Credit builder loans can be a valuable tool to help you establish or improve your credit score.

Karen Stevens

Oct 06, 2025

Read More

If you have a poor credit score or you’re just starting to build your credit, you might consider a credit builder loan. A credit builder loan is specifically designed to help establish and boost your credit so you can access more financial products at better rates. You can think of it like a monthly subscription for building your credit score.

This article reviews two Canadian credit building products – Borrowell Credit Builder and KOHO Credit Building.

Borrowell Credit Builder appears on your credit report as an instalment loan, and is designed specifically to help Canadians diversify their credit mix, and build their credit history and payment history (which is the largest factor that determines your credit score). With Borrowell Credit Builder, you can start building credit for only $5 biweekly over 48 months.

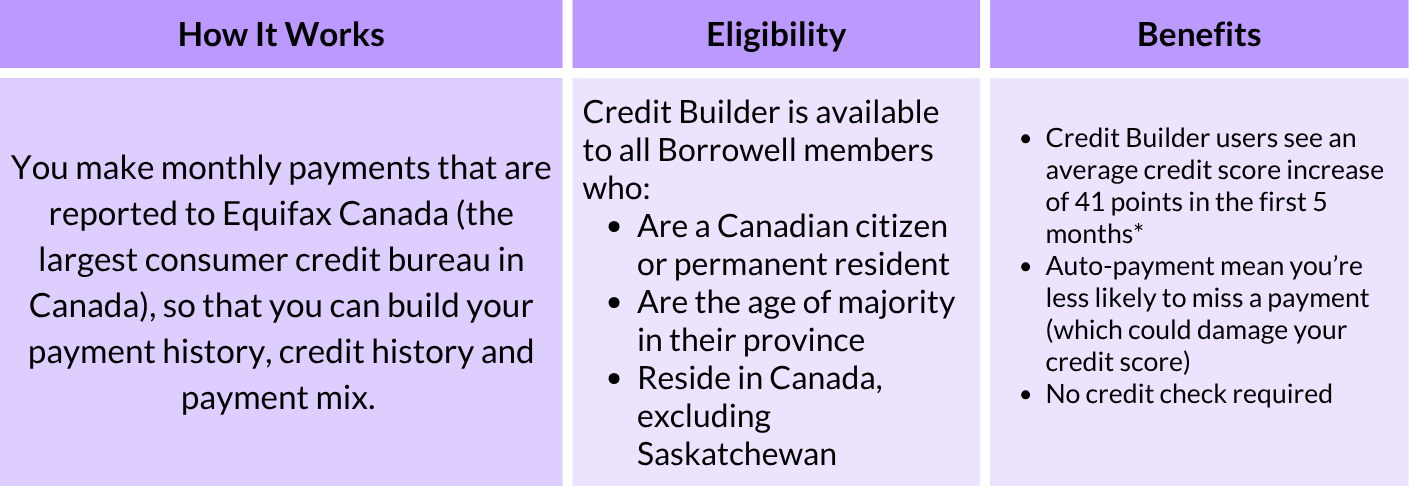

Unlike a regular loan, you don’t receive money upfront when you’re approved. Instead, you make fixed, bi-weekly payments of $5, $15 or $25 for 48 months. During this time, your payments are reported to Equifax Canada, which is the largest consumer credit bureau in Canada. Since payment history has the largest influence on your credit score (around 35%), demonstrating that you can make on-time payments over time can help to boost your score. Late or missed payments can negatively impact your credit rating.

To prevent you from missing a payment, Borrowell’s Credit Builder automates your payments through a pre-authorized debit agreement. All payments, including missed payments, are reported to Equifax Canada once per month.

*Based on a May 2022 study of Credit Builder members with an average loan size of $240 and an Equifax Canada ERS 2.0 credit score under 600 who made on-time payments on their Credit Builder and had a credit score increase. Individual results may vary. Other factors, including late payments, activity with your other accounts and credit utilization may impact results.

To apply for Credit Builder, visit Borrowell’s website and sign up for Borrowell. Just enter your email address and create a password. Once you’re signed up, Borrowell will walk you through the steps to apply for Credit Builder. If you're already a Borrowell member, you can also sign up using the Borrowell app. There is no credit check required.

To qualify for Credit Builder, you must meet the following eligibility requirements:

You must be a Canadian citizen or permanent resident

You must live in Canada, excluding Saskatchewan

You must be at the age of majority in your province

With consistent payment behaviour, Credit Builder can help you improve your credit score. With a higher credit score, you can secure lower interest rates on mortgages, car loans or personal loans. Having a good or excellent credit report also increases your chances of qualifying for products like premium credit cards and other top-tier financial products. Additionally, Borrowell Credit Builder offers:

Guaranteed approval

No hard credit check when you apply

No interest, just a flat program fee

Pre-authorized debit payments

Access to exclusive credit education and cash back rewards

Cancel any time without financial penalty

Currently, Borrowell Credit Builder is not available in Saskatchewan.

