Debt Consolidation Loans in Ontario

Looking for a debt consolidation loan in Ontario? Use Borrowell to get your credit score for free, find the best loans available to you based on your credit profile, and consolidate your debt.

Getting a Debt Consolidation Loan in Ontario

A debt consolidation loan can help you merge multiple sources of debt into one manageable payment. When you apply for a loan, lenders in Ontario will qualify you based on your credit score. Over 700,000 Ontario residents have signed up for Borrowell to check their credit score for free and quickly compare loan options available to them. Use Borrowell to get your free credit score, find the best debt consolidation loan options, and improve your financial health.

Debt Consolidation Ontario:

What You Should Know

A debt consolidation loan is a lump sum of money that you’ll use to pay off your high interest creditors. The lump sum of money will pay off those debts and then you’ll pay back the single loan on a monthly basis until the balance is zero and you are debt free. For example, you could use a debt consolidation loan to pay off outstanding credit card balances, department store credit cards, furniture financing programs, and payday loans. If you’ve found yourself with too much high interest debt and you’re struggling to pay it off in a timely manner, a debt consolidation loan can be an excellent tool to help jump start your debt repayment progress.

Using a debt consolidation loan in Ontario for debt relief by paying off high interest debts provides two key benefits: a lower interest rate and one single payment to manage.

If you have credit card debt, you could be paying as much as 29.99% interest on your debt. With an interest rate that high, it can be a challenge to make progress on getting rid of your debt, since so much of your monthly payment is going toward interest. Debt consolidation loans in Ontario tend to have significantly lower interest rates. If you have a good credit score, you can expect interest rates as low as high single digits.

If you have multiple sources of debt, prioritizing and managing all of your monthly payments can be stressful. Sometimes making payments to multiple debts can feel like you aren’t making progress. A debt consolidation loan pays off all your creditors and leaves you with a single monthly payment. You can track your progress on this loan easily and have a definitive debt free date.

To qualify for a debt consolidation loan in Ontario, your lender will consider your credit score, your income, and your current debt. They will judge whether you can afford to pay back their loan and will extend your credit based on that judgment. Note that each financial lender may have slightly different qualification requirements.

