Your credit score directly impacts your ability to get approved for financing, including credit cards, loans, and mortgages. Higher credit scores demonstrate to Canadian lenders how likely you are to pay back your debts on time. A good credit score will help you qualify for loans, credit cards, mortgages, and other financial products. A high credit score also gives you access to more favourable terms, including lower interest rates on loans and even premium rewards and perks on credit cards.

Life sometimes throws unexpected curveballs, and your credit score may be lower than you would like. If your credit score is preventing you from reaching your financial goals, there are simple steps you can take to improve your credit score as quickly as possible. Here are eight tangible steps you can take to improve your credit score.

Pay Your Bills On TimeYou may have heard that making on-time payments is the key to having a good credit score. But just how important is it to make your payments on time? If you have made the mistake of missing payments in the past, what can you do now to help improve your credit score?

With payment history making up around 35% of your credit score, paying bills on time is one of the best and easiest ways to improve your credit score. Paying bills consistently and on time shows potential creditors that you are financially responsible and trustworthy. Over time, paying bills on time will help increase your credit score. Although some lenders offer grace periods, it is important to make sure you pay all bills by the due date to avoid potentially being reported to the credit bureau. If you have any past due accounts, you should pay off the oldest ones first.

If you have an overdue utility bill, you should contact your provider as soon as possible to arrange a payment plan. If your bill doesn't have a minimum payment option (for example, a heating bill), you should call your provider and arrange a payment plan. Unpaid utility bills can hurt your credit score if your provider sends your unpaid bills to a collection agency.

To keep track of your bills and ensure timely payment, we suggest:

Setting bill payment alerts on your digital calendar to have bill payments top of mind

Automating your bill payments to be paid through your bank account or credit card; this will ensure that, if your account has the necessary funds, your bills are taken care of with each of your lenders without having to manually pay them

Another easy way to keep track of your bills and avoid missed payments is to use Borrowell’s free bill tracking mobile app, available on the App Store and Google Play. Using this app, you can connect your bank account and let Borrowell automatically forecast your upcoming bills.

Want to check your credit score AND track your bills?

Sign up for Borrowell to get your free credit score, and download the app to track and predict your upcoming bills. Take a hold of your bills to improve your credit score and your financial health.

Sign Up for Borrowell

Another important factor that can affect your credit score is credit utilization, which determines around 30% of your credit score. Simply put, your credit utilization is how much credit you’ve used up compared to the total amount of credit available to you. You should always aim to keep your credit utilization below 30%. If you are looking to improve your credit score to buy a house or get a loan, it is important to know how much of your total available credit is being used and to keep it at the lowest amounts possible.

Here is how you can keep your credit utilization rates low:

Pay More Than the Minimum Payment on Your Credit Card

If you carry a balance on your credit card, you should always try to pay more than the minimum payment. Paying more than the minimum amount will decrease your credit utilization rate, or the percentage of the available credit available to you that you are actually using. A low credit utilization rate can help improve your score.

As a bonus, making more than the minimum payment will also help you pay your credit card off much quicker, saving you money that would otherwise go towards the interest. Credit card companies often include an estimate of the amount of time that it will take to pay off your card along with your monthly statements.

Under-use Your Credit Card

Creditors look at the amount of credit you have available and the amount you have used. Keeping the balance on your card low will look good on your credit report. Again, keep your credit utilization below 30%. For example, if you have a credit card with a limit of $1,000, then you should keep the balance below $300. One useful tip to achieve this is to make more than one payment a month on your credit card bill, if you are able to do so.

Take an Offer to Raise Your Credit LimitAlthough it may seem counterintuitive, accepting an offer to increase your credit limit can help improve your credit score. If you keep your spending the same but increase your limit, then you will be decreasing your credit utilization. For example, if you increase your credit card limit from $3,000 to $4,000, but keep your credit card balance at $1,000, then your credit utilization will decrease from 33% to 25%.