You should get the Credit Builder loan if you want to build your credit history so you can qualify for new financial products with better interest rates, terms and approval rates. You should also consider the Borrowell Credit Builder loan if you:

Have little to no credit history

Are looking for an easier way to build credit on auto-pilot

Are new to Canada and want to start building credit

Are recovering from bankruptcy, a consumer proposal or another type of delinquency

Having a good credit score is important for most financial decisions. It can help you secure a better interest rate and terms on everything from a mortgage to a personal loan. But, establishing and building a credit score takes time. If you have no credit or poor credit and you want to build your score, Borrowell’s Credit Builder loan is likely a good fit.

Sign up for Borrowell to get your free credit score. That's right. For free.

KOHO offers three ways to build your credit history:

Credit Building Line of Credit. You take out a line of credit and establish credit by repaying it on time.

Flexible credit building. You can deposit money as a line of credit and repay it on time.

Build with both. Combine the credit building line of credit with flexible credit building to boost your credit history.

Here’s how KOHO’s Credit Building and Flexible Credit Building programs work:

Credit Building Line of Credit. KOHO will provide you with a credit line of $225. Each month, you choose a credit utilization rate (percentage of available credit that you’re using) in your KOHO app, and KOHO reports on-time payments to Equifax. For example, if you use $22.50 of your $225 credit, your credit utilization is 10% Each month, on your billing date, your utilization rate resets to 0%. The cost of the Credit Building tool is $5, $7 or $10 per month, depending on the account type. Your subscription will renew automatically from month-to-month, but you can cancel the program at any time.

Flexible Credit Building. With the Flexible Credit Building tool, you submit a security deposit between set aside $30 to $500 into your account to set up a secured line of credit. Then, you transfer this money to your KOHO account to spend. You can pay back the money manually before it’s due, or you can wait for KOHO to auto-collect on the due date. Each time you make a payment on time, this helps to build your credit score.

Build with both. To grow your credit as fast as possible, you can consider using both.

To apply for KOHO Credit Building, follow these steps.

Download the KOHO app and sign up for an account.

Add the Credit Building feature.

Once you’ve signed up, KOHO will review your credit rating (this is a soft credit check, it won’t affect your credit score).

The funds will be deposited into your account, minus fees.

Each month, payments will come out of your account and your payments are reported to the credit bureau.

Keep enough money in your account each month to cover the monthly fees.

To qualify for KOHO Credit Building, you must have an active KOHO account that is fully verified. In order to be eligible, you must also meet the following criteria: You must be a Canadian resident

You must be a Canadian resident

You must be at the age of majority in your province

You must have enough money in your account to cover subscription fees

The main benefit of KOHO Credit Builder service is the opportunity to establish and build your credit. Additionally, KOHO offers the following benefits:

You qualify regardless of your credit score

Monthly subscription that you can cancel any time without obligation

No interest charges, only a monthly subscription fee

No hard credit inquiry to apply

Free credit score checks

Access to financial coaching

As with all credit building programs, KOHO Credit Building is not guaranteed to improve your credit score. Other potential drawbacks include:

You must have an active, verified KOHO account.

It provides a lower credit limit than some other credit building options.

Just as KOHO reports on-time payments, they also report late payments, which can have a negative impact on your credit rating.

You should consider the KOHO Credit Building tools if you’re looking for a way to establish or boost your credit. If you’re worried about committing to a longer-term credit building program, like the Borrowell Credit Builder loan, KOHO’s credit builder tool, which offers a month-to-month subscription program, might be the right fit. However, you have the freedom to cancel out of both the KOHO and Borrowell programs at any time with no penalty fees.

KOHO Credit Building offers a few credit-building options with its Line of Credit and Flexible Credit Building tool. You can also choose to supercharge your credit building journey by using both tools at the same time.

Having a strong credit score can help you secure a better interest rate and terms, which translate to major savings over time. Borrowell’s Credit Builder loan and KOHO’s Credit Building tools offer Canadians the opportunity to build and improve their credit scores by reporting payment history to the Equifax credit bureau. If you’re looking for a smaller line of credit and a shorter term length, KOHO might be the right choice for you. If you want to report a larger amount on your credit report, which can potentially have a bigger effect on your credit score, then Borrowell's Credit Builder loan is likely the right fit.

Jessica Martel is a freelance writer and professional researcher. She specializes in personal finance and financial literacy. Her work has appeared on websites such as Investopedia, The Balance, Money Under 30, Scotiabank, Seeking Alpha, and more. Jessica has a Master of Science degree in Cognitive Research Psychology.

Credit builder loans can be a valuable tool to help you establish or improve your credit score.

Karen Stevens

Oct 06, 2025

Read More

A credit score of 680 or above is required to qualify for the best mortgage rates in Canada in 2026.

Sean Cooper

Nov 12, 2025

Learn More

13 steps to rebuild your credit score in Canada after a negative financial event.

Adrian Zee

Apr 11, 2022

Read More