Many people use the terms credit score and credit report interchangeably. Although the two are related, credit scores and credit reports are in fact different from each other.

Sean Cooper

Apr 06, 2021

Learn More

Your credit score is that magic number that helps you reach major milestones in your life. There are many reasons why your credit score is important. Lenders look at your credit score before approving you for credit cards, car loans and mortgages, so you should know what your score is before applying. It’s also good to know where you stand compared to others in the country.

According to 2026 data from over 3 million Borrowell members, the average Canadian credit score is 679. Having a credit score above this average will make it easier to qualify for credit products, so you should use this as a benchmark to compare your own credit score. If your score is below this average, there are many different ways you can improve your credit score.

In 2021, the average credit score of Borrowell members was 667. This means that the average Canadian credit score has improved by 12 points in the past 6 years.

Not sure where you stand? You can use Borrowell to check your credit score in Canada.

We dug deep into our data to find the average credit score of major Canadian cities. The data below shows the average credit score of the 20 most populous cities in Canada, in order from highest average credit score to lowest.

According to Borrowell’s data, the Canadian city with the highest credit score is:

Quebec City, QC: 723

Montreal, QC: 716

Markham, ON: 714

Vancouver, BC: 704

Laval, QC: 704

Vaughan, ON: 703

Ottawa, ON: 702

Toronto, ON: 693

Mississauga, ON: 687

Gatineau, QC: 684

Kitchener, ON: 678

Calgary, AB: 671

London, ON: 671

Halifax, NS: 669

Surrey, BC: 664

Saskatoon, SK: 659

Brampton, ON: 658

Hamilton, ON: 658

Winnipeg, MB: 657

Edmonton, AB: 646

Interestingly enough, there is a correlation between age and credit score. Data from Borrowell shows that the average credit score in Canada increases by generation. Gen Z in Canada have an average credit score of 659, while Baby Boomers have an average credit score of 718 and the Silent Generation have an average credit score of 769 in Canada. Millennials and Gen X are close with an average credit score of 673 and 676 respectively.

Gen Z (18-28): 659

Millennials (29-44): 673

Gen X (45-60): 676

Baby Boomers (61-79): 718

Silent Generation (80+): 769

There are some high-level reasons why credit scores seem to increase with age. Two factors that impact your credit score are your credit history and your credit mix. As you grow older, you might make bigger purchases to reach major milestones. Buying a car or a house involves adding different forms of credit to your credit mix. When you take out a car loan or a mortgage, your credit mix becomes more diverse. As you pay these off, your credit history grows. These two factors both help in increasing your credit score.

A word of caution, though: growing older doesn’t guarantee that your credit score will increase. Building good credit requires strong financial habits, like paying your bills on time and in full.