However, you will need to be careful to use the extra credit responsibly. It can be very tempting to increase your spending along with your new limit, which can lead to a slippery slope of compounding interest.

Be Cautious When Seeking Additional CreditNot all credit inquiries are created equal and they impact your score in different ways. There are two main types of credit inquiries you should know about: hard credit inquiries and soft credit inquiries. Do you know the difference?

A hard credit inquiry, sometimes referred to as a hard pull or hard check, happens when a potential lender checks your credit report before approving your application. Hard credit inquiries provide lenders full access to your entire credit history and will temporarily impact your credit score. A hard credit inquiry can temporarily have a negative impact on your score and may stay on your credit reports for up to 3 years.

A soft credit inquiry, sometimes referred to as a soft pull or soft check, happens when you check your own credit score using services like Borrowell’s free credit score check. It is important to note that soft credit checks do not affect your overall credit score

Diversify Your Credit MixYour credit score is affected by many factors, including your payment history and your credit utilization. Your credit mix is also an important factor that impacts your overall score.

A “credit mix” refers to the types of credit accounts you have open. This includes credit cards, but it also includes loans and mortgages. If you thought you could only build your credit score by opening a bunch of credit cards, think again! There are ways to build credit without a credit card, including taking out and paying back a personal loan or a car loan. This can help you increase and diversify your credit mix.

Lenders and creditors like to see that you have a diverse credit mix. They want to see that you’ve been able to manage different types of credit accounts responsibly over time. Generally, there are four different types of credit accounts you may find on your Equifax credit report.

Revolving credit: Revolving loans have limits associated with them, meaning you can access the credit at any time, but these balances must be paid a minimum balance each month. A credit card or line of credit are examples of revolving credit.

Installment credit: This refers to a loan that you are required to pay back through regular payments over a fixed period of time. Late payments will accrue penalties, but monthly payments typically remain the same. Car loans are an example of an installment loan.

Open status credit: Open status accounts on your credit report will include anything like mobile phone accounts or a utility bill.

Mortgage loan: If you’ve taken out a mortgage to purchase a home, your mortgage amount may also show on your credit report.

If you don’t have accounts in multiple types of credit, don’t worry. It is not necessarily recommended that you open several new accounts just to create a diverse credit mix unless you are planning to use them. Your credit diversity makes up around 10% of your overall score; therefore, we recommend focusing first on the more impactful factors, such as ensuring a consistent payment history and your credit utilization rate, to boost your credit score.

Dispute Errors on Your Credit ReportWe recommend regularly checking your credit report. For example, you may look at the report in detail to verify that the accounts listed are accurate, or that credit inquiries conducted on your report were done with your permission. You can get your free Equifax credit report by signing up for Borrowell.

But what happens if you spot an error on your credit report? In these cases, it will be important to take action as soon as possible and dispute inaccuracies on your report to avoid further issues.

While Borrowell can't change or remove any item on your credit report, filing a dispute is free, whether you file yourself or use an agency. In either case, the outcome should be the same as long as you provide the required documentation.

For information that you suspect is incorrect, we recommend contacting the financial institution or collections agency reporting this information first. If they verify they are reporting correctly to the credit bureau, your next step is to file a dispute with the credit bureau. Equifax will review the details you provide and may contact the source of the information to verify accuracy. If they find the reported information was incorrect or incomplete, the lender will then send Equifax the updated information and your file will be changed accordingly.

You can expect the dispute to take at least one month, however, there are lots of factors that can impact how long it can take to reach a resolution.

Keep your Oldest Credit CardIf you have a credit card account that you haven’t used for years, then you may be thinking about closing it. However, a better option might be to keep the account open, using it occasionally so your lender does not close it for lack of use. This is because a key factor that can affect your credit score is the age of the oldest account on your report; in this case, the older the better! By keeping the account open, you are building your credit history and your total available credit (which plays a role in credit utilization), showing lenders your ability to consistently pay down your debts without missing deadlines.

