If you’re wondering, “What is a credit score, anyway?” – don’t worry! We’ve got you covered.

The Borrowell Team

Jul 04, 2025

Learn More

Rent reporting is the practice of reporting your rent payments to credit bureaus, which allows you to build your credit score when you make your rent payments on time.

Rent reporting is particularly beneficial for those who have a low credit score or a limited credit history (and find it hard to get approved for loans or credit cards, which would normally help them build their credit score).

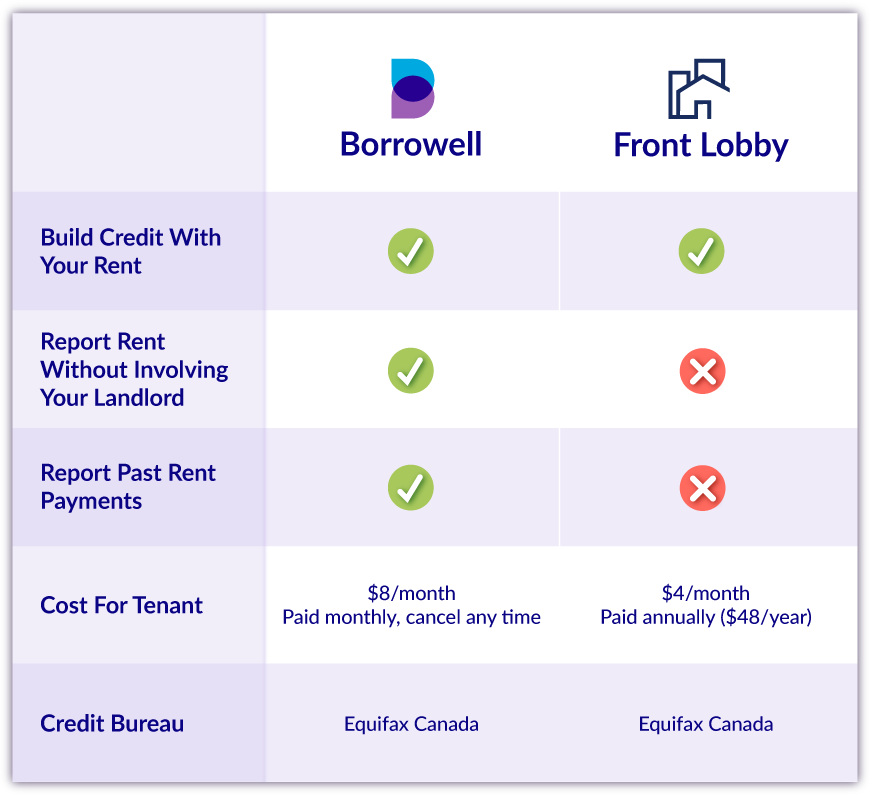

Traditionally in Canada, rent payments are not reported to credit bureaus by landlords and so do not influence your credit. However, that has changed in recent years with the launch of new products and organizations that make it possible for rent payments to count towards credit scores. Two services that provide rent reporting services in Canada are Rent Advantage™ and FrontLobby. Let’s compare them.

Borrowell Rent Advantage™ is a service that allows tenants to report their own rent payments to Equifax Canada, which is the largest consumer credit bureau in Canada. By reporting your rent payments to Equifax, you can build your payment history, credit history and credit mix using the rent payments you already make each month.

The main benefit of Borrowell Rent Advantage™ over FrontLobby is that Rent Advantage™ doesn’t require the involvement or cooperation of your landlord. Once you sign up, you simply connect your bank account and select your rent payments. That way, your credit report can be updated quickly to reflect your on-time rental payments. In addition, the service includes access to free credit monitoring and alerts through Borrowell.

Another advantage of reporting your rent with Borrowell is that you can also report up to 2 years of past rent payments, extending your credit history. This is particularly useful for people who are just getting started with credit, like young people and newcomers to Canada.

Renters can sign up to report rent with Borrowell on our website. There is a monthly fee of $8 to report current and future rent payments on your credit report with Rent Advantage, and a one-time fee of $59 to report up to 24 months of past rent payments in one go.

Add at least 12 months of past rent payments to your credit report and we’ll refund the one-time fee of $59 if your credit score doesn’t increase. Terms and conditions apply.

To report rent payments using Rent Advantage™, you need to follow these steps.

Sign up for a free Borrowell account or log in if you already have an account

Sign up for Rent Advantage™ - you’ll then enter your lease details and connect your bank account or credit card (whichever one you use to pay your rent). By doing so, Rent Advantage™ can track your rent payments and report them. Note that all of your payments — and missed payments, if you make any — will be reported.

Log in each month to confirm your rent.

You will be able to track your rent payment history in your Equifax credit report, which you can access online by logging in to the Borrowell website or mobile app.

It's important to note that Rent Advantage™ does not require your landlord's involvement, so you can sign up and report your rent payments even if your landlord is not participating in the program.

The requirements for reporting rent with Rent Advantage™ are that you need to provide your lease details, as well as link your applicable credit card or bank account. You’ll also need to pay the $8 monthly fee. Be aware that Borrowell recommends subscribing to the rent reporting service for at least six months to see the benefits.

Here are some of the benefits of reporting rent with Rent Advantage™

It’s fast and easy to sign up

You don’t need to rely on your landlord to report rent payments

You can cancel your participation at any time

No credit checks to set up

You’ll build credit history and be able to show future landlords that you’ve previously made on-time rent payments

You also have the option of adding up to 24 months of past rent payments, immediately extending your credit history

The potential drawbacks of reporting rent with Rent Advantage™ are:

If you miss a rent payment or multiple rent payments, it will be reflected in your credit report and could harm your credit score

You’ll need to log in each month to confirm your rent payments

Rent Advantage™ allows you to build your payment history, credit history and credit mix, which make up around 60% of the factors that determine your credit score.

