If you’re wondering, “What is a credit score, anyway?” – don’t worry! We’ve got you covered.

The Borrowell Team

Jun 17, 2024

Learn More

Your credit score can have a big impact on your financial future. Sign up for Borrowell to get your credit score and credit report for free! Join over 3 million Canadians and get the tools you need to help understand, manage, and master your credit - in under 3 minutes. Checking your free credit report with Borrowell won't hurt your credit score.

With Borrowell, you can view your credit score in Canada for free! Signing up takes less than 3 minutes, and no credit card is required. Once you've signed up for Borrowell, you can download your Equifax credit report for free AND check your credit score at any time without hurting it. Plus, you'll receive weekly updates on how your score has changed. Stay on top of your credit health with Borrowell.

Sign up for free in just 3 minutes with no commitment or impact on your credit score. Track your success, flag errors and spot fraudulent activity.

Once you've signed up for the Borrowell app, you will receive personalized tips, articles and tools to help improve your credit. You'll also receive regular insights into why your credit score has changed and the factors that may be impacting it.

Get automatically matched with financial products from over 75 partners that fit your credit profile. See your likelihood of approval and apply in just a few clicks.

Your credit report is like your financial report card, and your credit score is like your final grade. In Canada, banks and lenders review your credit when you apply for financial products. Your credit report can also be pulled by car dealerships, insurers, cell phone companies, landlords and future employers to determine your ability to manage debt and meet financial obligations. Because of this, it's important to know and understand your credit score.

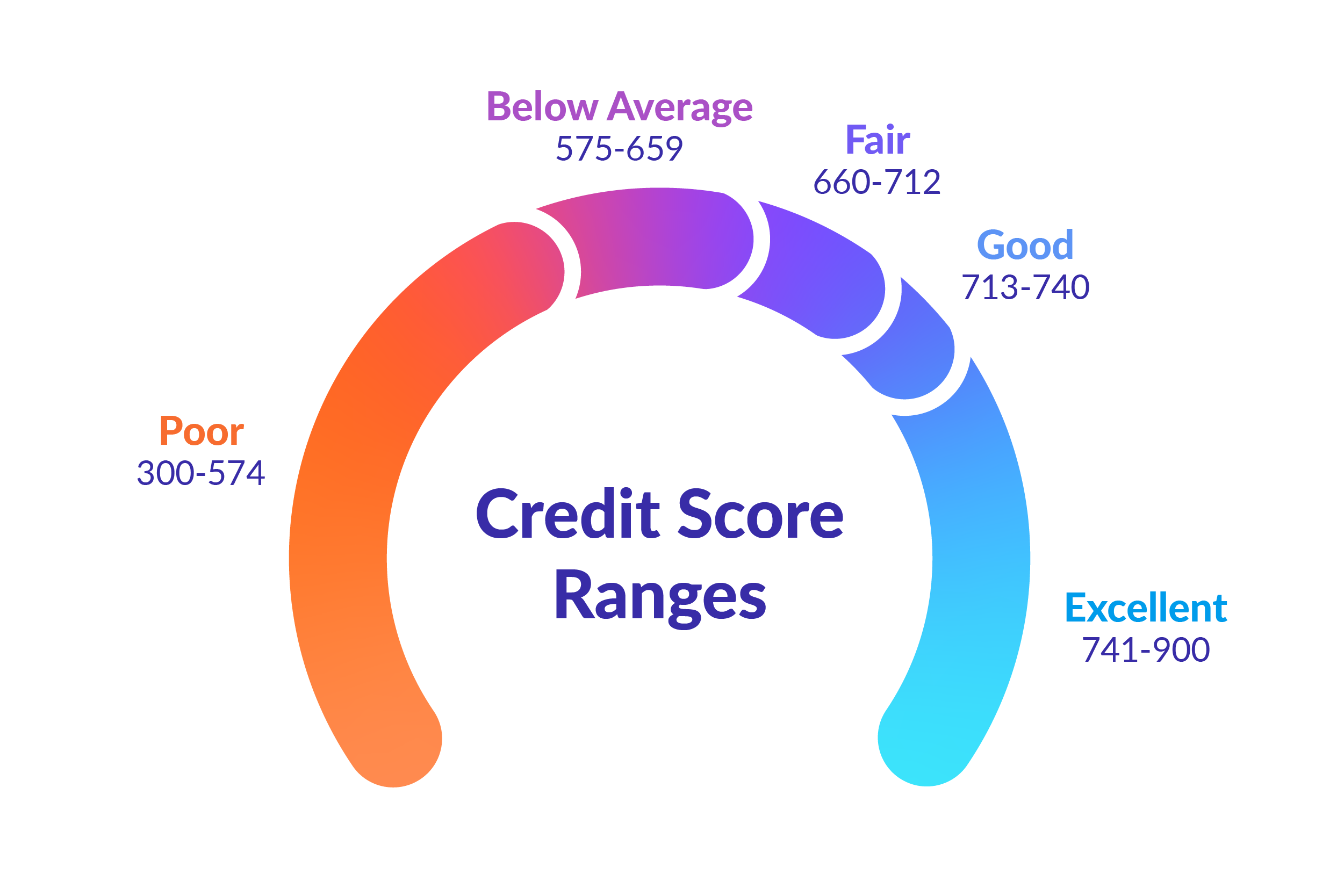

A good credit score in Canada is any score between 713 and 900. Credit scores in Canada range between 300 and 900. There are five distinct categories that your credit score could fall into, ranging from poor to excellent. Having a good credit score can help you qualify for financial products at lower interest rates. Not sure where you stand? Check your free credit score with Borrowell!

