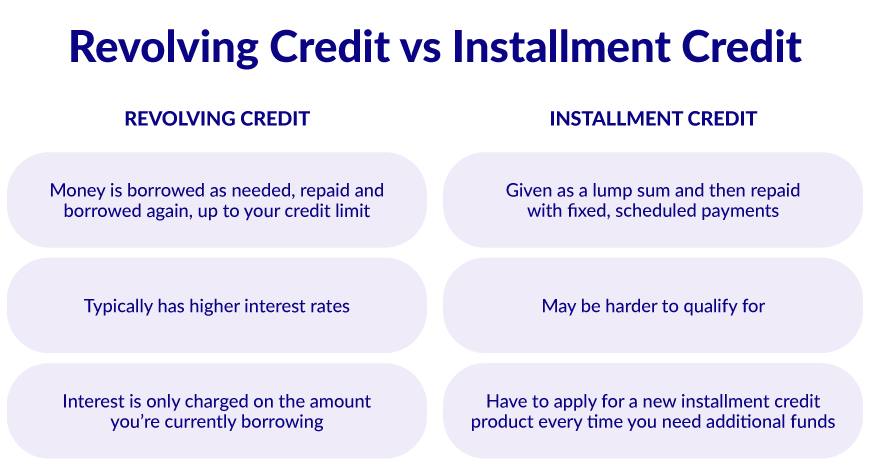

Understanding the two types of credit is important to maintaining a healthy credit score. Let’s take a look at the difference between installment and revolving credit.

Installment credit is a loan of a fixed amount that you are expected to pay back over a clearly defined payment schedule. The value of the loan is set at the time of approval and the amount you borrow won’t change over time.

Types of installment credit can include:

Student loans

Mortgages

Creditors expect regularly scheduled payments, plus interest, to be made in installments until the amount owed is paid in full. For example, the average Canadian university graduate with $26,000 in student loans would be responsible for monthly payments of $275.77, given a fixed interest rate of 5% over 10 years. Over time, the interest would add up to $7,092.44 for a total of $33,092.55 repaid to end the credit cycle.

Installment credit can be easier to manage, given that the fixed recurring payments are predictable and easy to budget for.

Installment credit has many advantages. Here are are few to consider:

Predictable payments: With installment credit, you know exactly how much you need to pay each month, making it easier to budget and plan your finances.

Lower interest rates: Installment loans generally have lower rates than other types of credit, such as credit cards or payday loans, saving you money in interest charges over time.

Longer repayment terms: Installment loans often have longer repayment terms than other types of credit, making it easier to manage your monthly payments.

While the benefits of installment credit mentioned above are quite useful, there are also some potential disadvantages, such as:

Accumulating interest: Although installment loans often have lower rates than credit cards or other types of credit, the interest can still add up over time, especially if you have a long repayment term.

Prepayment penalties: Some lenders may charge a penalty if you pay off your installment loan early, making it hard to save money on interest charges.

Limited financial flexibility: Once you sign a contract for an installment loan, you are typically committed to making the same monthly payments for the entire repayment term, which can limit your financial flexibility.

Installment credit can help finance large purchases or unexpected expenses when you don't have the cash to pay for them outright.

For example, If you want to make a large purchase, such as a new washer and dryer, but you can't afford to pay for them all at once, installment credit can be a good option to help you spread the cost over multiple paycheques.

Another way that installment credit might be useful is by helping to consolidate debt. For example, suppose you have multiple sources of high-interest debt, such as a couple of maxed out credit cards. By taking out a lower interest loan to pay off the balance of those cards, you’ll save yourself money in interest charges over the long term.

Revolving credit is a type of loan issued with a credit limit that you can borrow against. With revolving credit loans, you can continue to borrow as much as you like, as long as you stay under your credit limit. Once you repay the amount you’ve borrowed, that amount becomes available to be borrowed again at a later time.

Types of revolving credit include:

Revolving credit doesn’t have a fixed end to the credit cycle, like installment credit does. Creditors expect regular payments against the balance owed, made either in full or with a minimum monthly payment, plus interest. Revolving credit’s flexibility comes at an additional cost – its interest rates can reach upwards of 19%.

For example, a $300 charge on your credit card with a limit of $1,500 would reduce your borrowable amount to $1,200. Paying off the $300 in full would restore the amount available to borrow to $1,500. Alternatively, a $10 minimum monthly payment on the $300 charge would result in an available credit of $1,210 and would incur interest charges on the $290 you still owe.

Revolving credit fluctuates and can be more difficult to budget for, depending on your expenses and spending habits.

