Let’s take a look at what documents a landlord can ask for.

Jessica Martel

Apr 07, 2025

Read More

For many Canadians, rent is their largest monthly expense, with 33% of renters spending more than 30% of their income on shelter. Until recently, there was no way for renters to benefit from consistent on-time payments.

However, in 2020, the Landlord Credit Bureau (LCB) partnered with Equifax (one of Canada’s two major credit bureaus) to give Canadian landlords the opportunity to report the rent-paying habits of their tenants. In 2022, Borrowell launched Rent Advantage, also in partnership with Equifax, to allow renters to report their own payments on their credit report without involving their landlords.

Since then, Borrowell has also launched a service that allows renters to report up to two years of past rent payments in one go, allowing them to extend their credit history.

Rent reporting services share information about your rent payments with select credit bureaus. If you pay your rent on time each month, this can help to improve your credit score. A higher credit score allows you to qualify for better offers on credit cards, loans, mortgages, and more, at a lower interest rate. Over time, a lower interest rate can save you a significant amount of money.

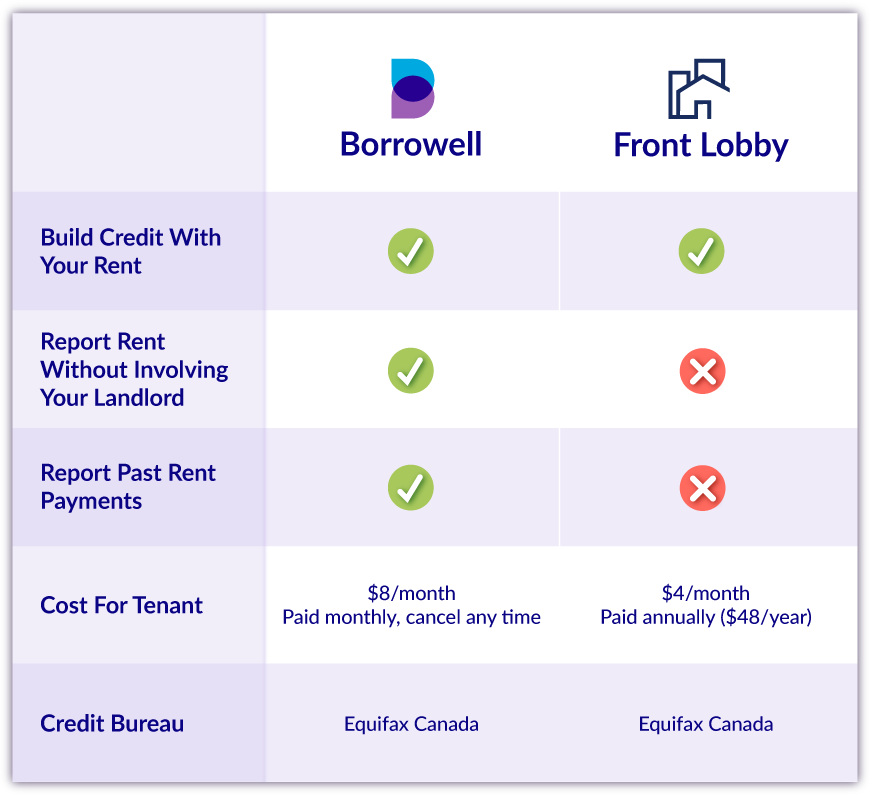

If you are considering a rent reporting service, take some time to compare companies to find the best rent reporting service for you. Think about factors such as who is responsible for reporting your rent payments (you or your landlord), how much the service costs, if you can cancel without penalty and whether or not you can report your rental payment history, as well as your ongoing payments.

If you want your rent payments to appear on your credit report, you have to sign up for a rent reporting program. Unlike when you take on a credit card or loan, your rent payments are not automatically reported to the credit bureaus. When selecting the rent reporting service that is right for you, there are several variables to consider:

Before committing to a service, ask who will report rent payments: you or your landlord. Many rent reporting services require the landlord to sign up for the service and/or verify your monthly payments. If your landlord doesn’t sign up for the service, your rent isn’t reported. This route could be a good idea for those who have a good relationship with their landlord and feel comfortable asking their landlord to report their rent, especially as the landlord often has to pay a fee.

Other rent reporting services, including Borrowell’s Rent Advantage, allow the renter to take control. It’s up to you as the renter to sign up for the program, and your payments are verified using your electronic banking records. You don’t have to ask your landlord for permission or rely on them to report rent payments each month.

