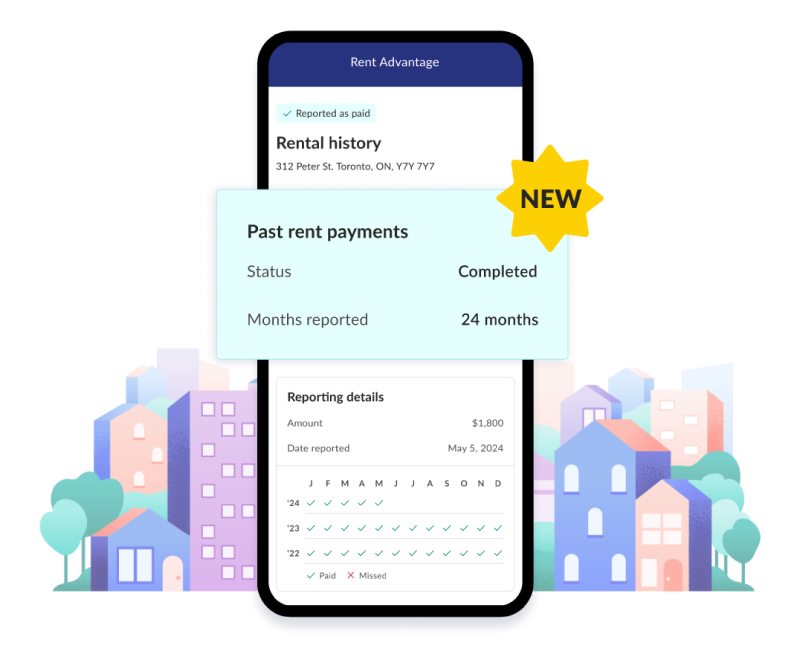

Build credit with your rent. Now add past payments!

NEW! One-time sign up fee of $69 + $8/month to report monthly rent payments and up to 24 months of past rent payments. Money-back guarantee if your score doesn’t increase.¹

Provide your email address to get access.

![Is rent reporting worth it?]()

We report your rent to Equifax Canada

![Over 3 Million have gotten their free Credit Score Report]()

Borrowell is trusted by 3 million members

New! Use up to 24 months of past rent payments to build credit history

Upload up to 2 years of your previous rent payments to Equifax Canada to build credit history in one go!

One-time fee starting at $69 + $8/month

Money-back guarantee! If your score doesn't increase, we'll give you your money back¹

How does reporting past rent payments work?

Sign up for Borrowell

Enter your email address above then sign up for Borrowell through the email invitation. Pay a one-time fee starting at $69 + $8/month to report up to 2 years of past rent payments in one go.

Confirm your past rent payments

Upload proof of your past rent payments by submitting your lease, bank statements, or rental receipts. Our team will verify your documents and report your rent payments to Equifax Canada.

Watch your credit grow

Your past rental payments will be added to your credit report. If you don’t see a credit score increase after uploading at least 12 months of past rent payments, we’ll give you your money back!¹