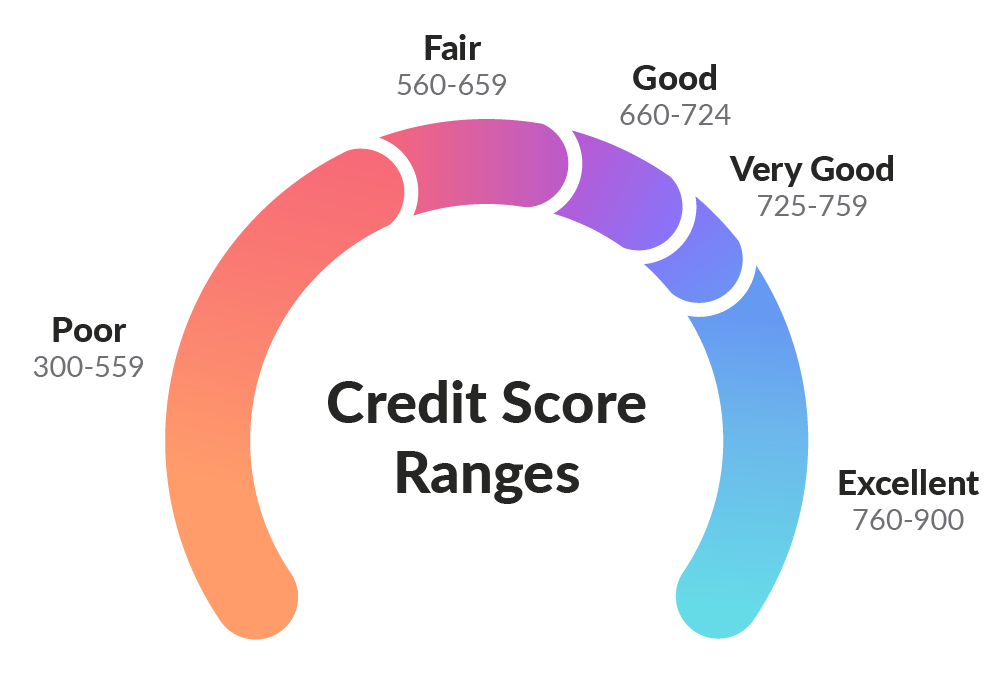

There are five distinct categories that your credit score could fall into. These range from poor to excellent. Here’s a simple breakdown of each of these categories.

Sign up for Borrowell to get your free credit score and see how you compare to the average credit score in Canada!

If your credit score falls in this range, congratulations! An excellent credit score helps you qualify for the best rates and terms on financial products. You’ll have an easier time getting approved for financing on large purchases, such as major appliances, a new car and your first home. You’re also more likely to receive promotional rates, rewards, and cash back bonuses on new credit cards.

Having a very good credit score means lenders see you as a low-risk borrower. You’ll get approved for solid interest rates, but there could be some simple steps you could take to bump up your credit score and access even better rates. With a bit of time, discipline and patience, your credit score could reach new heights and help you save money on interest in the long run.

A credit score in this range means you’re roughly at or above the 2022 average credit score of Borrowell members. With a good credit score, you’ll have access to standard rates and terms from lenders. You might not have trouble getting approved for loans or credit cards, but you won’t be able to access the lowest interest rates possible. You can qualify for most credit cards with a good credit score, but you might not qualify for premium cards with rewards and perks. Small changes to your financial habits can help you reach a very good or excellent credit score. This can help qualify for even more financial products in the future.

With a fair credit score, you’ll have a difficult time getting approved for standard rates and terms on credit cards or loans. You may be able to get a secured loan or a secured credit card, but the interest rate you’ll qualify for will be higher than average. To save money in the long run on interest payments, it’s in your best interest to build up your credit score and reach a good, very good or excellent score.

If your credit score falls in this category, you will have an extremely difficult time qualifying for loans, mortgages or any kind of credit product. You’re considered to be a high-risk borrower, and if you’re approved, you could end up paying a lot in interest. To build up your credit score, you will need to use a secured product and put up some funds as collateral. Making regular payments towards your secured product can help you build up your credit score.

If your credit score falls below the Canadian average of 679, don’t stress. Many individuals fall into this category, and there are concrete steps you can take to build your credit. Here are just a few of the steps you can take:

Paying your bills on time – every time – is one of the best things you can do to improve your credit score. Your payment history is the largest factor that impacts your credit score, and it makes up 35% of your score. Use a free bill tracking app to monitor your bills, or try setting up monthly automatic payments so you don’t miss your bills. If you have any past due accounts, try to pay off the oldest ones first.

Your credit utilization is the second largest factor that impacts your credit score. It’s the amount of credit you’ve used versus the total amount of credit you have available. You should aim to keep your credit utilization below 30%. This means if you have a credit card with a limit of $3,000, then you should keep the balance below $1,000.

A Borrowell study found a correlation between how often members checked their credit score and how much their score improved. Members who consistently log in and check their weekly credit score updates with Borrowell saw their credit scores increase by an average of 20 points. Members with credit scores below 600 saw their scores increase by an average of 43 points! Regularly monitoring your credit score, especially if you have poor credit, can keep you motivated and help you build good financial habits.

If your credit score is below the average of 679, don’t worry! You can still recover from a bad credit score, even if you’ve been through a bankruptcy or consumer proposal. Building up your credit score takes time, discipline and determination. But if you pay your bills on time, keep your credit utilization low and regularly monitor your credit, you’ll start seeing that magic number get bigger and bigger.

Many people use the terms credit score and credit report interchangeably. Although the two are related, credit scores and credit reports are in fact different from each other.

Sean Cooper

Apr 06, 2021

Learn More

Borrowell vs. Credit Karma: What's the difference? We break down how each one works so that you can understand how they help you with your credit and more.

Kate Smalley

Sep 30, 2025

Read More

Here are eight tangible steps you can take to improve your credit score. Your credit score directly impacts your ability to get approved for financing, including credit cards, loans and mortgages.

The Borrowell Team

Nov 28, 2025

Learn More