There are many benefits to using revolving credit. Here are a few to think about:

Flexibility: Revolving credit offers more flexibility than installment credit because you can borrow up to your credit limit and pay it back over time, rather than borrowing a fixed amount of money and repaying it in equal installments.

Convenience: Once you have a revolving credit account, such as a credit card, you can use it to make purchases without applying for a new loan whenever you need to borrow money.

Rewards: Many credit cards offer rewards programs that allow you to earn cash back, points, or miles for every dollar you spend. This can be a valuable perk if you use your card regularly and pay off your balance in full each month.

While revolving credit can offer flexibility and convenience, there are also some downsides:

High interest rates: Revolving credit, such as credit cards, often come with higher interest rates than other types of credit. This can result in significant interest charges if you carry a balance on your card.

Fees: Many credit cards charge fees, such as annual fees, balance transfer fees, or cash advance fees, which can add to the overall cost of using the card.

Temptation to overspend: Revolving credit can make overspending easy, especially if you have a high credit limit. This can result in accumulating debt, making it difficult to pay off your balance.

Variable interest rates: Some types of revolving credit, such as credit cards, may have variable interest rates that can change over time, making it difficult to predict your monthly payments.

While revolving credit can be useful for managing your finances and covering unexpected expenses, it's important to use it responsibly. Here are some situations where revolving credit might be a good option:

Everyday expenses: Revolving credit, such as a credit card, can be a convenient way to cover everyday expenses, such as groceries, gas, and bills, as long as you can pay off your balance in full each month to avoid interest charges.

Emergencies: Revolving credit can provide a safety net for unexpected expenses, such as urgent car repairs, that you may not have the cash to pay for immediately.

Building credit: Using revolving credit responsibly and making on-time payments can help you build and improve your credit score over time, making it easier to qualify for other types of credit, such as mortgages or car loans.

Revolving accounts can positively and negatively impact your credit score, depending on how you use them. For example, revolving accounts can hurt your credit if you have a high credit utilization rate, make late payments, or default on the loan. Furthermore, opening too many revolving accounts within a short time can also hurt your credit score, as it can indicate to lenders that you might be taking on too much debt.

On the other hand, revolving accounts can positively impact your credit score if you use them responsibly. Making on-time payments, keeping your credit utilization ratio low, and maintaining a steady repayment history can all help to improve your credit score over time.

Sign up for Borrowell to get your free credit score. That's right. For free.

A healthy credit report and score often include a mix of credit types. Having both installment and revolving credit accounts demonstrates to creditors that you’re able to manage numerous credit commitments. Regardless of the type of account, the leading aspect impacting your credit score is your ability to make payments on time.

When payments are made on time, installment credit can be a reliable way to build a good credit history. Missing regular installment credit payments could lower your credit score, result in the creditor repossessing what you bought, and could stain your credit history for up to seven years.

Revolving credit, on the other hand, has the potential to further damage your credit score if you’re not careful. In addition to the payments made on time, a large portion of your credit score is calculated based on your credit utilization rate. Carrying a balance of over 30% of your available credit may lower your credit score and make it harder to get a loan.

Installment credit, like a car loan, is a fixed loan repaid over a set period of time. With revolving credit, like a credit card, you can borrow as much as you need under an approved limit – as long as you continue to make payments.

To maintain a healthy credit score when using a mix of installment and revolving credit, remember to:

Make payments on time. With revolving credit, pay off the balance in full if you can.

Monitor your credit utilization, keeping it under 30% of your total available credit.

The effort you put towards improving your credit score will ensure that you can borrow money when you need it most.

There is no one-size-fits-all answer to whether installment or revolving credit is better, as each has advantages and disadvantages.

Ultimately, the best choice depends on your financial goals, ability to manage debt responsibly, and current credit profile.

Whatever you choose, It's important to use credit responsibly and only borrow what you can afford to repay. This means making timely payments and avoiding carrying a large balance on your credit accounts.

It’s important to understand the differences between installment and revolving credit. While both types of credit can be helpful in providing access to funds, it is important to know which type is right for your particular financial needs. Installment credit provides access to a fixed amount of funds that must be repaid in full over a predetermined period of time, while revolving credit gives access to funds that can be repaid in full or in part, depending on the financial situation. Understanding these differences can help you make informed decisions about your credit needs.

Here are eight tangible steps you can take to improve your credit score. Your credit score directly impacts your ability to get approved for financing, including credit cards, loans and mortgages.

The Borrowell Team

Nov 28, 2025

Learn More

Thanks to rent reporting services, you can now build your credit score by paying your rent on time every month.

Janine DeVault

Jun 17, 2024

Read More

A credit builder loan is specifically designed to help establish and boost your credit.

Jessica Martel

Aug 28, 2025

Read More