A score of 900 represents a perfect credit score! If you want to try to reach it, there are a few healthy credit habits you should be adopting.

Sandra MacGregor

Jul 02, 2025

Read More

Your credit score is incredibly important. Not only do potential lenders look at this score as a marker of your ability to responsibly manage credit, but it may also be checked by prospective landlords and even employers. Let’s take a look at how credit scores work, why credit scores are important and how to build good credit in Canada.

A credit score is a three-digit number that banks, credit card companies and other financial institutions use to evaluate your creditworthiness, meaning how likely you are to pay back debt. This includes personal loans, lines of credit, mortgages, car loans and credit cards.

Your score is calculated through careful analysis of information in your credit report by credit bureaus. The two main credit bureaus in Canada are Equifax and TransUnion. Financial institutions use this information to help make decisions about the services and products they offer you, such as interest rates and insurance premiums.

Your credit score is affected by your historical use of credit: how much you have, how long it takes you to pay back, what type you have and how long you’ve had it.

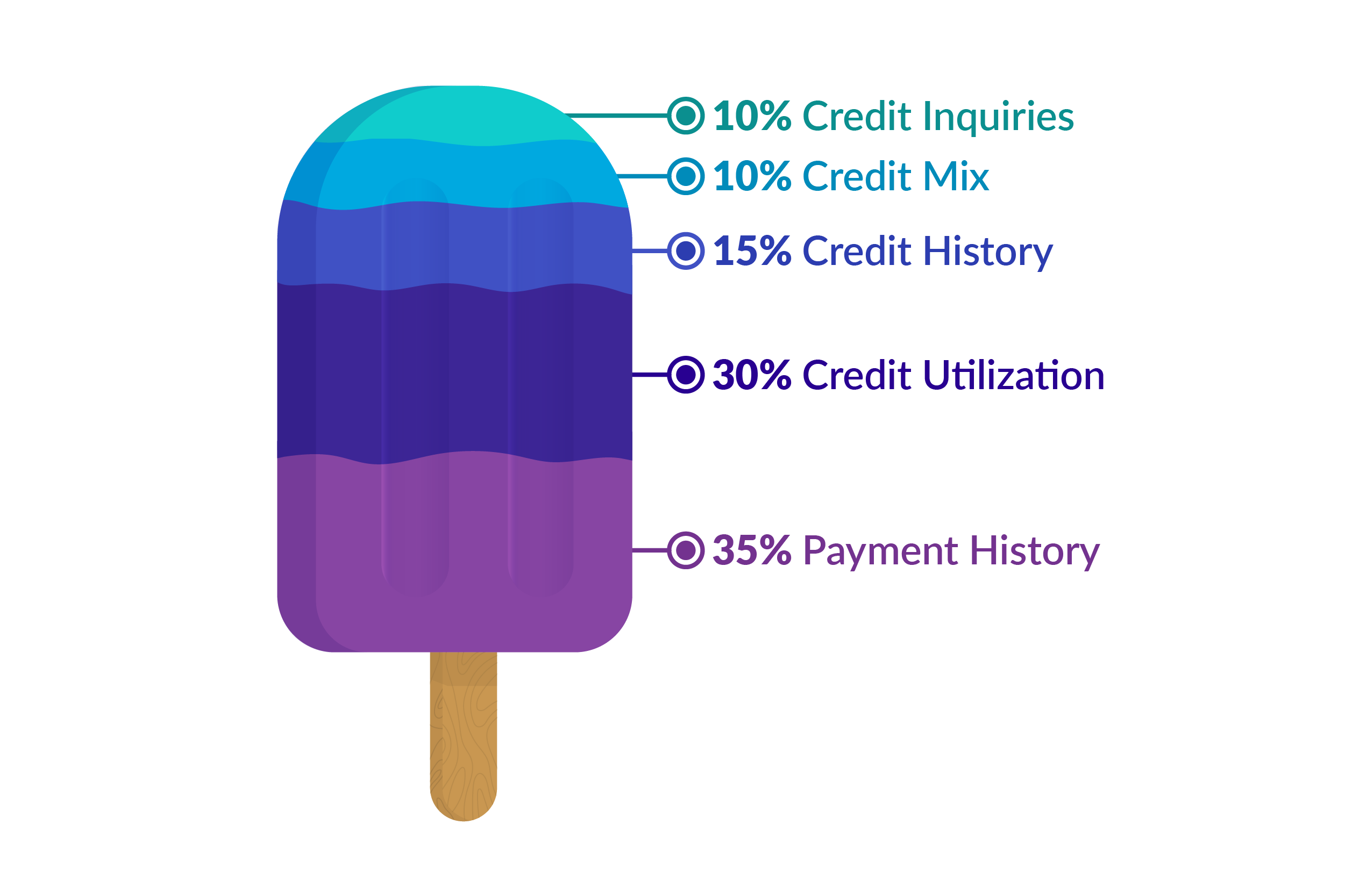

As the illustration shows, your credit score is affected by five different factors:

You can think of your payment history like your track record of making payments on time (or not). This includes payments for any credit cards or loans, even your utility bill payments if they’re included on your credit report.

As your payment history is such an important factor in determining your credit score, you want to make sure that you’re never late making a payment, even if you can only make the minimum payment. Any missed or late payments can stay on your credit report for up to six years and make financial institutions nervous about lending money to you.

Your credit utilization is the amount of credit you are using as a proportion of the total amount of credit you have available to you in your name. At Borrowell, we recommend aiming to keep your credit utilization below 30% if you want to see the most positive outcome on your credit score.

So say, for example, that you have two credit cards that each have a credit limit of $5,000, meaning you have $10,000 of credit in your name. You would want to aim to keep your balance across both credit cards below $3,000 (30% of $10,000).

The length of your credit history relates to how long any of your given credit accounts have been open, including any credit cards, lines of credit and mortgages. The longer the length of your credit history, the greater the positive effect on your credit score.