Credit scores are calculated based on five key factors from your credit report. Each factor makes up a certain percentage of your overall score. The core factors that make up your Equifax credit score (provided by Borrowell) are:

Payment history (35%)

Credit utilization (30%)

Credit history (15%)

Credit mix (10%)

Credit inquiries (10%)

Your credit score is used to determine your overall creditworthiness, meaning how likely you are to pay back credit. This is a popular and legitimate score that banks and lenders review when you apply for their products. A good credit score can help you qualify for credit cards and loans with low interest rates. A good credit score also helps you qualify for a mortgage. A bad credit score could get you denied for these products.

With Borrowell, you can check your credit score for free and see what credit cards, loans and mortgages you can qualify for based on your score! Sign up for free and see your approval chances from over 75 lenders in Canada.

It's important to know your credit score! Your credit score is an indicator of your overall financial health. Banks, lenders, and even landlords check your score when you’re looking to get a mortgage, personal loan, or your dream rental. Knowing your credit score beforehand can help you apply with confidence.

You can check your credit score for free with Borrowell. The best part? It takes less than 3 minutes. Checking your credit score and credit report with Borrowell does not hurt your credit score.

Once you've signed up for Borrowell, you'll find out what's impacting your credit score, how to improve your score and what financial products you should apply for with your current score. Whether you're looking for a new credit card, a car loan or a mortgage, Borrowell will help you find the best product for your credit profile.

Your credit report is a detailed breakdown of your credit history, provided by one of Canada's credit bureaus (Equifax or TransUnion). Your credit report is like your financial report card. It shows when you’ve been granted credit, for things like a new cell phone or a personal loan. Your credit report also contains personal information, a history of your trades and accounts and any derogatory marks (i.e. negative information, such as missed payments, etc.).

With Borrowell, you can download your Equifax credit report for free.

Although checking your credit report once a year is the bare minimum suggested, best practices dictate that you should at least check your credit report monthly. This way, you can spot any errors or fraud on your credit report that you otherwise might not have noticed until months later. Errors on your credit report can hurt your financial health. With Borrowell, you can receive credit report updates weekly and stay on top of the accuracy of your credit report.

Checking your credit report with Borrowell will NOT hurt your credit score. Any time you check your credit report or score with Borrowell, it is considered a ‘soft’ inquiry and will not impact your score. This makes it easier to track your progress as you build and improve your credit score. With this in mind, you should learn how to read your credit report and start reviewing your report on a regular basis.

A ‘hard’ inquiry, on the other hand, does impact your score and is triggered if you apply for a credit card, a loan, a mortgage or other types of credit products. Hard inquiries are triggered when a lender requests to review your credit report before approving your credit application.

The credit scores you receive from credit bureaus and credit score providers may be different because each company uses its own proprietary model to calculate your credit score. Note, however, that while the scoring algorithms vary, credit bureaus largely depend on the same factors when establishing your score, including payment history, credit utilization, length of history, types of credit and new credit. The credit score you receive from Borrowell is the Equifax Risk Score 2.0 (ERS 2.0), which is calculated based on Equifax's proprietary model.

In general, most negative information stays on your credit report for 6 years. There are set time frames for items like bankruptcies and collections that Equifax (the credit bureau we pull your report from) has put in place.

Yes, increasing your credit limit can impact your credit score. A higher credit limit may improve your credit score by reducing your credit utilization rate, which is one of the main factors used to calculate your credit score.

Generally, a utilization rate under 30% is considered 'good' and positively affects your credit score. So, a higher credit limit can positively influence your credit score because it reduces your utilization rate, as long as your credit use remains the same.

Your credit card company may offer you a credit limit increase, which could be worth taking. You could also reach out to your credit card provider directly and ask for a credit limit increase.

The earlier you start building credit history, the better. Having a long history of good credit behaviour will help you qualify for loans, credit cards and mortgages in the future. Even if you're a teenager or are about to graduate high school, there are steps you can take to build credit history at 18. This will help you in the long-run when you're looking to lease your first car, rent your first apartment or buy your first home, for example.

There are specific steps you can take to build credit history, especially if you are building credit from scratch. Getting a cell phone plan in Canada, getting a secured credit card, or taking out a loan with a co-signer are a few ways you can build a history of good payment behaviour and establish good credit.

Borrowell also provides two products specifically designed for helping you to build your credit. Borrowell's Credit Builder is a 4-year loan that reports to Equifax Canada, which helps you to diversify your credit mix. Making on time payments to your Credit Builder loan allows you to build your payment history.

Borrowell's Rent Advantage product permits you to report your rent payments to Equifax Canada with no landlord involvement, with various reporting and payment options depending on what your needs are. By reporting your rent payments, you'll build your payment history, while adding the Rent Advantage product to your portfolio helps to diversify your credit mix.

With Borrowell, you'll learn how to build credit responsibly.

Start with your FREE credit score, then get weekly updates to learn how your credit score has changed, see what's been added to your credit report and spot any inquiries made on your credit report.

Work to improve your score and tackle debt with personalized tips, tools and product recommendations that match your credit profile.

Get matched with the best products from over 75 partners to help you improve your financial health. Plus, get access to innovative tools that can help you plan ahead, pay bills on time and budget more effectively.

Borrowell uses advanced 256-bit SSL data encryption. We won't share your personal details with unauthorized third parties or initiate transactions without your consent.

If you’re wondering, “What is a credit score, anyway?” – don’t worry! We’ve got you covered.

The Borrowell Team

Jun 17, 2024

Learn More

Thanks to rent reporting services, you can now build your credit score by paying your rent on time every month.

Janine DeVault

Jun 17, 2024

Read More

Your credit score is a critical marker that lenders use to gauge your creditworthiness when you apply for new products.

Janine DeVault

Jan 25, 2023

Read More