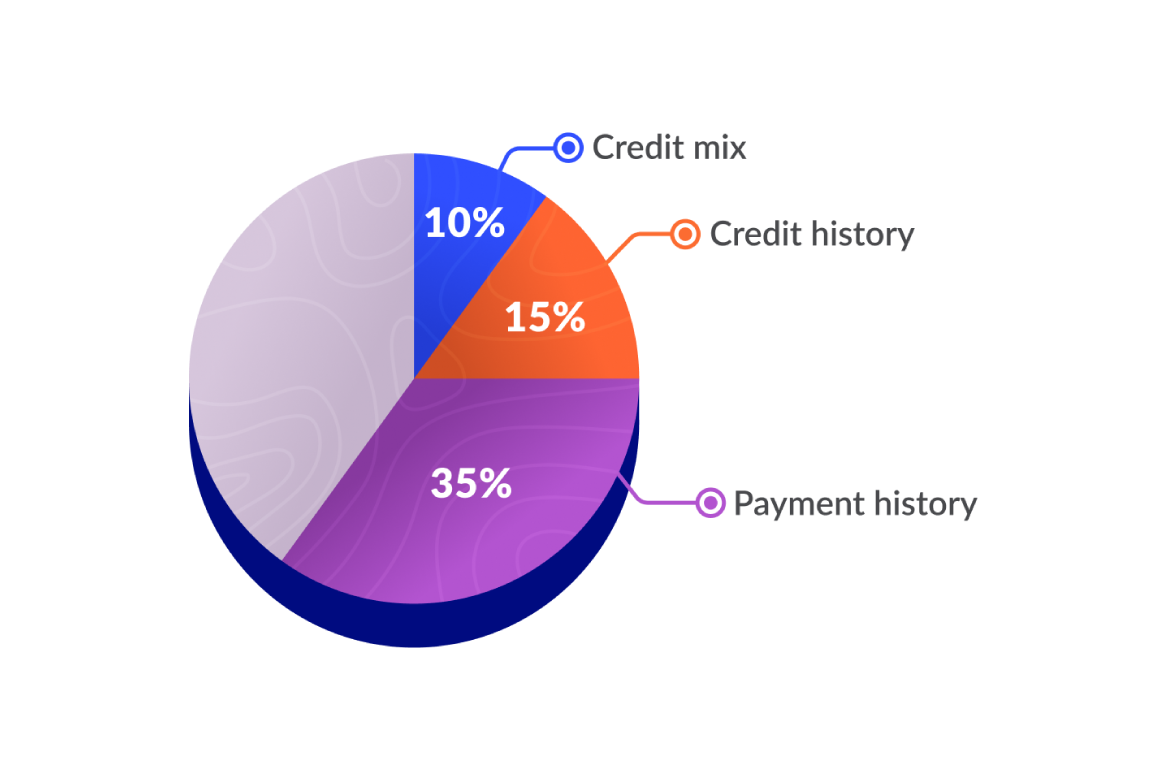

How does rent reporting help build credit history?

Reporting your rent to the credit bureau helps improve three factors on your credit report: your payment history, credit history and credit mix. Together, that makes up 60% of the factors that determine your credit score!

What's the difference between Rent Advantage and reporting past rent payments?

Rent Advantage

With Rent Advantage, we’ll report your current and future rent payments to Equifax Canada starting at $10/month. Sign up for Rent Advantage to get started.

Reporting past rent payments

For a one-time fee of $99, you can report up to 24 months of past rental history to Equifax Canada, allowing you to extend your credit history. Enter your email address to sign up.

Why is rent reporting helpful?

Build credit history with Equifax Canada

Good credit history can help you get lower rates which will save you money in the long run.

You can use Rent Advantage to report your current and upcoming rent payment as you pay them. Now you can now extend your credit history by adding 2 years of past rent history in one go!

Access more financial products at better rates in the future

Unlock more credit products like mortgages, car loans and exclusive credit cards. Plus, with a higher credit score, you'll likely be offered lower interest rates and better rewards.

Easy setup with no hidden fees

No cancellation charges. No additional debt. No landlord approval required.

To start seeing benefits, we recommend you report at least six months of upcoming rent payments if you’re subscribing to Rent Advantage, or at least 12 months of previous payments if you’re reporting past rent payments.

For media enquiries, please contact [email protected]. Consult our press release for more information on the launch of reporting past rental payments.

Rent Reporting FAQs

To get started on adding up to 24 months of your past rent payments to your credit report, enter your email address at the top of the page. You’ll then receive an invitation to sign up for a one-time fee of $99.

From there, simply upload proof of your past rental payments by submitting your lease, bank statements, or rental receipts. You can report up to 24 months of past rent payments from the time you signed up for the service. These payments do not have to be consecutive, but they must be from the 24-month period immediately before you enrolled in the service.

Our team will then verify your documents and report your rental payment history to Equifax Canada. The past rent payment history will be added to your Equifax Canada credit report.

If you don’t see a credit score increase after uploading at least 12 months of past rent payments, we’ll give you your money back.¹

To be eligible for the money-back guarantee for reporting past rent payments, you must have reported at least 12 months of rent payments from the past 24-month period prior to your transaction date or when your rental information is submitted by you and verified by Borrowell, whichever is later. These payments do not have to be consecutive, but they must be from the 24-month period prior to enrollment. Additionally, your credit score on your Borrowell credit report must have either remained the same or decreased due to the addition of past rent payments.

For complete money-back guarantee terms and conditions, visit borrowell.com/terms-money-back-guarantee.