For this reason, we recommend that you keep your oldest credit accounts open, even if you don’t use them very often anymore. This way, you make sure you retain that credit history you’ve built with your oldest credit lines.

Your credit mix refers to the various types of credit accounts that make up your credit report. Having different types of credit accounts on your credit report signals to potential lenders that you can responsibly manage your finances well.

There are four main types of credit that could appear on your report: revolving (like credit cards and lines of credit), instalment (like loans), mortgages and open (like cell phone plans and utility bills).

A credit inquiry is when a lender, creditor or other individual requests to view your credit report. This happens when you make an application for a credit product or to rent a property, and even some employers will check your credit when you apply for a job!

Any credit inquiries you’ve made in the past three years will appear on your credit report, so it’s important that you don’t make too many in a short space of time. Having too many inquiries on your credit report might make potential lenders nervous that you’re struggling financially and desperately seeking credit.

Credit scores typically range from 300 to 900 depending on the scoring model, and the higher your score is, the easier it may be for you to access these financial products and services.

A very good to excellent credit score in Canada is generally between 725 and 900. According to 2026 Borrowell data, the average credit score in Canada is 679.

760 or more: You have an excellent credit score!

725 to 759: You have a very good credit score. You should expect to receive good interest rate offerings and a variety of credit products.

660 to 724: This is considered a good credit score to lenders.

560 to 659: This is a fair credit score.

300 to 559: Your credit score is poor and needs improvement. You’re considered to be a high-risk borrower and if you’re approved, you could end up paying a lot in interest.

Although the typical range of credit scores is 300-900, it’s also possible to have a zero credit score if you don’t have any credit history in Canada. This might be because you’ve only just turned 18 and haven’t had any credit products yet, or because you’ve recently moved to Canada.

Credit scores, in the eyes of financial institutions, reflect your behaviour when it comes to credit, and they use your score to make decisions about whether or not to lend money to you.

