We’ve compiled a list of Canada's best travel credit cards to make your search easier.

Colin Graves

Jan 13, 2026

Read More

Sep 12, 2025 • 6 min read

With so many travel credit cards available in Canada, choosing the right one can be overwhelming. You can narrow the options by comparing two popular choices side by side, which is what we’re doing in this article.

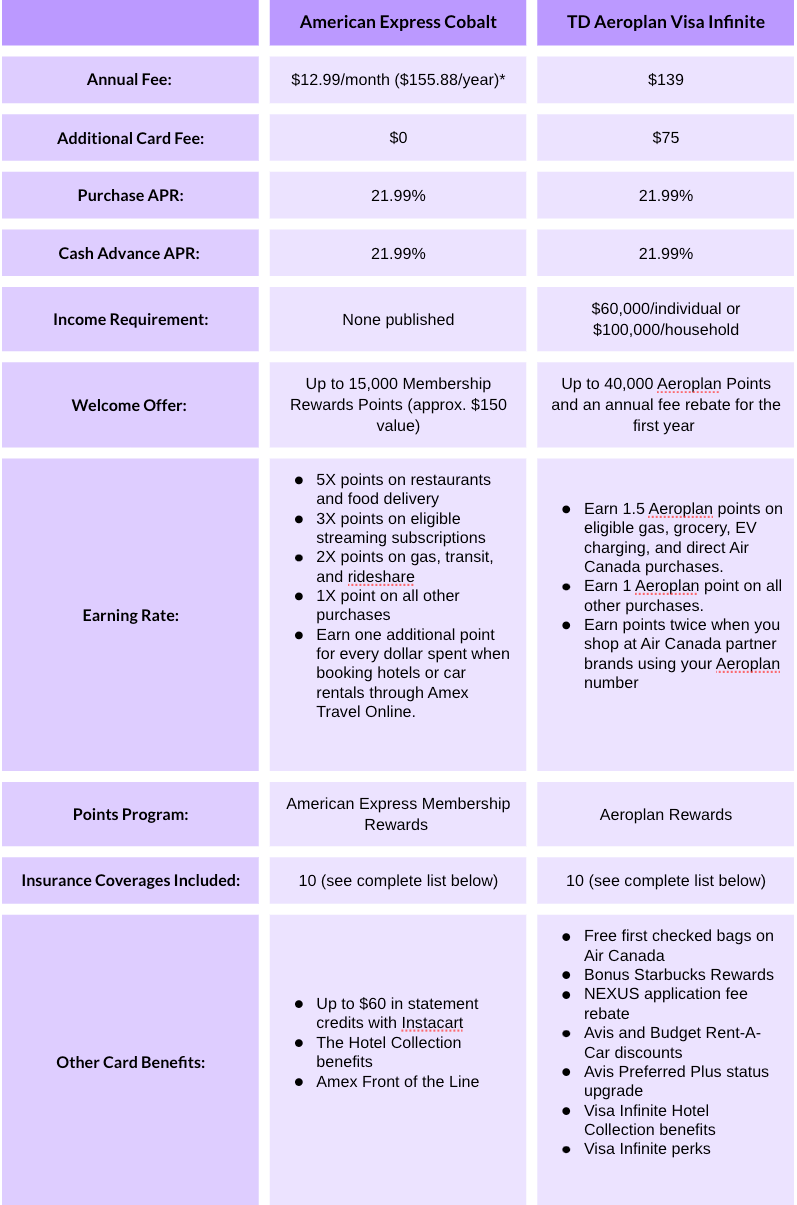

The TD Aeroplan Visa Infinite and American Express Cobalt cards are both favourites with Canadian travellers, for different reasons. We’ll provide you with a clear, head-to-head comparison to help you decide which card best fits your spending habits and travel preferences.

*The American Express Cobalt card monthly fee will be increasing to $15.99/month ($191.88/year) starting on November 5, 2025 for all non-Quebec residents. Residents of Quebec currently pay an annual fee of $150, which will increase to $191.88 on November 5, 2025.

American Express Cobalt cardmembers earn 5X the points per dollar on groceries, dining out and food delivery; 3X points on streaming services, 2X points on gas, transit and rideshare; and 1X point on all other purchases. While point values vary depending on how you use them, they are worth as much as 1 cent per point when you book flights through Amex.

This translates to an exceptional earnings rate of up to 5% on groceries, dining and food delivery, which is more than you can earn with the TD Aeroplan Visa Infinite.

But it gets even better. If you transfer your Amex points to Aeroplan (1:1), they could be worth even more. That’s because Aeroplan points can be worth up to 2 cents per point, depending on how they are redeemed.

One drawback to earning rewards with the Amex Cobalt is a $2,500 monthly spending cap on the 5X point bonus spending category. Once you exceed the cap, the rate drops to 1X point for every dollar. While this won’t impact all cardholders, high spenders might want to take a closer look and assess their monthly spending.

TD Aeroplan Visa Infinite cardholders earn 1.5X Aeroplan points on eligible gas, EV charging, grocery and Air Canada purchases, which include flights and vacation packages. All other purchases earn 1X points. It offers a solid earning rate of up to 3%, but not as high as the Amex Cobalt.

Winner: Amex Cobalt is the winner due to its exceptionally high earn rate on groceries, dining and food delivery.

