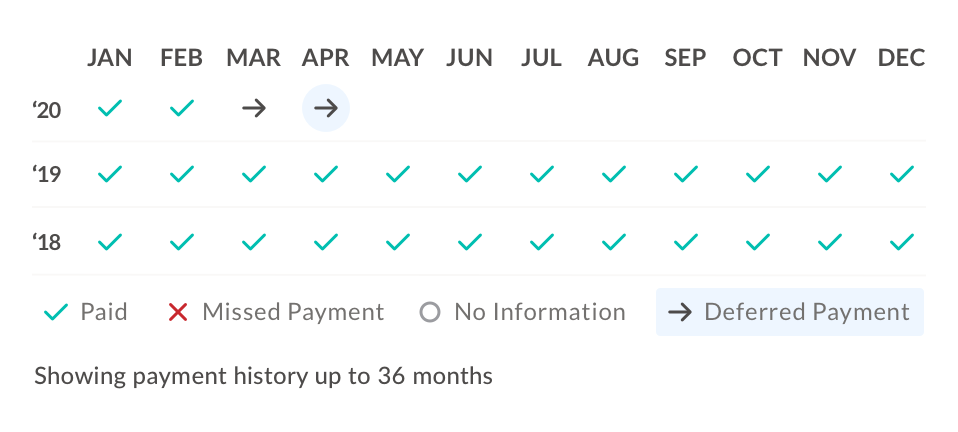

Taking a payment deferral shouldn’t impact your credit score, however there is a risk that the lender may incorrectly report it as a missed payment. Payment history makes up 35% of a typical credit score, which could mean a significant hit on your credit score if not flagged.

Borrowell has recently introduced a new feature that allows you to check whether the financial institution has reported your payment deferral correctly right on your payment calendar. It’s easy and free.

How does it work?

Borrowell offers free access to your Equifax credit report, so you can always keep an eye on what’s happening with your credit health anytime. This can be important when you’re going through major life events or making adjustments to your finances. If you aren’t already a member, take a few minutes and sign up. Your credit score gets updated on a weekly basis, and checking your score it won’t impact.

How to Check Deferrals Through the Payment Calendar

If you are on Desktop or Mobile Web Version of Borrowell

From the dashboard, go to credit report

On desktop display, click 'credit report' on horizontal navigation at top of page

On mobile web display, click the top right hamburger menu where you can click 'credit report'

On the credit report page, scroll down to trades/accounts section

Expand the account details on the relevant account

You'll then see the payment calendar at the bottom of the account details section

If your deferral has been reported, you should see it indicated with an arrow on your calendar

If you are using the Borrowell Mobile App

Tap 'score' on the bottom navigation

Tap the 'see your full credit report' card

Select 'Trades and Accounts'

Expand the account details for the relevant account

You'll see the payment calendar at the bottom of the account details section

If your deferral has been reported correctly, you should see it indicated with an arrow on your calendar

What happens if my deferral isn’t showing up?

Lenders are currently managing unprecedented volumes of deferrals to Equifax. Reporting is typically done monthly, so it can take some time to show on your calendar.

What if it’s reported incorrectly as a missed payment?

If you see your payment reported as missed or late, you should contact your lender immediately.

In the event that your deferral has been incorrectly reported to the credit bureau, you will need to file a dispute.

The Bottom Line

Monitoring your credit health is an important part of feeling in control and confident with your finances. If you are struggling to manage debt, there are lots of great tools and resources available to help you understand your options and make more informed choices when it comes to your finances.

Trusted by over 3 million Canadians, Borrowell provides free weekly credit scores and report monitoring, personalized financial product recommendations and affordable tools to help you build your credit. Sign up for your free Borrowell account today on borrowell.com, or download the mobile app for Android or iOS.