Just remember that your oldest credit card could be cancelled by your credit card provider after a certain amount of time. An inactive card that's suddenly been cancelled could hurt your credit score. To keep your oldest credit card open, use it to make the occasional small purchase, or set it to auto-pay one of your recurring expenses, like your streaming service account.

Consider a Secured Credit Card or Credit Builder LoanMost people are familiar with credit cards but what you might not be familiar with is the difference between unsecured and secured cards. If you are having trouble getting approved or are just starting out, a secured credit card might be a great choice, especially if you have no credit or are in the process of rebuilding your credit.

Secured credit cards are available with most major credit card companies and require that you make a single deposit upfront, which then becomes your credit limit. For example, if you put down $300, your credit limit is $300. The idea is to demonstrate that you can use the card responsibly and pay your balance regularly. After a period of time, often a year, many lenders will allow you to upgrade or reapply for an unsecured card.

Some Canadian lenders offer secured cards to help you build your payment history, which is the largest factor that influences your credit score. By using a secured card to make purchases and building your payment history, you could start seeing your credit score improve over time.

Credit builder loans are another smart way to build credit. They are specifically intended to help you build credit rather than to lend you money upfront. Here’s how they work.

Instead of loaning you money outright, the lender will set aside the money into a secured account. You’ll still make payments on your loan even though you can’t access the money. In the meantime, your payments are reported to a credit bureau. This will help you build your credit history and increase your score. At the end of the loan period, you’ll get access to your secured loan money.

Not only is a credit building loan a great way to up your credit rating, it’s a fantastic way to hone your money-saving muscles. If you're new to Canada, haven't used credit in the past, or are recovering from an insolvency, a credit builder loan can help you rebuild your payment history and positively influence your credit score.

How Long Does it Take to Improve my Credit?In general, consumers with lower credit scores can see their scores improve in as little as 30 days. Individuals with lower credit scores are in a better position to quickly improve their scores compared to those who already have built a strong credit history. The quickest way to improve your credit score is by paying your bills on time and using less than your available credit limit. These actions, when done consistently, may improve your score by as many as 100 points.

Your payment behaviour is reported to credit bureaus every 30 days and gets added to your credit report. Each time your credit report updates monthly, your credit score has a chance of improving. By taking consistent steps towards making timely payments and staying within your credit budget, you will be able to, slowly but surely, improve your credit score.

If you have negative information on your credit report, or if you are trying to dispute your credit report, it can take three to six months to fix your bad credit score.

If you have a low credit score, there are financial programs to help you build your credit history. These programs allow you to create a secured account, make payments towards the account, and have those payments reported to Canada's credit bureaus and added to your credit report. This type of program can help you if your credit score is low, if you haven't used credit products to build up your score, or or if you're new to Canada and don't have a credit score at all.