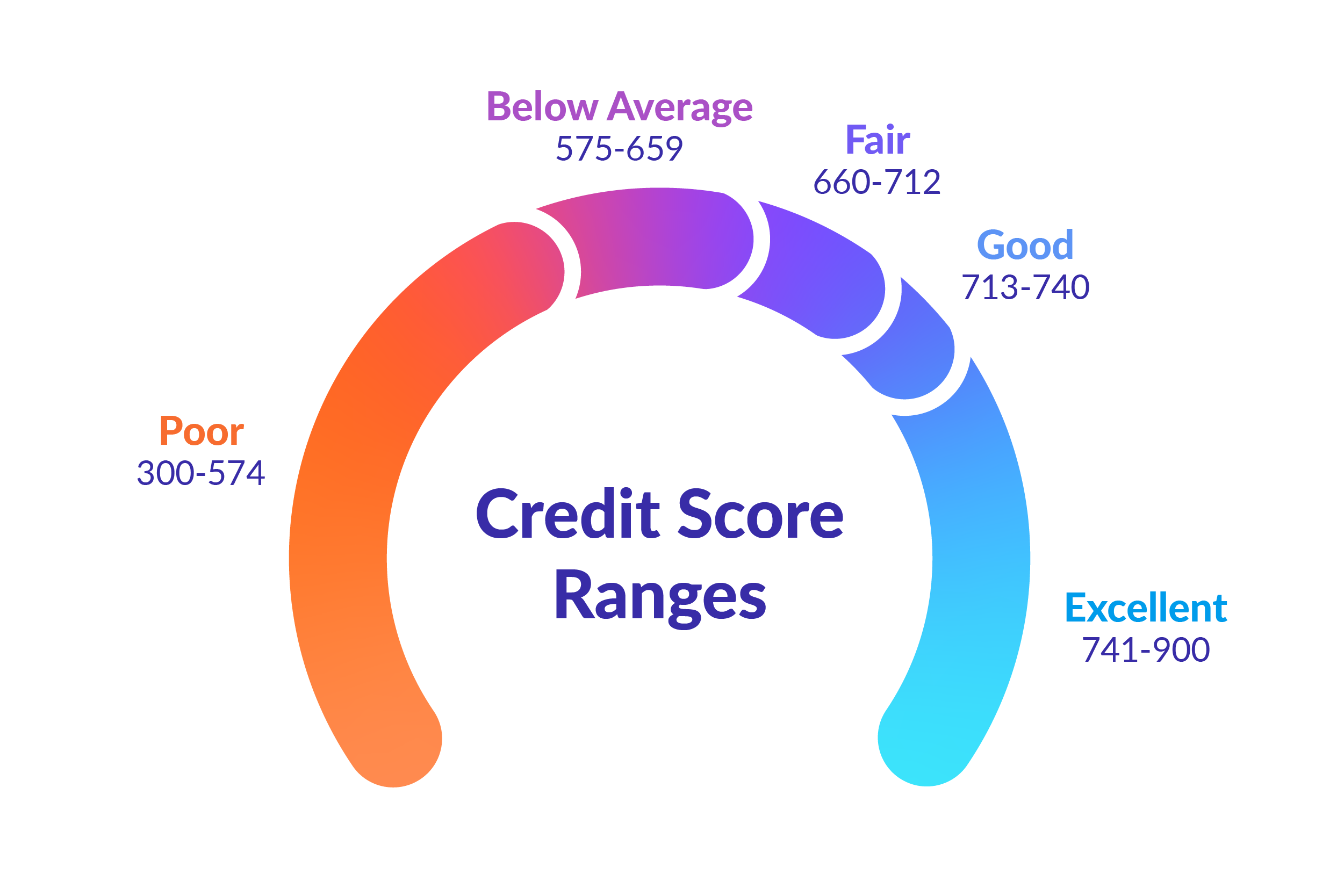

Borrowers with credit scores of 660 or higher have the best chances of qualifying for a loan. Don’t worry: if your credit score is below 660, there may still be debt consolidation loan options available. Sign up for Borrowell to see what options are available to you based on your credit score.

You can apply for a debt consolidation loan in Ontario in person or online at traditional banks and credit unions. To compare loan options, you can use an online lending aggregator like Borrowell, which will connect you with an online lender that suits your unique financial profile. Sign up for free to find a loan that matches your profile.

When applying for a loan in Ontario, you should have the following documentation at hand.

Your full name, address, email address and phone number

Your social insurance number

Proof of employment (such as pay stubs)

A void cheque to a Canadian chequing account

Not every lender in Ontario will offer you the same loan terms and interest rate, so it’s important to compare the loan options available to you. You can do your own research by visiting the websites of major banks and credit unions, or you can use a lending platform like Borrowell. Borrowell will connect you with dozens of lenders and will summarize their loan terms on one page.

If you have a unique limiting factor on the types of loans you can apply for, such as a low credit score or a low income, Borrowell can adjust their results to only show you lenders that work for these types of borrowers. Sign up for free to see what loan options are available to you.

A debt consolidation loan can impact your credit score, and whether it positively or negatively affects it will depend on how you manage your repayments. If you make on-time payments towards your loan, you should see your credit score increase over time. If you miss or make late payments towards your loan, your credit score could decrease.

A debt consolidation loan will positively impact your credit score if:

You make your monthly payment on time every month

You use the money to pay down your debts and do not rack up additional debt

A debt consolidation loan will negatively impact your credit score if:

You miss your monthly payment

You eventually max out your high interest debt tools again, resulting in more overall debt

Why You Should Check Your Credit Score First

Lenders look at your credit score

Your credit score is one of the main criteria for qualifying for debt consolidation loans. To make the application process easier, you should know what your actual credit score is before applying for a loan. With Borrowell, you can quickly check your credit score for free to speed up the process.

Applying for loans impacts your credit score

When lenders check your credit score, it is recorded on your credit report as a “hard inquiry.” Hard credit inquiries temporarily lower your credit score, and applying for many loans at once results in multiple hits to your credit score. To protect your credit score, you should only apply for loans that you’re confident you’ll qualify for.

Borrowell shows you loans you qualify for

To minimize impacts to your credit score, you want to make sure you apply for a loan that you'll likely get approved for. Borrowell helps protect your credit score by showing you your likelihood of approval for recommended loan offers, based on your credit score.

Is Signing Up for Borrowell Free?

Yes, it's really free. Borrowell provides you with your Equifax credit score, free of charge. Based on your credit score, we provide you recommendations on the best loans, credit cards, and financial products that you are likely to qualify for. Knowing your credit score speeds up the loan application process and helps you get your money as quickly as possible.

Still Have Questions?

Get More Answers

Yes, you can still get a debt consolidation loan with bad credit in Ontario. You may not be able to go through traditional lenders, but Borrowell’s platform can connect you with lenders who specialize in working with low credit borrowers. Keep in mind the interest rate on a bad credit consolidation loan may be higher. Sign up to see more options.

If you don’t qualify for a debt consolidation loan in Ontario, you may be able to use other consolidation programs for debt relief. These programs often involve using a certified credit counsellor to help you pay off your debt. A credit counsellor will make a repayment proposal to your creditors and negotiate with them directly on your behalf for debt relief. You’ll make payments to the credit counsellor, which will include the fees for their service. Credit counselling appears on your credit history and will remain for up to two years.

If you have a low income and significant amounts of debt, you might not be able to qualify for debt relief via a debt consolidation loan in Ontario from a traditional lender. If this is the case, you can either work with a lender that specializes in low income lending, or work with a credit counselor. There are ways to get out of debt with low income, you may just need to spend some more time researching and finding an option that’s the best for you.

Debt consolidation loans in Ontario can be used for debt relief to pay off almost any type of debt you can imagine. Here are some examples:

Credit card debt

Overdue utility accounts

Personal lines of credit

Home equity loans

Payday loans

Car loans

Other personal loans

Department store financing programs

“Good” and “bad” debt is a traditional way of classifying various types of debt. Good debt is generally any debt that can be used to improve your financial position. Examples of good debt include student loans and a mortgage, because student loans increase your earning potential, and a mortgage helps you purchase property, which will increase in value over time.

Bad debt is usually consumption-oriented debt like credit card debt and debt accumulated from payday loans. Bad debt does not help you improve your financial situation, and often the interest charges negatively impact your finances.

Find a Debt Consolidation Loan in Ontario with Borrowell

Ready to find the right debt consolidation loan for you? Sign up for Borrowell to get your free credit score, receive personalized loan recommendations based on your score, and quickly apply for a loan today!