Worried you have bad credit? It’s important to understand what your credit means and what category it falls in. Credit scores in Canada generally range between 300 and 900. A bad credit score is any score between 300 and 574.

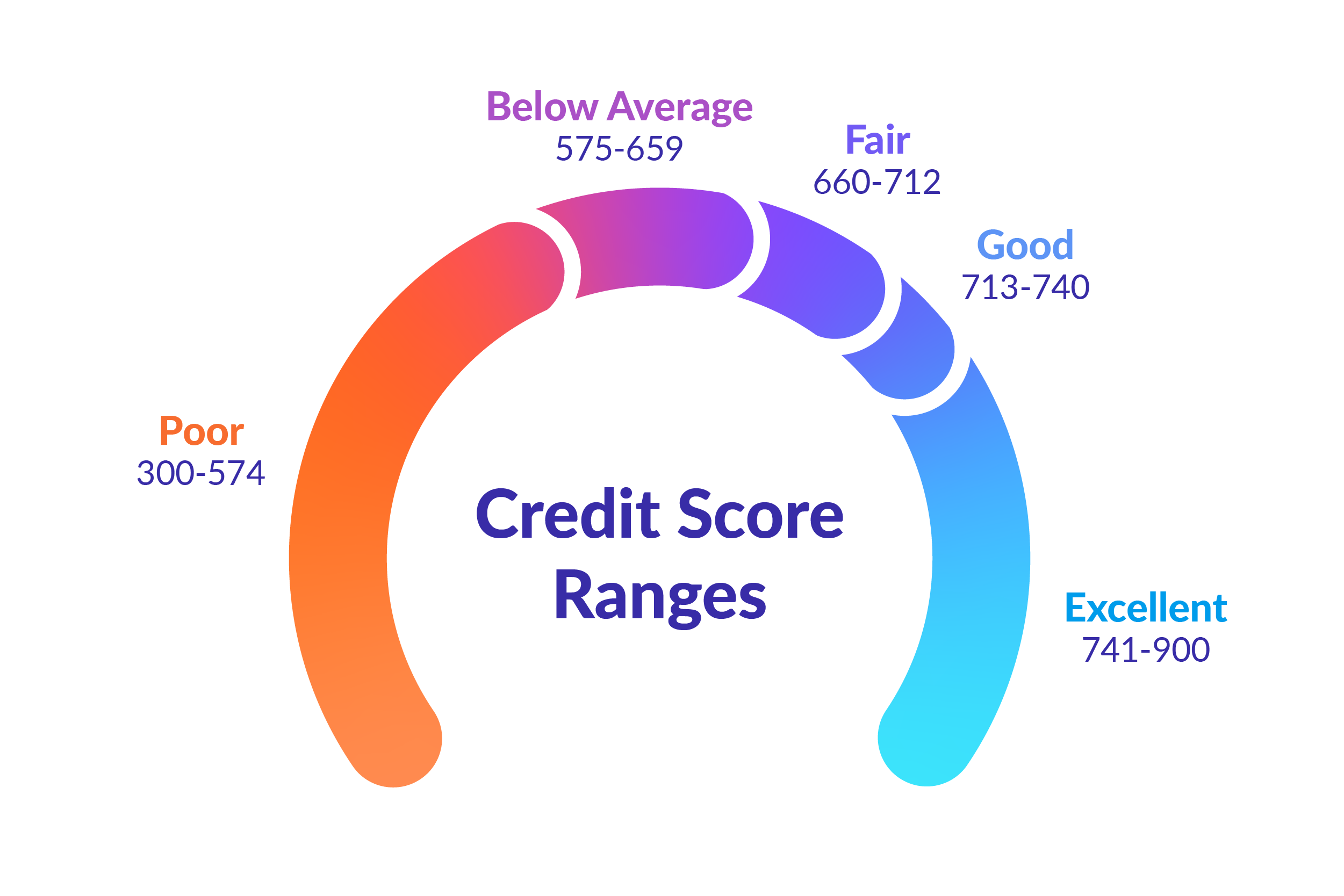

A bad credit score limits your ability to qualify for credit cards, loans, mortgages, and other financial products at low interest rates. In comparison, a good credit score is typically above 713, and having a good credit score can open up your financial product choices. The higher your credit score, the higher your approval chances for financial products, and the more options you’ll have available. Here's a general breakdown of how credit scores range in Canada:

741 to 900 (Excellent Credit): With excellent credit, you can access the best terms and rates on loans, credit cards, and mortgages.

713 to 740 (Good Credit): With good credit, you should qualify for very good terms and interest rates on loans, credit cards, and mortgages.