With reporting past rent payments, you can report up to 24 months of your previous rent payments in one go to Equifax Canada for a one-time fee of $99, allowing you to extend your credit history. To get started, enter your email at the top of the page.

With Rent Advantage, we’ll report your current and future rent payments (as you pay them) to Equifax Canada on an ongoing basis for $10/month.

You don’t need to involve your landlord to enrol in either program.

Borrowell is trusted by over 3 million Canadians. We've partnered with Equifax Canada, one of the two major credit bureaus in Canada to launch Rent Advantage, which is a credit history building product that allows tenants to report their rent payments on their residence to Equifax Canada without landlord approval. Borrowell Rent Advantage will only report to Equifax Canada.

Most rent reporting services in Canada require either landlord verification for payments or require you to make rent payments on their platform. Rent Advantage is different and verifies payments using electronic banking records, which removes the headache associated with landlord sign up and approval.

You can sign up for Rent Advantage by visiting this link. You'll be asked to provide your lease details and connect the bank account or credit card you use to pay your rent. All payments (including missed payments) are reported to Equifax Canada. On-time payments reported to the credit bureaus help build your credit history, which can help you to qualify for lower interest rates and better offers on credit cards, mortgages, loans and more.

Your monthly subscription payments are billed automatically to your credit card on file, so you never have to worry about missing a Rent Advantage payment. To start seeing benefits, we recommend you report at least six months of rent payments.

Borrowell Rent Advantage has a monthly subscription fee. This amount will be automatically billed to your connected bank account or credit card. There are no hidden fees or financial penalties for cancelling. If you cancel Rent Advantage, you may use your subscription until the end of your current subscription term, then your tradeline will be reported as closed to Equifax Canada.

To report up to 24 months of past rent payments, there is a one-time fee of $99 that will be refunded if you report at least 12 months of rent payments and your credit score doesn’t increase. For complete money-back guarantee terms and conditions, visit borrowell.com/terms-money-back-guarantee.

Your credit history impacts your daily life and influences almost every financial move you make. Good credit history helps you access five major things:

Lower interest rates: Lower mortgage rates, car loans and personal loan interest rates make your monthly payments lower, freeing more space in your budget for saving and spending.

Better credit terms: Higher approval chances for credit means you can make financial decisions about your future with confidence, whether you need additional funds for school, home renovations or a new car.

Higher credit limits: You'll automatically qualify for higher credit limits, which gives you more financial flexibility in an emergency and makes it easier to maintain a reasonable credit utilization rate.

Top-tier financial products: You’ll have much higher chances to qualify for premium credit cards, such as rewards cards and cash back cards, along with other top-tier financial products.

Rental applications: Landlords often require a copy of your credit report as part of your rental application; in a competitive real estate market, having stronger credit can help indicate you’ll be a reliable tenant.

Reporting your rent payments with Rent Advantage helps boost several different factors that help determine your credit score:

Payment History: Your payment history is your track record of how successful you’ve been at making credit payments, and is the single biggest factor that makes up your credit score. By making your rent payments on time and having them reported to Equifax Canada, you’re building a solid payment history, signalling to lenders that you can be trusted with credit.

Credit Mix: Your credit mix refers to the various types of credit accounts that make up your credit report. By adding an open tradeline for rent reporting, you’re diversifying the different types of credit on your report, which indicates that you are able to successfully manage multiple credit accounts.

Credit History: If you’ve never had a credit product before and Rent Advantage will be the first tradeline on your credit report, then you’ll also be building your credit history. The longer your history with credit, the more trustworthy you’ll be seen by potential lenders when assessing whether or not to lend to you.

Your first rent payment will be reported by Borrowell to the credit bureau (Equifax Canada) in the following month after you make your Rent Advantage subscription payment. After that, the information will be reported monthly.

Borrowell Rent Advantage reports to Equifax Canada, the largest consumer credit bureau in Canada.

¹ Terms and conditions apply. To be eligible for the Money-Back Guarantee for reporting past payments, (1) you must have reported at least twelve (12) months of your past twenty-four (24) months of rent payments from the time you signed up for past rent payments or when your rental information is submitted by you and verified by Borrowell, whichever is later; and (2) your credit score on your Borrowell credit report must have either remained the same or decreased due to the addition of past rent payments. For complete Money-Back Guarantee terms and conditions visit borrowell.com/terms-money-back-guarantee.