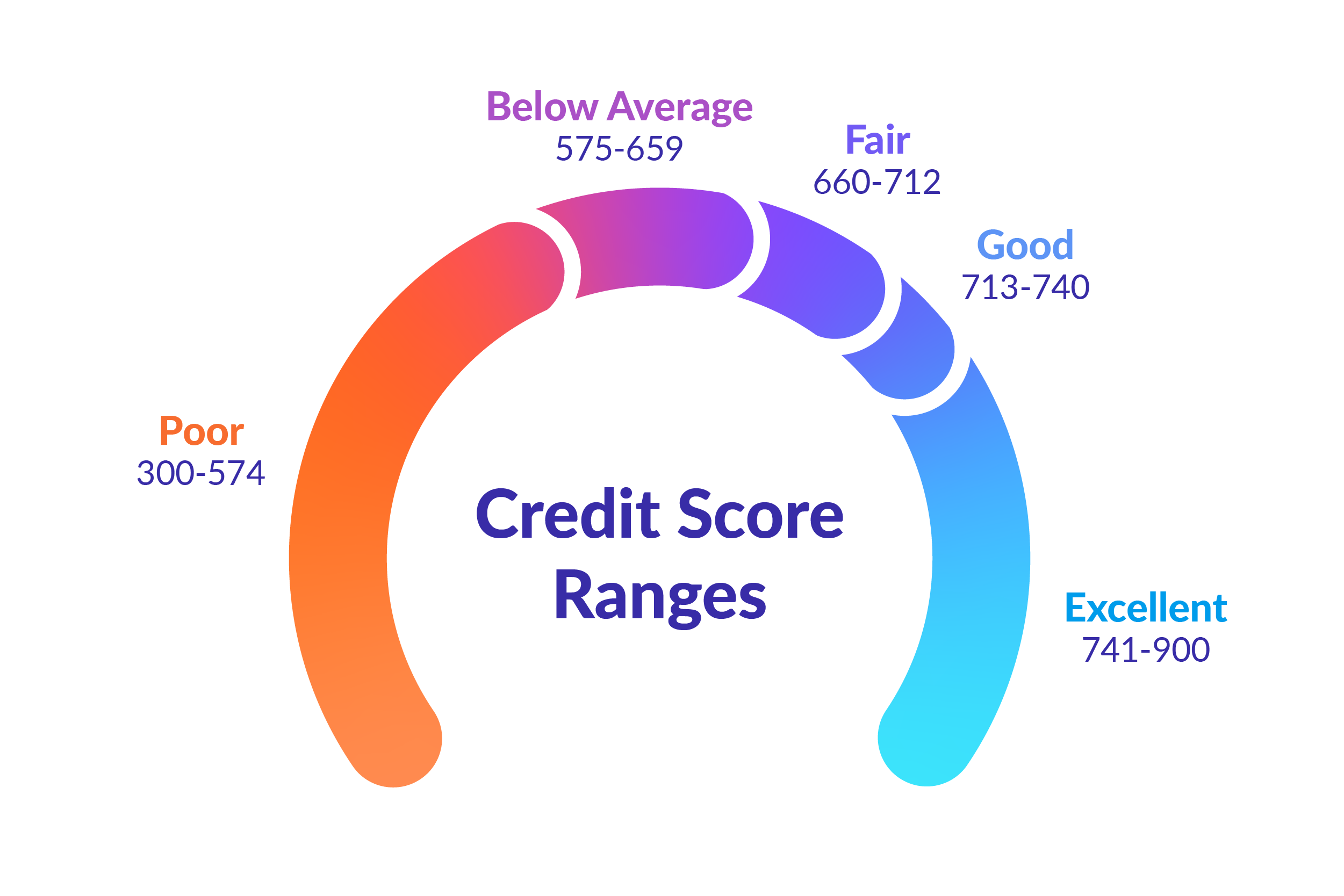

What is a Good Credit Score in Canada?Credit scores above 713 are considered good in Canada. Your credit score is a number that typically ranges between 300-900, depending on the scoring model. As we determined in our unique study examining the average credit score based on cities across the country, 667 is the average credit score of a Borrowell member. Depending on where you live, the average credit score of your city may skew lower or higher than this average.

According to Equifax, lenders generally see those with credit scores of 660 and higher as lower-risk borrowers. At Borrowell, we use the Equifax Risk Score 2.0 (ERS). If you aren't already a member, you can sign up with Borrowell to track your progress and check your credit score anytime – for free - as well as get personalized tips from our Credit Coach, Molly. It only takes a couple of minutes to sign up and checking won't impact your score.

Using Borrowell’s study, you can compare your credit score to your city’s average score (or a city near you). A good credit score can make achieving your financial goals a lot easier. Monitoring your credit score may help you improve your score over time! Checking your Canadian credit score with Borrowell is the first step to improving your financial well-being.

The Bottom LineWhile it may seem overwhelming at times, there are many steps you can take to improve your credit score - no matter where you are on your financial journey. By taking the eight steps above, you can make tangible improvements to your credit score.