Using Rent Advantage™ can be a wise choice if your landlord doesn’t use a rent reporting service and you are confident that you will pay your rent on time.

Signing up for Rent Advantage™ is fast and easy and doesn’t involve a hard credit check.

Rent Advantage™ doesn't require any landlord involvement. The tenant themselves is in control of reporting their rent.

The cost is $8 a month to report current and future rent payments and you can cancel at any time.

There is a one-time cost of $59 to report up to 2 years of past rental payment history on your credit report.

As long as you make your rent payments on time and in full each month, you are improving your credit history, credit mix and you can use those payments to show future landlords you’ve made past rent payments on time.

The Landlord Credit Bureau (LCB) was a credit reporting agency that landlords could report tenants’ rent payments to. In the last two years, however, the LCB has transformed to become solely a consumer reporting agency that maintains a database of verified tenant records.

Landlords can use these records to screen applicants, and tenants can use them to show prospective landlords a positive rental history even if they have no credit or have a previous history of bad credit. According to the LCB website, these tenant records include rental payment history and verified contact information for previous landlords. In order to create/access official tenant records from the LCB, landlords and tenants must sign up via FrontLobby.

Tenants (who sign up via FrontLobby) can share their official tenant record with potential landlords. The service provided by the Landlord Credit Bureau is designed to help tenants build up a good payment record, while helping landlords screen potential renters and thereby cut down on missed payments and “problematic” tenants.

Tenants and landlords can only report rental payment information to the Landlord Credit Bureau by signing up through FrontLobby.

To report rent payments to the Landlord Credit Bureau, both tenants and landlords/property managers must go through FrontLobby. This costs $48 annually for renters, which needs to be paid up front and averages out to $4 per month.

Some benefits of reporting rent to the Landlord Credit Bureau include:

If rent payments are made on time, it could boost your credit score.

If you have a strong history of always paying your rent on time, it could make it much easier to find a good apartment.

Showing your verified tenant record to a prospective landlord could help you land an apartment.

Here are some drawbacks of reporting rent to the Landlord Credit Bureau to consider:

In order to report your rent to the Landlord Credit Bureau through FrontLobby, you need the cooperation of your landlord to report your rent as paid.

Reporting rent only benefits those who are responsible in paying their rent on time. If a tenant is often late with rent payments, reporting payments could hurt their credit score instead.

If you feel like you are a responsible tenant who would benefit from rent reporting, using FrontLobby to ensure your landlord reports your payments to the Landlord Credit Bureau could be a smart choice.

Responsible renters can raise their credit score by ensuring their rent payments are reported to the Landlord Credit Bureau.

Rent reporting can be especially beneficial for those without credit cards or loans, who risk being “credit invisible” if their rent is not reported to credit bureaus. Paying rent may be the only way they develop a credit file at all.

To have your rent payments reported to the Landlord Credit Bureau, you must sign up via FrontLobby and also get your landlord to sign up.

FrontLobby is a company that provides a variety of products and services for landlords and tenants, including tenant screening, rent reporting, credit building, and dispute resolution.

FrontLobby Canada lets landlords screen potential tenants, including credit checks, evictions and more. Additionally, landlords can also report rental payment information to the LCB through FrontLobby rent reporting service. This may help tenants build credit history and improve their credit scores.

The way FrontLobby works for tenants is that they sign up and begin by providing their lease details and creating a tenant record. A tenant must then invite their landlord to join FrontLobby. If your landlord doesn’t accept your invitation, your rent won’t get reported.

The requirements for reporting rent with FrontLobby as a tenant is that you must set up an account and then invite your landlord to join. The cost of reporting your rent as a tenant using FrontLobby is a fee of $48 per year, paid upfront (or an average of $4 per month).

The benefits that tenants can enjoy by signing up with FrontLobby include:

As long as your landlord agrees to sign up and report your payments, you can use FrontLobby to build your credit history and credit score.

If you manage your rent payments responsibly, you could see an improvement in your score in as little as six months.

As long as you’re a responsible tenant, you’ll build a positive tenant record that might make you more attractive to future landlords.

There are some drawbacks to using FrontLobby for tenants:

The main drawback is that tenants are totally dependent on the participation of their landlord to enjoy the benefits of the rent reporting service.

Tenants have to pre-pay $48 for the year (a monthly $4 fee) to get your rent reported.

Similar to Borrowell Rent Advantage™, if you miss a rent payment or multiple rent payments, it will be reflected in your credit report and will harm your credit score

Front Lobby doesn’t allow the reporting of past rent payments

The relatively low cost of using FrontLobby, makes the rent reporting service an attractive option, however, your ability to use the service is totally dependent on your landlord’s participation.

In addition to the tenant signing up, landlords must also sign up to FrontLobby in order for rent payments to be reported credit bureaus.

Cost for the tenant is $48/year paid up front, which is equal to $4 a month.

Reporting your rent on your credit report is an incredibly useful way to use rent payments to boost your credit score. Whether you go with Rent Advantage™ or FrontLobby, it’s crucial to keep in mind that your rent payment history will only lead to a good credit score if you make your payments on time.

If you’re wondering, “What is a credit score, anyway?” – don’t worry! We’ve got you covered.

The Borrowell Team

Jul 04, 2025

Learn More

Let's take a look at how a positive rental payment history can help raise your credit score.

Sandra MacGregor

Nov 08, 2022

Read More

Your credit score is a critical marker that lenders use to gauge your creditworthiness when you apply for new products.

Janine DeVault

Jul 07, 2025

Read More