660 to 712 (Fair Credit): With fair credit, you'll still be able to qualify for financial products, but you might not qualify for the best rates available.

575 to 659 (Below Average): In the eyes of banks and lenders, this is a below-average credit score. If your credit score is below 640, you might have trouble getting a conventional mortgage from a bank or online lender.

300 to 574 (Bad Credit): Your credit score is poor and needs improvement, but that’s OK. As your credit stands right now, you’d be considered a high-risk borrower. Even if you’re approved for financial products, you would end up paying extremely high interest rates. You should make an effort to improve your credit score in order to access better rates in the future.

If you don’t know your score, you can check yours with Borrowell! You can now get your credit score in Canada for free with Borrowell. If you want to learn more about how a bad credit score can impact you and the steps you can take to improve your credit score, keep reading below.

How Does Bad Credit Affect Me?

A bad credit score can prevent you from qualifying for certain types of financial products, like credit cards, mortgages, and loans. If you’re looking for a personal loan to cover sudden expenses or fund a big purchase, bad credit can get in your way. There are still ways to qualify for short term loans with bad credit, but you’ll have less options to choose from.

There are lenders that offer bad credit loans in Canada. These lenders specialize in working with individuals who are looking to build their credit in a sustainable manner. Keep in mind that these loans may have higher interest rates than your typical loans.

Bad credit can also impact other areas of your life. It could prevent you from buying your first car or renting your favourite apartment in town. Landlords check your credit before approving your rental application to evaluate whether you’ll be a trustworthy tenant.

Bad credit could even prevent you from landing your dream job. During your job hunt, a potential employer might request to pull your credit as a final step of their hiring process. Employers want to see if you’re financially responsible or if you have any recent red flags on your credit report, such as collections and bankruptcies.

What Causes a Bad Credit Score?

There are various factors that make up your credit score, all of them unique to you and as an accumulation of your financial habits. Typically, bad credit scores are due to factors such as:

Poor Payment History

Your payment history is the biggest factor that impacts your credit score, making up around 35% of your score. Missing one bill payment can decrease your credit score by as much as 150 points, according to Borrowell internal data. A single late payment could prevent you from qualifying for prime credit cards, low-interest loans, and attractive mortgage rates.

Lenders look at your credit score when qualifying you for products. Late payments will impact your credit score and raise red flags to lenders. In order to keep your credit score healthy and maintain your financial reputation, it’s important that you stay on top of your bill payments.

The key takeaway is that the longer a bill goes unpaid, the more potential damage it can have on your credit score.

High Credit Utilization Rate

Credit utilization is another important factor that affects your credit score. Your credit utilization rate determines around 30% of your overall score. Simply put, your credit utilization rate is how much credit you have used up compared to the total amount of credit available to you. You should always aim to keep your credit utilization rate below 30%.

If you are looking to improve your credit score to buy a house or get a loan, for example, it is important to know how much of your total available credit is being used and to keep it at the lowest amounts possible.

Here is a four-step process you can take immediately to calculate your credit utilization rate:

Step 1: Tally all your balances from all your credit cards

Step 2: Tally the limits you have on all your cards

Step 3: Divide the total balances you have by the total credit limit

Step 4: Multiply by 100 to get your ratio as a percentage

Too Many Credit Inquiries or Cancelled Accounts

A credit inquiry is when a lender, creditor, or other individual requests to view your credit report. There are two different types of credit inquiries: Hard and Soft. Hard inquiries can impact your credit score, while soft inquiries do not impact your credit score.

Another factor that contributes to a lower credit score are cancelled credit accounts. Credit accounts with a long history can positively affect your credit score, while cancelling accounts can harm your score. For example, if you have a credit card account that you have not used for years, you may be thinking about closing it. However, a better option might be to keep the account open, using it occasionally so your lender does not close it for lack of use. This is because a key factor that can affect your credit score is the age of the oldest account on your report. Credit accounts age like fine wine: the older the better!

By keeping old credit accounts open, you are building your credit history and your total available credit (which plays a role in credit utilization), showing lenders your ability to consistently pay down your debts without missing deadlines.

How Do I Improve a Bad Credit Score?

Raising your credit score and improving your financial health is like exercising: the results take time, discipline, and consistency. It’s possible to see your credit score start improving within one to two months after taking recommended actions. That said, there are several factors that ultimately determine this timeline, including what financial incidents you are recovering from and what steps you’re taking to recover.

Here are some key steps you can take to improve your credit score.

