Given the unstable economy, making loan payments may be tougher than you ever expected. Instead of defaulting on your payments, it might be a good idea to consider different options such as payment deferrals, debt consolidation or refinancing to help you manage. The key is to make sure you understand how each works and whether it meets your goals and current financial position.

What is refinancing?

Simply put, refinancing is when you replace one loan such as a mortgage, auto or personal loan, with another with different terms. This process could save you money by securing a lower interest rate, reduce your monthly payments by extending your loan terms, or allow you to access additional funds.

There are three main reasons you might consider refinancing:

Your financial circumstances have changed since you first borrowed.

You need access to money immediately, or looking to consolidate debt or reduce your monthly payments.

Other options have become available that offer better terms or lower interest rates.

You can get refinancing by contacting your current lender or looking elsewhere. Regardless, it’s important to consider the risks and benefits to ensure you manage your debt responsibly.

Step 1: Create a budget and check your score

When considering refinancing, you need to have a good idea of what you qualify for and how you will repay the loan amount. Make sure you’ve made a budget first and that you understand all your options.

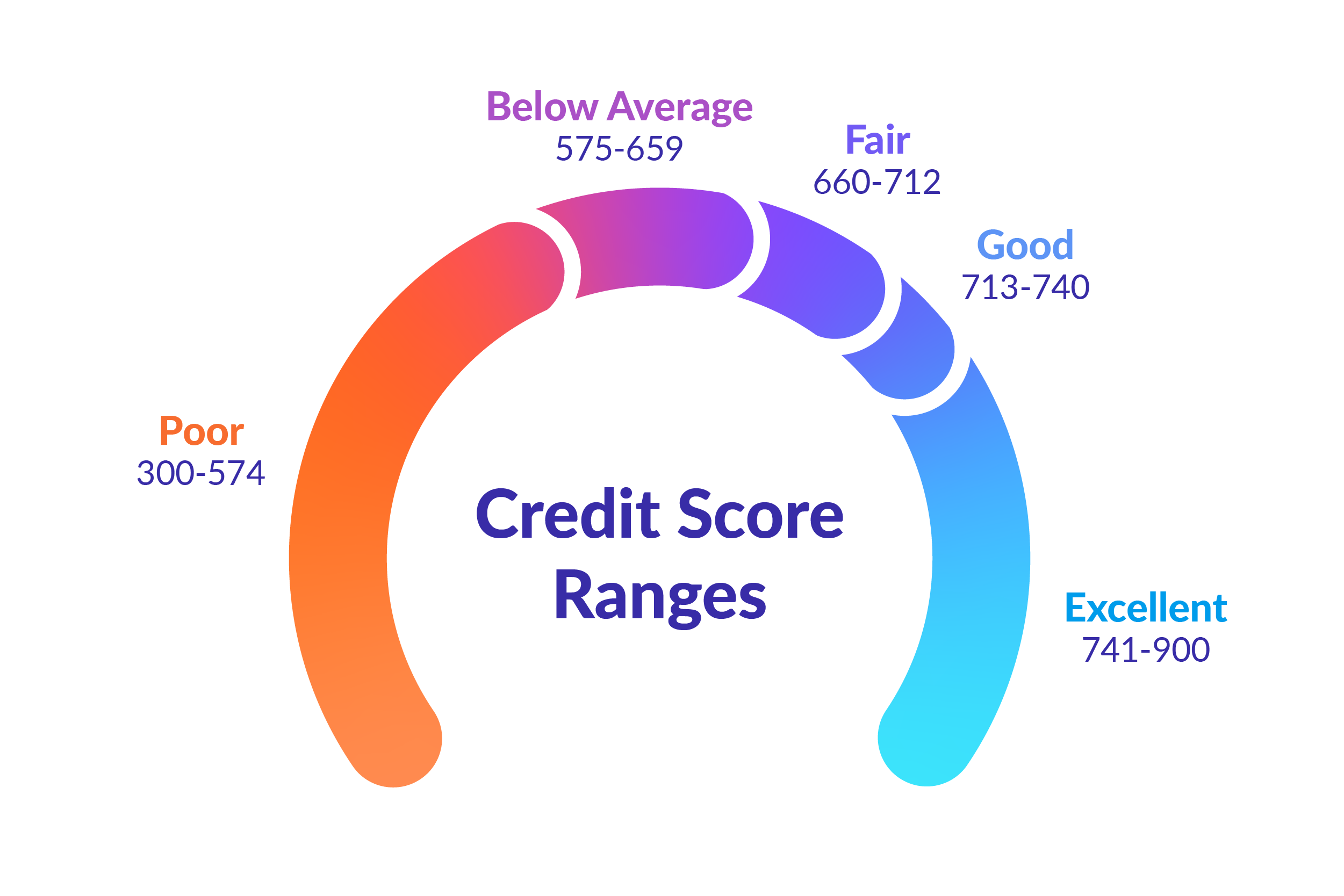

Potential lenders are going to review your credit report to see your record of accounts and activity. They’ll want to know that the new loan doesn’t put them at risk, so cleaning up and disputing errors on your credit report before applying for a loan can help boost your credit score. The more you’re able to improve, the better opportunity you’ll have to receive the lowest possible interest rate.

The good news is that checking your credit report won’t negatively impact your credit score. Borrowell is considered a soft inquiry that is not factored into your credit score calculation. In other words, you can check as many times as you need before applying for a loan.

Step 2: Make an Informed Choice

Remember, refinancing doesn’t reduce your loan balance; in fact, it could even lead to an increase in your debt, so it shouldn't be taken lightly.

