Renters can now add up to two years of past rent payments to their credit report with our new service.

The Borrowell Team

Nov 04, 2025

Read More

Having a solid credit score is an important goal for many Canadians, as good credit can lead to better access to financial products and being able to borrow at lower interest rates. Your credit score can even impact your chances of getting a job or renting an apartment. But, when it comes to credit scores, what’s never seemed very fair is that while homeowners’ mortgage payments contribute to their score, renters' on-time rent payments are not automatically factored into their credit reports, despite rent probably being their biggest monthly expense.

Even with the recent introduction of a handful of rental reporting programs that allow renters to have their payments reported to credit bureaus, there was no way to add past payments to your credit file, only the payments you make after signing up.

However, for the first time, Canadian renters can now add up to 24 months of past rent payments to their Equifax Canada credit report at once with Borrowell, allowing renters to extend their credit history in one go, rather than having to wait months for new rent payments to impact their reports.

Reporting your past rental payment history is especially useful if you’re new to Canada or don’t yet have a credit score because you can add a tradeline without having to take on debt.

To report up to 24 months of past rental payment history on your credit report, you will need to sign up or log in to Borrowell. After paying a $59 one-time fee, you then upload proof of your past rent payments by submitting your lease and bank or credit card statements.

The past rent payments you report do not have to be consecutive or from the period immediately preceding enrollment in the service. For example, if you rented a place for six months, weren’t renting for six months, rented another place for three months then stopped renting again for the past nine months, you would still be able to report the nine months you were making rent payments, despite the fact that you’re no longer renting and you had gaps between rentals.

The Borrowell team will then verify your documents and report your rent payments to Equifax Canada: Canada’s largest consumer credit bureau.

Add at least 12 months of past rent payments to your credit report and we’ll refund the one-time fee of $59 if your credit score doesn’t increase. Terms and conditions apply.

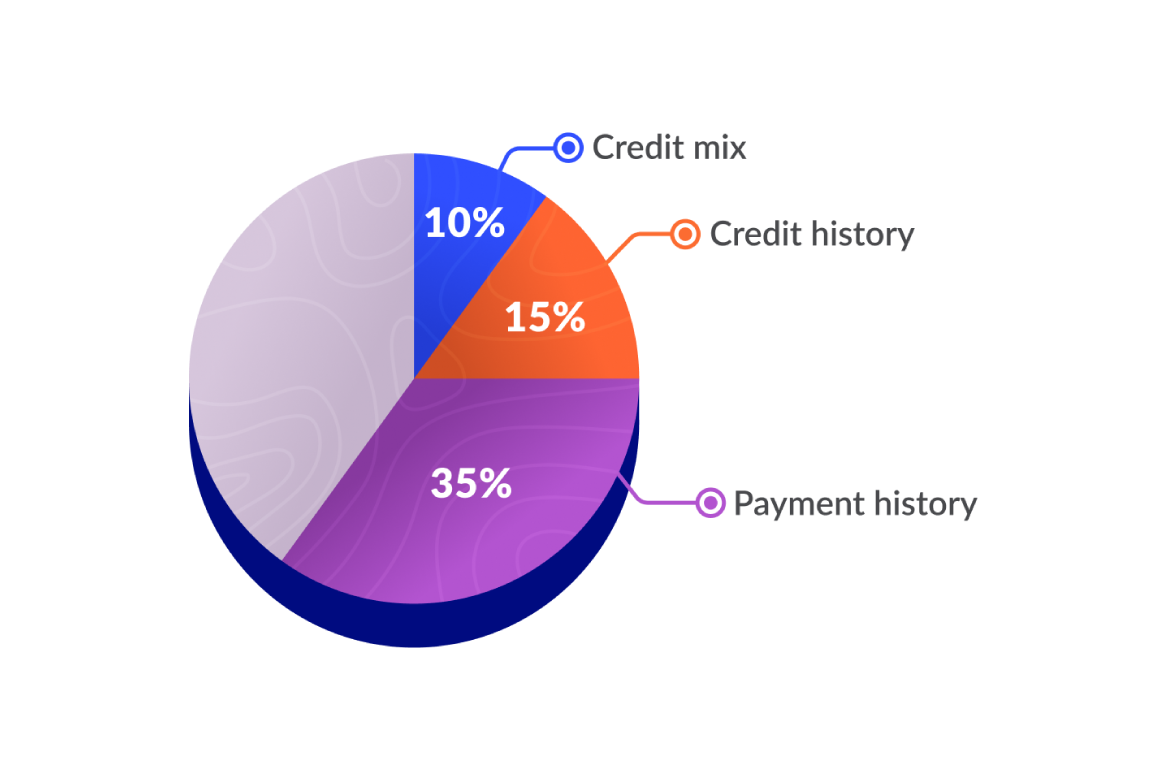

Just how does reporting your rent on your credit report contribute towards a stronger credit score? It’s because your credit score is based on five main factors: your payment history, credit utilization, credit history, credit mix and credit inquiries. When your rent payments are reported on your credit report, you’ll impact three of the five factors that make up your score. Here’s how:

Payment History (35% of your credit score): You can think of your payment history as your track record for making your credit payments on-time, and it makes up a whopping 35% of your total score. For this reason, it’s the most crucial element to target for improvement. As long as you’ve made your rent payments on time in the last 24 months, then reporting a two-year streak of responsible rental payment history can significantly extend this most important component of your credit score.

Credit History (15% of your credit score): Adding up to two years of past rental data lengthens your credit history significantly. A longer credit history has a positive impact on your overall credit score (as long as you’ve been good about payments), because credit bureaus like to see how you manage credit over a longer period of time.

Credit Mix (10% of your credit score): Credit bureaus give your score a boost if you have a mix of revolving and installment credit products, such as credit cards, car loans and lines of credit. Rental payments are treated like an “open tradeline”, which diversifies your credit mix. A healthy mix of different credit types can raise your score as it shows potential lenders that you are able to manage different sorts of credit.

So, is rent reporting worth it? As long as you consistently make your rent payments on time, reporting them can have a big impact on your credit score by strengthening key components like your payment history, credit mix, and length of credit history. Building up a good score is crucial for your overall, long-term financial health for numerous reasons:

Get Better Interest Rates: A higher credit score will help you get lower interest rates on loans, mortgages, credit cards, and other financial products, potentially saving you thousands of dollars in interest costs.

Increased Borrowing Power: It’s much easier to get access to credit products when you have a high credit score because lenders will see you as creditworthy and will be more willing to extend credit. Not only will you get approved more often, but you’ll also have access to larger amounts of funds for major purchases like homes or vehicles.

Improved Job Prospects: Some employers do credit checks on potential employees as a higher credit score can be seen as a sign that you are responsible and also know how to manage cash.

Get An Apartment: To ensure their prospective tenants are responsible and are likely to pay their rent, many landlords ask for your credit report credit checks. That means that a good score makes it easier for you to secure a place to live.

Being able to extend your credit history by reporting 24 months of on-time rent payments in one go can have a major positive impact on your financial health, especially if you are new to Canada or don’t have much of a credit file yet. Building credit in this way can help you reach your short and long term financial goals, like getting approved for credit cards, landing a new job, or even securing a mortgage.

Renters can now add up to two years of past rent payments to their credit report with our new service.

The Borrowell Team

Nov 04, 2025

Read More

87% of renters want rent payments to count towards their credit scores — find out why.

The Borrowell Team

Jun 18, 2024

Read More

Young people are spending more on housing than any other generation. Rent reporting will make things fairer.

Andrew Graham

Mar 28, 2024

Read More