As you search for a rent reporting service, you want to consider the cost and the type of payment. Does the company charge an annual flat fee or an ongoing, subscription-based monthly fee? Also, consider who pays the fee for the service, is it you or your landlord? Once you know these details, you can decide which service works best with your budget.

Before you can start reporting your rent, you need to make sure that you are eligible for the service. For instance, Borrowell’s Rent Advantage program is available in Quebec and Front Lobby's is not.

Currently, Equifax is the only major credit bureau in Canada that accepts rent payment reports. Equifax is Canada's largest consumer credit bureau.

You can also ask how frequently the rental reporting service reports rent payments to the credit bureau. Is your rent payment reported monthly or on a different schedule?

You can also ask how long it will take for your first payment to show up on your credit report. Do you have to wait for a month after submitting your first rental payment with the rent reporting service, or will it show up sooner?

With Rent Advantage, your rent payment is reported to Equifax within one business day after you confirm your payment, although it may take up to 90 days for your first rent payment to appear on your credit report.

In Canada, only one service allows you to report your past rental history and that is the one offered by Borrowell. You can add up to 24 months of previous rent payments to your credit report in one go, allowing you to extend your credit history. This is particularly useful if you have some short-term goals that require a strong credit score, like applying to rent an apartment, getting a new credit card, or even securing a mortgage.

Add at least 12 months of past rent payments to your credit report and we’ll refund the one-time fee of $59 if your credit score doesn’t increase. Terms and conditions apply.

Also, consider what personal information the rent reporting service requires before you can start benefiting from credit building. For instance, you may need to provide some personal information to sign up for the service. You might also need to provide the details of your lease and your banking or credit card information if you are responsible for paying for the rent reporting service.

Does the rent reporting service require additional information from your landlord to get started, or can you move forward on your own? For instance, is the landlord responsible for signing up for the rent reporting service?

With FrontLobby, your landlord is responsible for the initial set-up and regular reporting of your rent payments, whereas with Rent Advantage, you’re in charge.

Inquire about the company's cancellation policy. Ask if there are any hidden fees or financial penalties for cancelling the service.

With Rent Advantage, you can cancel at any time with no financial penalty.

It is recommended that you report at least six months of rental payments before you start to see a real benefit. So consider this if you are thinking about cancelling because you haven’t seen a change to your credit score within the first few months.

To ensure you have a solid understanding of what the rent reporting service offers, you can also ask if the company offers any additional service or features.

Reporting on-time monthly rent payments can help to build your credit score. Young Canadians or newcomers to Canada who often have a thin credit file can use rent reporting to establish and grow their credit scores. While you can’t rely on rent reporting alone to grow your credit score, there are several ways it can improve your score, including your:

Payment history: Payment history accounts for the largest portion of your credit score at around 35%. By paying your rent on time each month, you can start to establish a strong rental payment history and grow your credit score. However, late rent payments are also reported, so do your best to pay your rent on time, every time.

Credit mix: Reporting rent can also contribute to your credit mix. Creditors like to see that you can handle a variety of accounts which might include credit cards, a loan, and rent payments.

Credit history: If you have no credit history, you can use a rent reporting service to create your first tradeline on your credit report. Credit history accounts for around 15% of your credit score, and the longer your credit history, the better.

Improving your credit score over time can help you gain access to more products with lower interest rates, higher credit limits, and better terms.

Borrowell’s Rent Advantage is the best rent reporting service for renters who don’t want to have to involve their landlord in reporting their rent. With Borrowell, you can take rent reporting into your own hands to ensure your monthly rent payments are added to your credit report.

Plus, Borrowell offers Canada’s only rent reporting service that allows you to add your past rent payments to your credit report, as well your ongoing ones.

If a significant portion of your income is going to rent each month, you deserve to benefit from your on-time payments. Signing up for a rent reporting service can help you establish and grow your credit score. But, there are differences between rent reporting services, so make sure you find the service that works best for you. If you want to take rent reporting into your own hands instead of leaving it up to your landlord, then your best option is likely going to be Borrowell’s Rent Advantage.

Jessica Martel is a freelance writer and professional researcher. She specializes in personal finance and financial literacy. Her work has appeared on websites such as Investopedia, The Balance, Money Under 30, Scotiabank, Seeking Alpha, and more. Jessica has a Master of Science degree in Cognitive Research Psychology.

Let’s take a look at what documents a landlord can ask for.

Jessica Martel

Apr 07, 2025

Read More

Let's take a look at how a positive rental payment history can help raise your credit score.

Sandra MacGregor

Nov 08, 2022

Read More

A low credit score can make renting in Ontario more challenging, but there are solutions.

Sandra MacGregor

Apr 29, 2025

Read More