Use a Secured Credit Card

The responsible use of a credit card and managing payments is critical to rebuilding your credit score. This means keeping note of your credit utilization (i.e., staying under the limit) and paying your bills on time, every time. A secured credit card is a great option for rebuilding your credit score

A secured credit card is backed by a cash or security deposit from the card owner. How much money you’re required to put on the card is based on your unique credit profile and the card issuer’s requirements. Let’s say the credit limit you’re approved for is $1,000. You’ll give the lender a cheque for $1,000 as a security deposit and they in turn give you a card with $1,000 on it to spend. If you don’t make your payments, the lender will claim that security deposit against any outstanding charges.

A secured credit card is different from a debit card or prepaid credit card as it helps you build your credit. This is because the issuer of the card usually reports to a credit bureau to provide details about your activity. This includes information such as your payment history and credit utilization (how much of your available credit you’re using each month).

A secured credit card can be an excellent option if:

You want to re-establish your credit after insolvency or bankruptcy

You want to Improve your bad credit rating

You’re new to Canada

You’re a young Canadian who is new to using credit

The best card for you depends largely on your credit score. When you check your free credit score with Borrowell, you’ll instantly see the best credit card options available to you based on your credit score and your financial goals. You’ll also see your approval chances for each product, so you can apply with confidence.

Pay your Bills On Time

As we frequently mention, paying bills on time makes up 35% of your credit score. Your payment history is the largest factor that impacts your credit score. For this reason, it is extremely important to keep up with payments or be aware if you’re late. In addition to negatively impacting your score, chronically missed payments may lead to higher interest rates, late fees and penalties, reduced credit limits, and even court judgments.

If you know you are down to the wire on a payment, call your credit card company or lender as soon as possible. On some occasions, if you advise them in advance that it might be late, they can make a note on your file. And if you have it, providing the payment confirmation number from your online banking may help you too. You can also look at options like payment deferrals and refinancing. Both are better options than being late or missing a payment.

Pay Down Debt

Paying down debts plays a critical role in helping build your credit score.

We recommend that you prioritize paying off the higher interest debts first. If you find yourself paying a very high-interest rate on your debt, it may be a good idea to move it over to an account with a lower interest rate, if possible. For example, if you have a credit card with a 19.99% interest rate and you may be late on payments, it may be in your best interest to pay off this debt with a low-interest personal loan.

Another method to pay off your debt is to pay it off from the lowest balance to the highest. This strategy gives you the psychological bump of the “quick wins” of eliminating your debts quickly, but it may not be the most efficient way to get out of debt.

An additional option you can explore, especially if you have more than one type of high-interest debt (for example, credit card debt), is taking on a debt consolidation loan. Debt consolidation is the process of combining multiple debts into a single loan with a lower interest rate. The benefit of a debt consolidation loan is that you’ll lower the overall interest rate of your debts, and only have a single monthly payment – which some find more convenient than making multiple payments on multiple debts. Managing a single monthly payment could help you get out of debt easier.

Avoid New Hard Inquiries

Even if you’re taking all of the steps we’ve outlined so far, your credit score can easily be impacted by a hard credit inquiry. A hard credit inquiry, sometimes referred to as a hard pull or hard check, happens when a potential lender checks your credit report when making their lending decision. Lenders and other companies require your permission before making a hard credit inquiry.

When a lender performs a hard inquiry, it will slightly lower your credit score. Hard inquiries are listed on your credit report and, in Canada, will stay there for three years.

Common examples of when hard credit checks occur include:

Credit card applications

Personal loan applications

Car loan applications

Mortgage applications

Apartment rental application

Cell phone contract

Internet plan contract

Because these credit inquiries affect your score, it is best to keep them to a minimum when you are trying to improve your credit score.

The Bottom Line

A bad credit score below 575 can hinder your life. It can prevent you from qualifying for low-interest credit cards, buying a new car, or even starting a new job. But there are ways to bounce back from bad credit.

Once you’ve identified why you have bad credit, you can take tangible steps to improve your credit. Keeping a regular pulse on your credit score can help you manage your overall financial health. Borrowell can provide you with your free credit score and help you pinpoint what’s impacting your credit score. You’ll receive personalized tips on what you can do to improve your credit score, and you’ll be matched with financial products that match your credit profile.

Sign up for Borrowell today to take control of your financial health!

Gaurav is a senior communications consultant in the executive recruitment industry, focusing on financial services. He enjoys creating educational content related to credit health and personal finances for Borrowell. Gaurav has a passion for conveying complex messages in an impactful way, and graduated with Honours from the University of Waterloo with a degree in Rhetoric and Professional Writing.