Refinance Your Mortgage

As a result of COVID-19 mortgage rates are fluctuating, so if you're up for renewal, this might be a good time to contact your mortgage provider to discuss available options. You can also use the mortgage calculator here to see monthly costs. If you are a new homeowner, keep in mind that most banks and lenders require that you have maintained your original mortgage for at least 12 months before you can refinance, so contact your lender for details and restrictions.

If you have enough equity in your home, you could be eligible for a cash-out refinance or Home Equity Line Of Credit (HELOC). This lets you make interest-only payments by leveraging the value of your home. If you’re low on cash at the moment, this might be a viable option for the short-term.

If you and your spouse are over the age of 55, you could be eligible for a reverse mortgage, which uses your home’s equity as collateral. This means you might get a lump sum to help you through a difficult period, but keep in mind that you’ll need to pay off the loan when you sell the property or move out.

If your income has decreased since you got your mortgage, it may be difficult to get ‘a straight refinance’ but you could qualify for a loan modification.

If you’ve lost your job, you might need to look at other unsecured options like personal loans or credit cards. Although a personal loan usually comes with a higher interest rate than adding your debt to your mortgage, it’s usually a lot lower than the interest rates charged on credit cards and payday loans.

Understand the Potential Costs

Before refinancing your existing mortgage, it’s important to be aware that there may be costs. You may be required to pay a mortgage penalty, transfer fees and appraisal fees, although some lenders will cover it or let you capitalize it into your mortgage payments.

It really pays to shop around - just make sure you protect your score (see Step 3). Borrowell also offers a credit coach that can help you improve your score as well as a recommendation engine that helps you find the right products that match your profile.

Refinance Your Auto Loan

Car payments can be a significant expense, looking at refinancing your car loan could save you hundreds or even thousands of dollars. You’ll still need to repay the entire balance of the existing loan, but you could qualify for a lower interest rate or extend the length of your payment period.

If you find yourself low on funds, you might decide to opt for a longer-term and reduce your current payments. Be aware, this could result in more interest being paid, and unlike a home, a car loses value over time so make sure you have a plan for how you will repay in the long term.

If your car is worth more than the balance left on your loan, you may be able to dip into that equity and get cash-back, essentially this is borrowing against the equity you have in your vehicle.

What is the Process?

The process of refinancing is like buying your vehicle all over again, which means you’ll need to qualify. The lender will assess things like the condition of your vehicle, the size of your loan, credit score, debt-to-service ratio, current interest rate and the length of your loan.

Personal Loans

If you have a high-interest loan, you could consider refinancing with one at a more favourable rate. Refinancing a personal loan could mean lower monthly payments in the short-term, but might result in a longer repayment period, as well as possible fees.

If you have credit card debt or student loans, you may be able to refinance at a lower interest rate and you might also look at debt consolidation.

Remember everyone’s situation is different, sign-up free or login and find the options that match your profile as well as see your likelihood of approval for personal loans.

Step 3: Shop Around for the Best Interest Rate, but Protect Your Score

Rates and terms can vary between lenders, so it’s important to start early and do your research. Finding the best interest rates for a refinanced loan typically involves shopping around. Comparing multiple mortgages, for example, won’t negatively impact your credit score any different than applying for a single mortgage- if you work quickly. Credit scoring models view multiple hard inquiries for the same type of loan as a single inquiry as long as they occur within a grace period which can range from 15 to 45 days. If you spend several months on the process, it’s possible your credit score could take multiple hits with hard inquiries and make it difficult to qualify for the best rates.

Borrowell makes it easier to shop around by matching your credit profile and showing you the likelihood of approval. If you’re approved, the new loan pays off the existing debt completely.

Some tips to keep in mind:

Make sure you know your current rate and terms. It’s important so you can effectively research and compare (as well as negotiate!)

Pay attention to the fine print and look for a full breakdown of related costs and fees-- a lower rate might not mean a ‘better’ offer.

Compare the same terms, length etc. Sometimes you can also get a lower interest rate, but because the loan is extended, you might pay more with a longer payment period.

Step 4: Apply

Make sure the new loan fulfills your financial goals and circumstances. If you’re approved the new loan pays off the existing debt completely and you make payments until you pay it off, or refinance it. Be prepared to provide the following types of information:

Paystub or proof of income

Income Tax Return

Statement of Assets

Statement of Debts

How Refinancing Impacts Your Credit

While checking in on your own credit doesn’t influence your score, refinancing a loan does. Refinancing can affect your credit by:

Shortening your account history: Funds from a refinanced loan are used to pay off the original loan. This closes the original loan account and may negatively impact your credit score by reducing the average age of your credit accounts.

Increasing the number of credit checks: Refinancing requires a lender to check your credit score, resulting in a hard credit check. These types of inquiries can result in a dip to your score, depending on how many take place and how close together they’re made.

Potentially missing a payment: It’s possible for miscommunication to occur between the new lender and the old lender, resulting in a missed payment toward the old loan. A missed payment may create a negative entry on your credit report and lower your credit score.

The Bottom Line

Refinancing is a smart way to save money by restructuring debt that is no longer the best fit for you as the borrower. Although the refinancing process has the potential to slightly decrease your credit score, if you make informed and thoughtful decisions and make payments on time, it isn’t likely to affect your credit significantly over the long term.

Trusted by over 3 million Canadians, Borrowell provides free weekly credit scores and report monitoring, personalized financial product recommendations and affordable tools to help you build your credit. Sign up for your free Borrowell account today on borrowell.com, or download the mobile app for Android or iOS.