For this reason, it’s important to demonstrate good credit behaviours that will reflect positively on your credit report. For example, missed or late payments may lower your score, while being in the habit of paying your bills on time will likely improve your score.

Sign up for Borrowell to get your free credit score. That's right. For free.

Your credit score is a measure of trust: the higher your score, the more trust lenders and institutions will have in your ability to pay them back. A good credit score can help you improve your financial well-being and make getting a mortgage, getting a loan to buy a car or fund a renovation a lot easier (and cheaper!)

As the diagram above shows, your credit score is affected by payment history, credit utilization (how much credit you use out of what is available to you), your credit history, credit mix (types of credit), and your number of credit inquiries.

If you credit score is low, here are some great habits that could help improve it:

1. Pay your bills on time. Set up pre-authorized payments on all of your bills, especially the ones that report to the bureaus (mortgages, student loans, auto loans and credit cards). These can also include your utilities, cell phone, insurance, etc. Your payment history accounts for about 35% of your credit score.

2. Watch your credit utilization. Using a lot of the credit that you have available to you can signal to potential lenders that you’re struggling financially, which can raise a red flag when they’re considering whether or not to lend to you. For this reason, it is recommended you keep your credit utilization below 30%. As an example, if you have two credit cards with a limit of $5,000 each, meaning you have $10,000 total credit in your name, you should aim to keep your combined balances below $3,000 at any given time.

3. Diversify your credit mix. Potential lenders like to see that you can handle multiple types of credit, so if you only have one sort of credit product, it could be a good idea to take on some different types of credit to help diversify your credit mix. There are three types of credit: revolving (eg credit cards and lines of credit), instalment (e.g. personal loans) and open (mortgages, utility bills).

Some ideas for diversifying your credit mix include:

Reporting your rent payments: Including your rent payments on your credit report is an easy way to add a new credit line to your report without taking on any extra debt. Think about it: if you’re already making your rent payments on-time every month, then why not get extra credit for doing so? Get started on reporting your rent with Borrowell Rent Advantage. This is reported as an “open” tradeline on your credit report. Plus, you can now add up to two years of past rent payments to your credit report in one go, allowing you to extend your credit history.

Switching to a monthly cell phone plan: If you’re on a pay-as-you-go plan, you might want to consider switching to a monthly plan so that your payments get included on your credit report. However, make sure to check with your cell phone provider that they do report to the credit bureaus before signing up, as not all do. Cell phone plans are reported as an “open” tradeline on your credit report.

Using Credit Builder: Borrowell Credit Builder is a credit building product that reports your monthly payments to Equifax, one of the two credit bureaus in Canada. This will help you build your credit history, payment history and credit mix. Borrowell Credit Builder is reported as an instalment tradeline on your credit report.

There are lots of different factors that impact your credit score. Being aware of why it matters and building good financial habits is a great first step! Don't forget to track your progress - you can sign up for Borrowell to check your free credit score in under three minutes. You'll receive weekly updates to your score and report, and checking the Borrowell app won't impact your score. You'll also receive personalized recommendations for financial products, based on your profile and likelihood of approval.

Trusted by over 3 million Canadians, Borrowell provides free weekly credit scores and report monitoring, personalized financial product recommendations and affordable tools to help you build your credit. Sign up for your free Borrowell account today on borrowell.com, or download the mobile app for Android or iOS.

A score of 900 represents a perfect credit score! If you want to try to reach it, there are a few healthy credit habits you should be adopting.

Sandra MacGregor

Jul 02, 2025

Read More

Most apartment rental listings stipulate that a credit check will be required, but you may be wondering what credit score you need to secure a rental.

Janine DeVault

Jul 03, 2025

Learn More

A credit score of 680 or above is required to qualify for the best mortgage rates in Canada in 2026.

Sean Cooper

Nov 12, 2025

Learn More