Track Your Bills and Credit Score For Free (bill tracking discontinued)

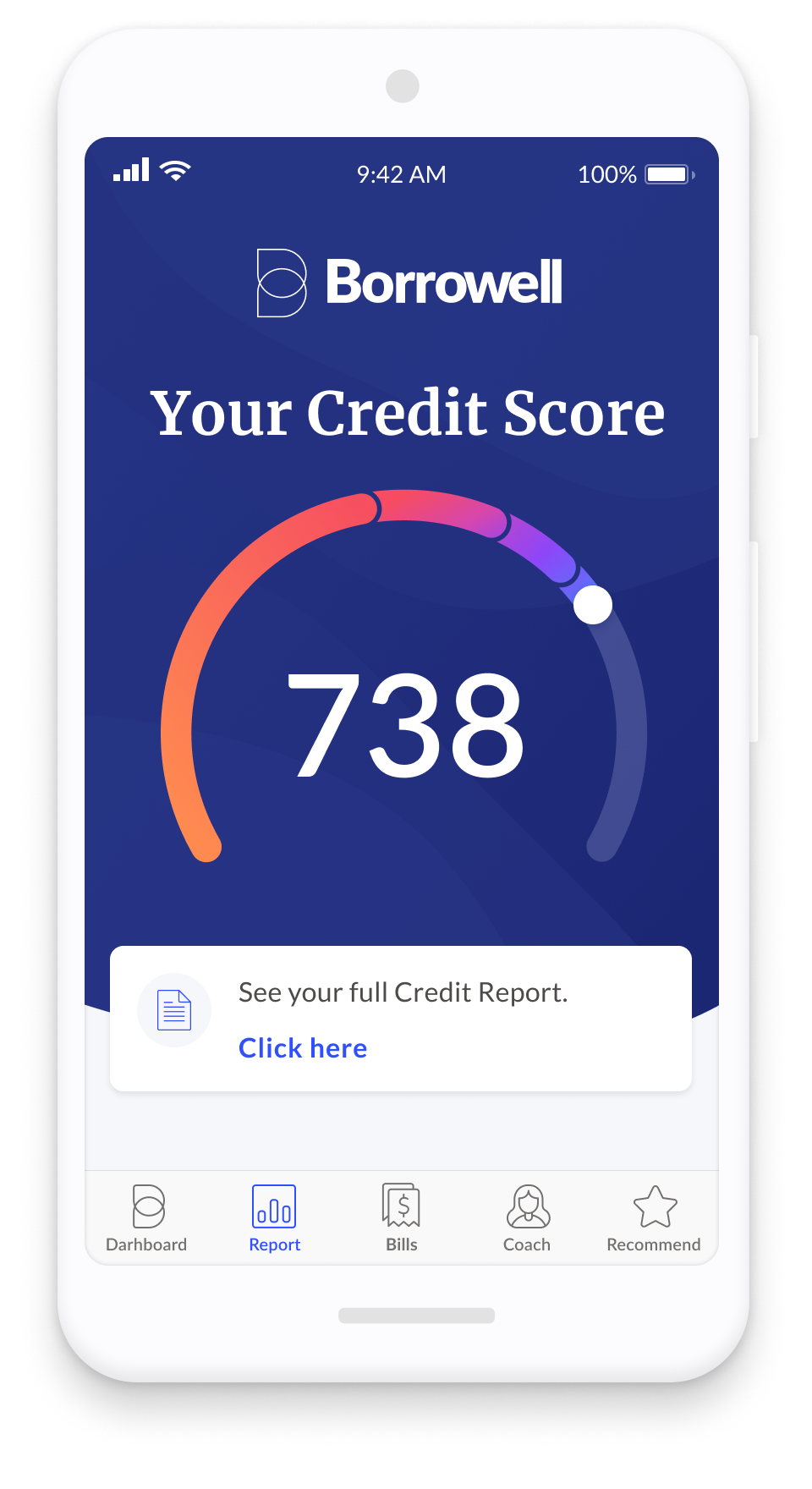

While Borrowell Boost bill tracking has been discontinued, you can still receive your free credit score and report, updated weekly. Sign up in less than 3 minutes and join the over 3 million Canadians who use Borrowell to feel confident about money.

How to Stay On Top of Your Finances

Track & Improve Your Score

Your credit score is like your financial report card, and you shouldn't avoid it. Knowing your credit score is the first step to improving it.

Why Are Your Credit Score and Report So Important?

Your credit report is like your financial report card, and your credit score is like your final grade. In Canada, banks and lenders review your credit when you apply for financial products. Your credit report can also be pulled by car dealerships, insurers, cell phone companies, landlords and future employers to determine your ability to manage debt and meet financial obligations. Because of this, it's important to know and understand your credit score.

Frequently Asked Questions

Access to Borrowell Boost bill tracking is no longer available. If you have any questions or concerns, please contact us here.