If you’re looking for flexible rewards, the Amex Cobalt has you covered. Cardmembers can redeem their Membership Rewards points with Amex or transfer them to several Amex travel partners, including Air Canada Aeroplan, Delta SkyMiles, British Airways, Cathay Pacific, Hilton Honors, Marriott Bonvoy, and more. Notably, when you transfer your points to Aeroplan, it’s done at a 1:1 ratio. In addition to flights and hotels, you can redeem your points for statement credits, gift cards, and shopping rewards.

When you spend with your TD Aeroplan Visa Infinite card, your rewards are automatically funneled into your Aeroplan account. While Aeroplan points don’t offer the same flexibility as Amex Membership Rewards, i.e., you can’t transfer Aeroplan points to other rewards programs, there is some redemption flexibility within the Aeroplan program.

You can redeem points for flights on Air Canada and partner airlines, as well as for hotel stays and car rentals. You can even spend your points on seat upgrades and other travel perks, as well as gift cards, merchandise and experiences.

Winner: The Amex Cobalt earns the nod here due to its unmatched flexibility in reward redemptions.

Sign up to compare the best credit cards based on your unique credit profile.

The best premium travel rewards cards offer a wide range of additional travel benefits, including comprehensive insurance coverage, and the Amex Cobalt is no exception. The card comes with several perks, including The Hotel

Collection, which offers a hotel credit of up to $100 USD and a room upgrade when you stay two or more consecutive nights at participating properties. Other Amex benefits include Amex Offers, Front of the Line (for exclusive access to in-demand concerts and events and statement credits for eligible Instacart purchases. Here is a list of complementary insurance coverage:

Out of Province/Country Emergency Medical Insurance

Flight Delay Insurance

Baggage Delay Insurance

Hotel Burglary Insurance

Lost or Stolen Baggage Insurance

$250,000 Travel Accident Insurance

Car Rental Theft and Damage Insurance

Mobile Device Insurance

Buyers Assurance Protection Plan (Extended Warranty Coverage)

Purchase Protection Plan

The TD Aeroplan Visa Infinite includes some valuable Air Canada travel perks not offered by the Amex Cobalt. This includes free first checked bags for the primary cardholder, additional cardholders and up to eight travel companions travelling on the same reservation. Cardholders also receive a NEXUS application fee rebate once every 48 months (up to $100 value).

The list of perks doesn’t end there. Cardholders can also earn 50% more Starbucks Stars rewards on Starbucks purchases by linking their card, car rental discounts and the ability to reach Aeroplan Elite Status more quickly with Status Qualifying Miles.

When it comes to luxury perks, the TD Aeroplan Visa Infinite doesn’t disappoint. Enjoy complimentary Visa Infinite benefits, including access to its 24/7 Concierge, Luxury Hotel Collection, Dining Series, Wine Country Program, Entertainment Access and Troon Golf Rewards Silver Status.

This card’s list of insurance coverage is equally impressive:

Travel Medical Insurance

Trip Cancellation/Trip Interruption Insurance

Flight/Trip Delay Insurance

Delayed and Lost Baggage Insurance

Common Carrier Travel Accident Insurance

Auto Rental Collision/Loss Damage Insurance

Hotel/Motel Burglary Insurance

Mobile Device Insurance

Purchase Security

Extended Warranty Protection

Winner: The TD Aeroplan Visa Infinite is the clear winner, offering more value through its Air Canada travel perks, extensive luxury travel benefits and an equally impressive list of insurance coverages.

The TD Aeroplan Visa Infinite holds two crucial advantages over the Amex Cobalt that are well worth considering: a lower annual fee and a much higher worldwide acceptance.

First, the TD Aeroplan card charges a slightly lower annual fee than the Amex Cobalt ($139 vs. $155.58). In addition, the Amex card fee is scheduled to increase to $191.88, effective November 5, 2025.

Secondly, Visa credit cards are more widely accepted by retailers worldwide than American Express cards. This is especially true when you are shopping with smaller merchants. So, you’ll want to consider whether that might be an issue for you, depending on where you shop. You might be okay with the Amex Cobalt if you have a secondary Visa credit card in your wallet to use in an emergency.

Winner: The TD Aeroplan Visa is the winner for the reasons explained above.

While this article is a head-to-head comparison of two top Canadian travel credit cards, there is no clear overall winner. The best choice will depend on your spending habits and the travel perks that you value the most. Choose the TD Aeroplan Visa Infinite if you are loyal to Air Canada and wish to earn and redeem points for Air Canada flights and travel perks, like free checked bags, car rental discounts or Visa Infinite luxury benefits.

On the other hand, if you want the card with the highest rewards potential and most flexible redemption options, choose the American Express Cobalt card. Unlike Aeroplan points, Amex Membership Rewards points can be transferred to a wide range of airline and hotel partners, including Aeroplan. Just make sure you are comfortable with Amex’s more limited acceptance. For more choices, you can sign up for free and browse over 60 credit card options on the Borrowell marketplace.

We’ve compiled a list of Canada's best travel credit cards to make your search easier.

Colin Graves

Jan 13, 2026

Read More

With a rewards credit card, you can earn rewards just for using your credit card and then redeem them for perks and benefits. Here’s our curated list of the best rewards credit cards in Canada for 2025.

Jessica Martel

May 08, 2025

Read More

Looking for the best cash back credit card in Canada for 2025? Our guide ranks top options by bonus rates, fees and rewards. Get paid for your everyday spending!

Colin Graves

Jun 23, 2025

Read More